UK inflation slowed a lot but not as much as expected. Sterling had been advancing a bit in anticipation of this ‘beat’ to the consensus expectations, jumped higher then faltered a bit. There is another inflation reading due before the next Bank of England meeting. The chance of a cut in June nevertheless fell sharply on the inflation number, which at 2.3% was down to its lowest level since July 2021. But the decline from March’s 3.2% was not as precipitous as the 2.1% expected. And worryingly for the BoE, services inflation declined to 5.9% vs 5.5% expected. This may stay the hand of the more cautious members of the MPC for a while longer. And in fact it may be a blessing for the BoE to prevent it from potentially cutting too soon in this cycle – we have seen how persistent inflation is and with UK wage growth still running at 5-6% there is plenty of juice in that particular tank. Anyway, we have another month of data yet.

Markets now price a roughly 15% chance of a cut next month, down from around 50% before the inflation data. The chance of a cut in August is no longer fully priced, now a coin toss. Remember, market pricing is not necessarily a great predictor of events. Only a best guess for the moment. Gilt yields moved up sharply led by the front end, pushing up global yields, which is maybe just weighing on risk this morning and pushing stocks down a tad. European stock markets declined in early trade on Wednesday with the FTSE 100 down around half a percent to a two-week low. Adding to the upwards pressure on yields, the RBNZ held rates steady but flagged a potential delay in cuts due to persistent inflation. The ECB meanwhile has sent a very strong signal it will cut in June. Oil has slipped to a week-low – inventories due later.

Marks & Spencer bucked the trend with a gain of 9% after profits rose 58%. Lots to like about MKS (LON:MKS) here with the turnaround and shares reflecting the improvement now +82% over the last 12 months. A year ago I said that LFL food sales +5.4% seems OK but not excessive…margins compressed, 3.4% in food vs 4% management target. Clothing and home margins +8.7%, above 2019/20 levels, but below the 10% target. Online margin down to 5% from 9.1% due to investment and cost pressures.

Fast forward a year and we see LFL Food sales up 11.3% and margins up to 4.8%. Clothing & Home LFLs +5.2% and margins above target up to 10.3%. And online margins are back up to 8.2% with the M&S App now accounting for 44% of orders as sales grew 7.8%. Management pat themselves on a job well done here with the improvement thanks to the removal of unprofitable lines, logistics efficiencies and reduced failed deliveries.

Nvidia – loads resting on these results, Nvidia (NASDAQ:NVDA) is now 5% of the S&P 500 and has accounted for a fair chunk of its gains this year with its 92% rally in 2024. Wall Street has decided it’s going to be monster; options imply an 8-9% on the results. Any sniff of a downswing could hurt the overall market.

Revenues are seen +242% to $24.6bn, with net income soaring from $2bn to almost $13bn in what’s a staggering rise.

For the near term, investors will want to know more about any potential delay in new chip orders as it transitions to new models.

Here’s a bit of extra detail from the Street

EvercoreISI: "The combination of decelerating revenue growth and increased concerns about competition has driven Nvidia's relative P/E ratio to the lower-end of the 10-yr range, creating a scenario where a healthy beat-and-raise [on earnings Wednesday] will lead to near-term upside to the stock and we expect a healthy beat-and-raise.”

Deutsche Bank analysts say they are not sure there is much left in terms of surprises and are stuck with a hold rating. “Overall, we remain impressed by NVDAs best-in-class technology roadmap and believe AI fervor by its customers is likely to be sustained, yielding yet another strong quarter/ guide,” they wrote. “However, investors apparently have become more discerning of AI-driven upside in earnings season QTD, and we believe continued fundamental strength is already well understood.”

Wells Fargo (NYSE:WFC) was more upbeat, arguing Data Center revenue could reach $23-$24 billion vs the Street estimate for approximately $21.1bn. The bank’s analysts raised its Nvidia forward estimates and upped the target price on the stock from $970 to $1,150.

Wall Street ended Tuesday higher – the S&P 500 and Nasdaq both closing with fresh records. Vix at 11.86 was the lowest since Nov 2019 usually a period of successive record highs for SPX and super-low VIX readings is a harbinger of something nasty around the corner but no one wants to miss out on the ride.

Macro

- MS macro analysts have made the following calls for the second half of the year

- Central banks to cut rates over the next 18 months

- Expects ‘good environment’ for risk assets with moderate growth, disinflation and rate cuts

- Bond yields to fall even as CBs shrink their balance sheets, US 10yr to 4.10%

- Could be more aggressive with easing, which could see yield curve steepen

- Bond issuance – second highest supply ever in 2024 - has not stopped positive returns

- Go from equal weight global and European equities to OW for both

- In equities preference for Japan and Europe over highly valued US

GS is out with a view on the Fed and points to our divergence thesis that is very much the core market narrative – Fed to cut a tad later than the ECB and BoE. Maybe not so divergent from the BoE after today?

“The Federal Reserve will not be in the first wave of cutters because of the pickup in sequential core inflation during Q1. However, we also estimate that the market-based core PCE index rose just 0.18%, a pace that would be quite consistent with a July cut if maintained.”

FOMC meeting minutes are due out later tonight and are not usually massive and we have a TON of Fed speakers this week.

Mester: “I need to see a few more months of inflation data that looks like it is coming down.”

Barr: “We need to sit tight where we are for longer than we had previously thought.”

And Fed governor Waller said the US central banks can “probably” rule out further rate hikes and had been “happy to see a reversal” in April of the acceleration in CPI registered in Q1.

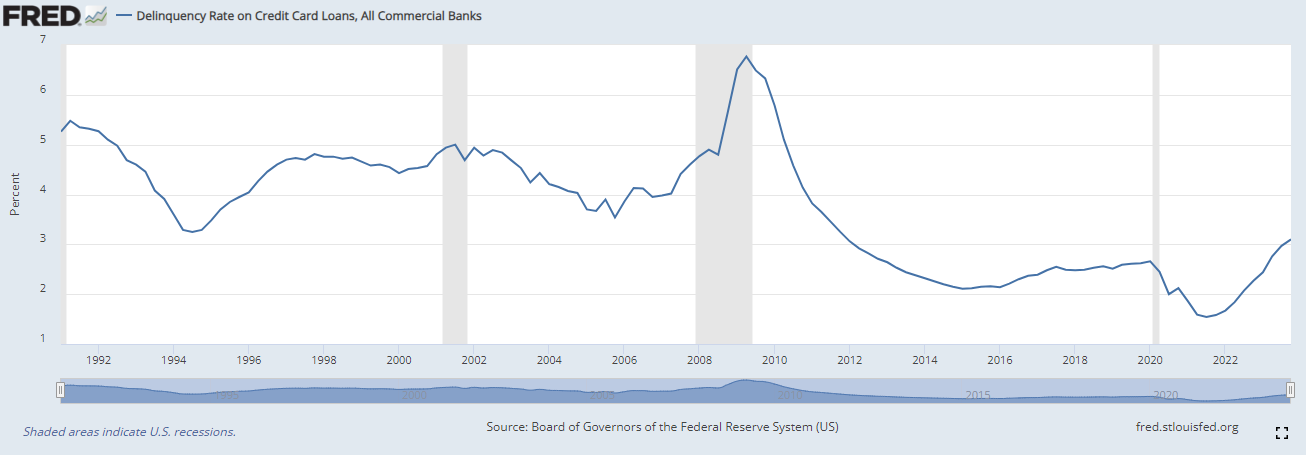

He noted that Credit card and auto loan delinquency rates suggest some consumers are under stress.

It has risen a lot - to a 12-year high – but it’s not high by historic standards

GBP/USD jumped from 1.2710 to 1.2760 but has pared gains after hitting its highest in a month.