Market pricing has tipped in favour of ‘no rate cut’ at the upcoming Bank of England (BoE) meeting in June after UK CPI came in higher than expected this morning. Markets were assigning a 50/50 chance of a rate cut in June before the CPI release according to data from Reuters. The probability of a cut has now dropped to 15%. It’s not that the data was bad, it just wasn’t as good as expected. As often happens, the initial reaction is driven by how the actual reading correlates to expectations, and in this case, inflation didn’t drop as much as hoped.

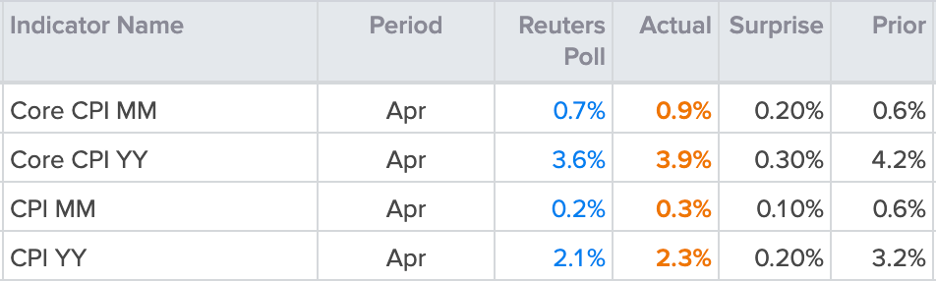

Consumer prices grew 2.3% in the year to April, a significant drop from the 3.2% in March, but not as low as the 2.1% anticipated. The month-on-month rate dropped from 0.6% to 0.3%. It is core inflation – which excludes volatile prices like energy and food – that has been closely monitored in recent months and could explain the hawkish reaction in markets. The monthly rise in core prices was not only higher than expected but also higher than the previous month, which can be seen as a serious concern for the BoE. YoY core CPI has dropped from 4.2% to 3.9%, above expectations of 3.6%.

UK inflation data for April

Source: refinitiv

The stronger data, specifically the stubbornness in core CPI, is making it harder for markets to believe the BoE can cut rates in June, or even during the summer. The first fully-price-in 25bps rate cut is now in November, with a 60/40 chance of a cut in September. These are likely to continue evolving over the coming days as markets fully digest the meaning of the data but it’s unlikely that the June meeting is a real contender for a rate cut any more. But we will have to wait for commentary from BoE officials to see how they factor the latest inflation data into their forecasts.

For markets, the stronger CPI reading has favoured the pound and weighed on the FTSE 100 as expected. As currency pairs continue to be driven by rate differentials, the pushback in rate cut expectations has levelled the BoE to the Federal Reserve with regards to timing, which has allowed GBP/USD to break above recent short-term resistance and cover some further ground. The bullish momentum looks to be strong with the path of least resistance pointing higher, but traders should be aware of overbought conditions creeping up, with the RSI nearing the 70 mark, which has been an area of reversal for the past six months. The 1.28 mark likely remains a key focus for buyers over the coming days, but there seems to be a fair amount of resistance along the way.

GBP/USD daily chart

Past performance is not a reliable indicator of future results.

Disclaimer: This is for information and learning purposes only. The information provided does not constitute investment advice nor take into account the individual financial circumstances or objectives of any investor. Any information that may be provided relating to past performance is not a reliable indicator of future results or performance. Social media channels are not relevant for UK residents.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84.01% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

The information provided is not to be considered investment advice or investment research. Capital.com will not be liable for any losses from the use of the information provided.'

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI