The US dollar has been on a tear over the past few weeks boosted by a string of positive economic data tempering the expected rate path from the Fed and investor’s betting that Donald Trump will win the election next month. The dollar index (DXY) has rallied over 4% in the past month undoing the selloff that originated from the weaker-than-expected July jobs data.

US Dollar Index (DXY) 4-hour chart

Past performance is not a reliable indicator of future results.

Markets are now pricing in an 89% chance of a 25-bps cut from the Federal Reserve in November, versus an 11% of no cut – this is a stark contrast from the 53% chance of another 50-bps cut priced in just a month ago. A pickup in the US economic data has played a crucial part in this, with inflation and the jobs market showing signs of resistance once again after faltering slightly during the summer months. As slowing growth no longer seems to be a pressing concern, investors now believe the Federal Reserve will not be as rushed in its cutting cycle.

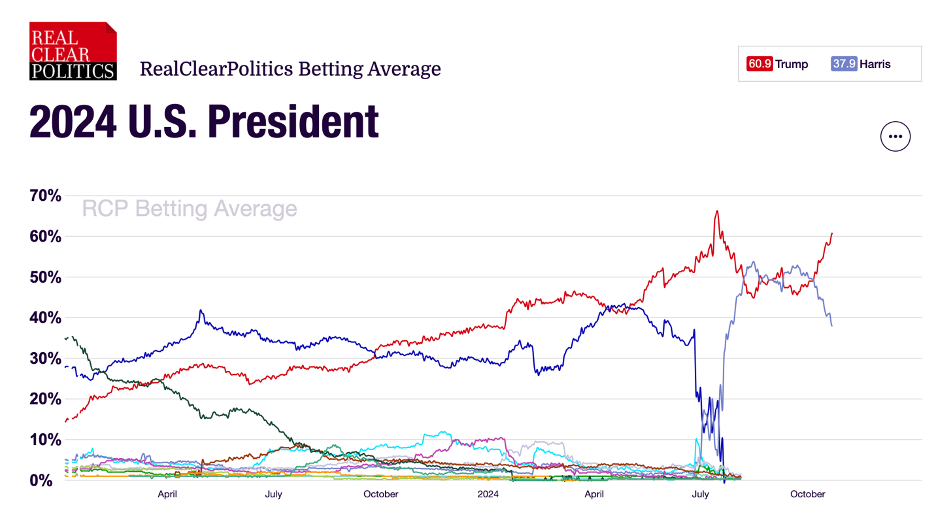

Another key factor has been the Trump trade. Betting odds now show a 60-38 advantage for Donald Trump and markets are clearly agreeing with this with yields and the dollar pushing higher as traders expect a rise in public spending and inflation if he is elected. If the concept of another Trump presidency solidifies in the coming days with polls giving him an advantage, then we could see the dollar continue to move higher, attempting to solidify the gains above 104 in the dollar index.

EUR/USD downslide continues

The resent resurgence in the dollar has led to a change of direction for its key currency pairs. EUR/USD has succumbed to the dollar dominance and is now trading at its lowest level since August, back at its level prior to the US data weakness scare. There tends to be this dynamic in the pair where the majority of the time it is driven by the dollar, but when the dollar weakness there is a need to look for reasons to back the euro and justify why EUR/USD is rising, other than the weakness in the dollar. This time around it was the ECB’s preemptiveness in cutting rates, getting ahead of the curve by trying to balance limiting inflation and enabling growth to continue. It worked for a while, with EUR/USD hitting a one-year high September but as soon as the dollar has found its strength once again, the positive side of the euro is forgotten, with many now highlighting the weakness of the European economy as a driver in the pair’s bearish correction.

The fact markets are now pushing back on rate cut expectations from the Fed whilst believing the ECB is likely to keep on track of continued rate cuts has shifted rate differentials in favour of the dollar once again. The daily chart is starting to show some exhaustion in the EUR/USD pullback so we could see some correction in the coming days, but this is unlikely to change the path of least resistance in the short-term. The area between 1.0775 and 1.0720 has been key for support in the past so we could see some weakening of the bullish drive heading towards these levels.

EUR/USD daily chart

Past performance is not a reliable indicator of future results.

USD/JPY risks threats of further intervention from Japan

Meanwhile, the Japanese Yen has put up a bit more of a fight in its depreciation against the dollar, but USD/JPY has been driving strong bullish demand these past two days. The pair is up 1.2% on the day having pushed past its 200-day simple moving average (SMA) for the first time since July 31. Wednesday’s move has shot through a level where traders have exercised caution in the past, especially when Japanese intervention was at the front of everyone’s minds. The next level to watch out for is the 154 area where indecision has creeped in before.

Traders should be aware that there is a risk that another round of Japanese intervention becomes a real possibility the more the pair appreciates, especially ahead of the US election. As opposed to most other central banks, the Bank of Japan (BoJ) is in the midst of a tightening cycle which has been allowing JPY appreciation as rate differentials were tightening. Because of this, we could see the BoJ using strategic commentary about further rate hikes in an attempt to stop the depreciation of the yen, specifically against the US dollar.

USD/JPY daily chart

Past performance is not a reliable indicator of future results.

Capital Com is an execution-only service provider. The material provided in this article is for information purposes only and should not be understood as investment advice. Any opinion that may be provided on this page does not constitute a recommendation by Capital Com or its agents. We do not make any representations or warranty on the accuracy or completeness of the information that is provided on this page. If you rely on the information on this page, then you do so entirely at your own risk.