The pound found a surprising amount of bids in the latter half of the week which led to a break over the important resistance identified last week. Despite a sharp fall in the services PMI and a meek BoE, a weaker US dollar saw the momentum swing in favour of the pound. We are likely to see a pull back to the support gained, where a larger bullish wave will begin.

The Cable has seen a surprising reversal in its fortunes as the US dollar now comes under pressure. The UK services PMI fell sharply early on in the week from 55.6 to 53.3 which saw the recent low come under pressure. That was short lived as manufacturing production lifted to 0.5% and the GDP estimate came in at 0.5% q/q.

Despite the Bank of England keeping rates on hold once again, and saying inflation would remain near zero well into 2016, the pound broke free of the resistance identified last week at 1.5240. The FOMC meeting minutes were taken by the market as more dovish than expected, as the chance of a rate rise this year becomes doubtful.

Keep an eye on UK inflation figures due early this week, with anything above the 0.0% y/y expected will see the cable continue the recent bullish run. UK employment figures are also due with the market expecting the unemployment figure to remain steady at 5.5%. From the US, keep an eye out for their CPI figures, with any lift likely to stoke speculation of a rate rise from the Fed this year.

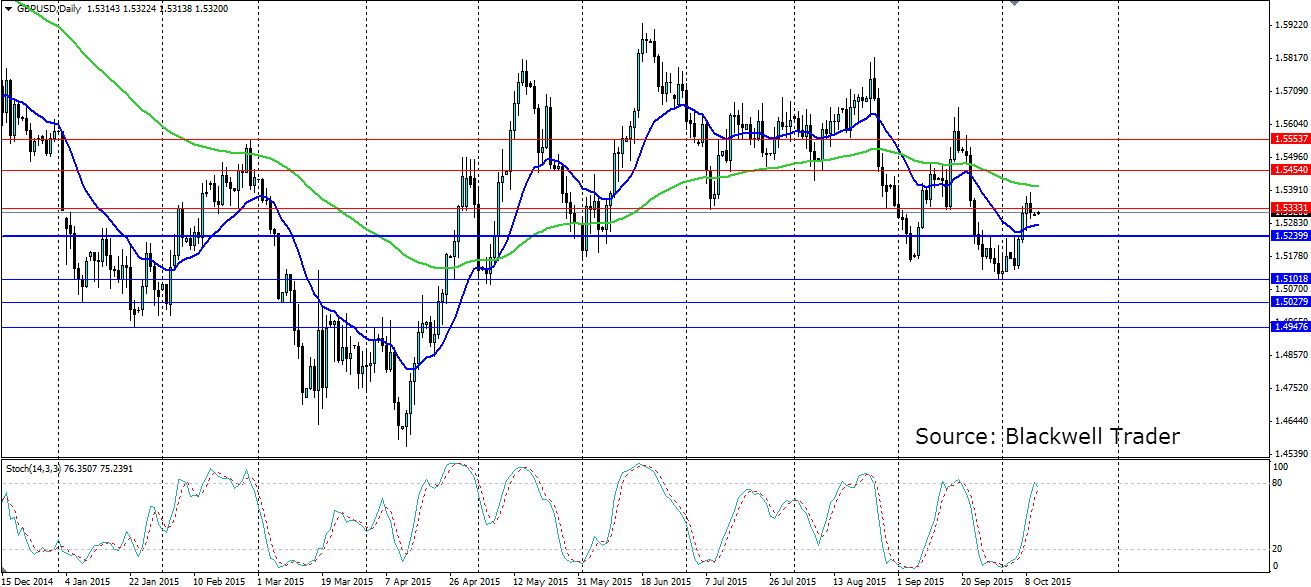

From a technical perspective, the broken resistance at 1.5239 has swung momentum towards a bullish bias and it will now act as support gained. We could see a pull back to that level before a larger bullish leg forms that will see last month’s losses regained. Look for support at the previous resistance at 1.5239, with further support at 1.5101 and 1.5027. Resistance is found at 1.5333, 1.5454 and 1.5553.