The UK retail sector started the year on a high. Retail sales bounced by more than 3% in January, fully offsetting a sharp fall in spending over Christmas. Those December figures raised a few eyebrows when they were released last month, given that the 3.3% fall was unusually large, even for a dataset as volatile as this.

At the time, some of the weakness was blamed on bad weather and consumers tightening their belts. But the rapid rebound suggests the dip was more likely down to the ever-shifting seasonal trends in spending, which have continued to change pace since Covid-19. The switch to making Christmas purchases in November around Black Friday instead of closer to the festive period isn’t new. But it seems to be a growing trend that makes it tricky for statistics agencies to accurately seasonally-adjust the numbers – a challenge that is not unique to the UK.

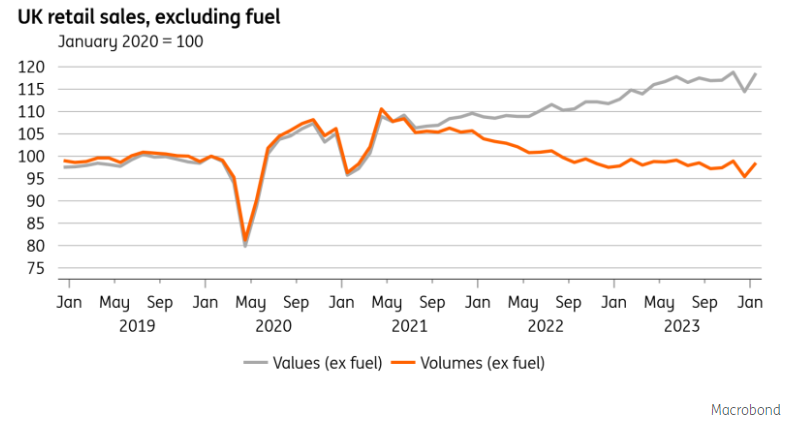

In short, January’s bounce should be taken with just as much of a pinch of salt as December’s fall. That’s not to say we should ignore it completely, though. The weak end to 2023 in retail seems to have played a partial role in the overall decline in UK GDP during the fourth quarter. Those figures sparked a lot of headlines about a technical recession, but the bounce in retail adds another reason to expect a rebound in growth during the first quarter.

More broadly, the outlook for the UK consumer is improving. The mortgage squeeze will continue in 2024, but with rate cuts on the horizon, we think around two thirds of the passthrough to homeowners has happened already. The average rate on outstanding mortgage debt has risen from 2% to 3.3% since rate hikes began, and we think this will rise to 3.7% by the end of 2024 as homeowners continue to refinance off lower fixed rates this year. That’s a much more modest passthrough than expected three to six months ago, even accounting for recent rebound in market rates.

At the same time, real incomes are growing. Headline inflation will dip below 2% in the second quarter, in thanks partly to a sizeable prospective fall in energy bills in April. Wage growth, meanwhile, is proving much stickier.

While we shouldn’t get too carried away – not least because the jobs market will continue to cool gradually – an improved consumer backdrop should help the UK economy return to modest growth through 2024.