Donald Trump's win and the Republican sweep of the House (probably) and the Senate (certainly) is consistent with our Roaring 2020s scenario. Indeed, it increases the odds that the good times will continue through the end of the decade and possibly into the 2030s. Stocks soared yesterday on the widespread perception that Trump 2.0 will include a cut in the corporate tax rate and reductions in business regulations.

The impact of higher tariffs and wider government budget deficits under Trump 2.0 was largely ignored by the stock market, but not the bond market. While the 10-year US Treasury bond yield rose over 4.40%, the S&P 500 climbed 2.5% to a new record high of 5,929.

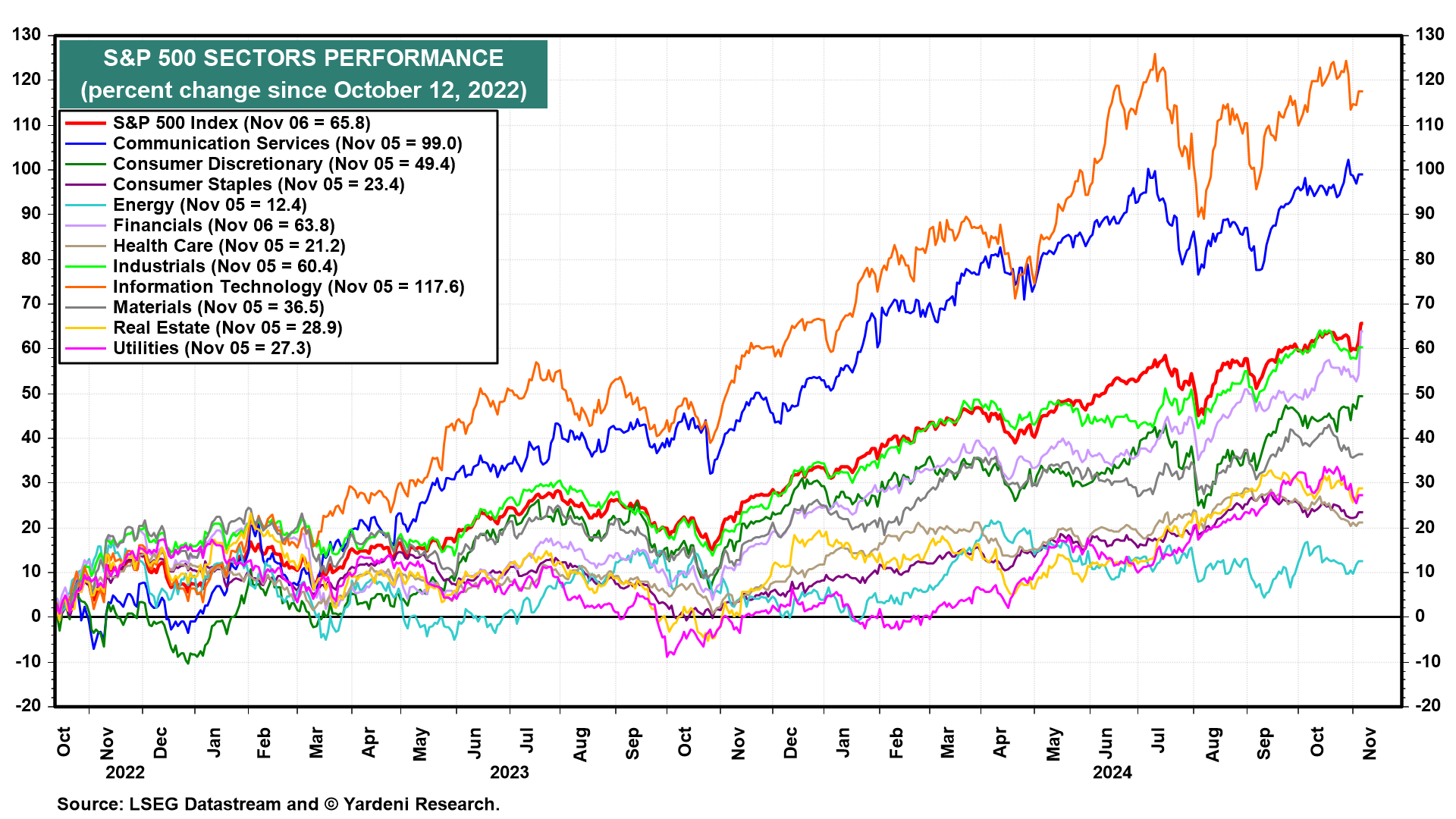

Cyclical sectors that we've been recommending such as Financials, Industrials, and Information Technology (including Communication Services) rose sharply while defensives and rate-sensitive stocks underperformed (chart).

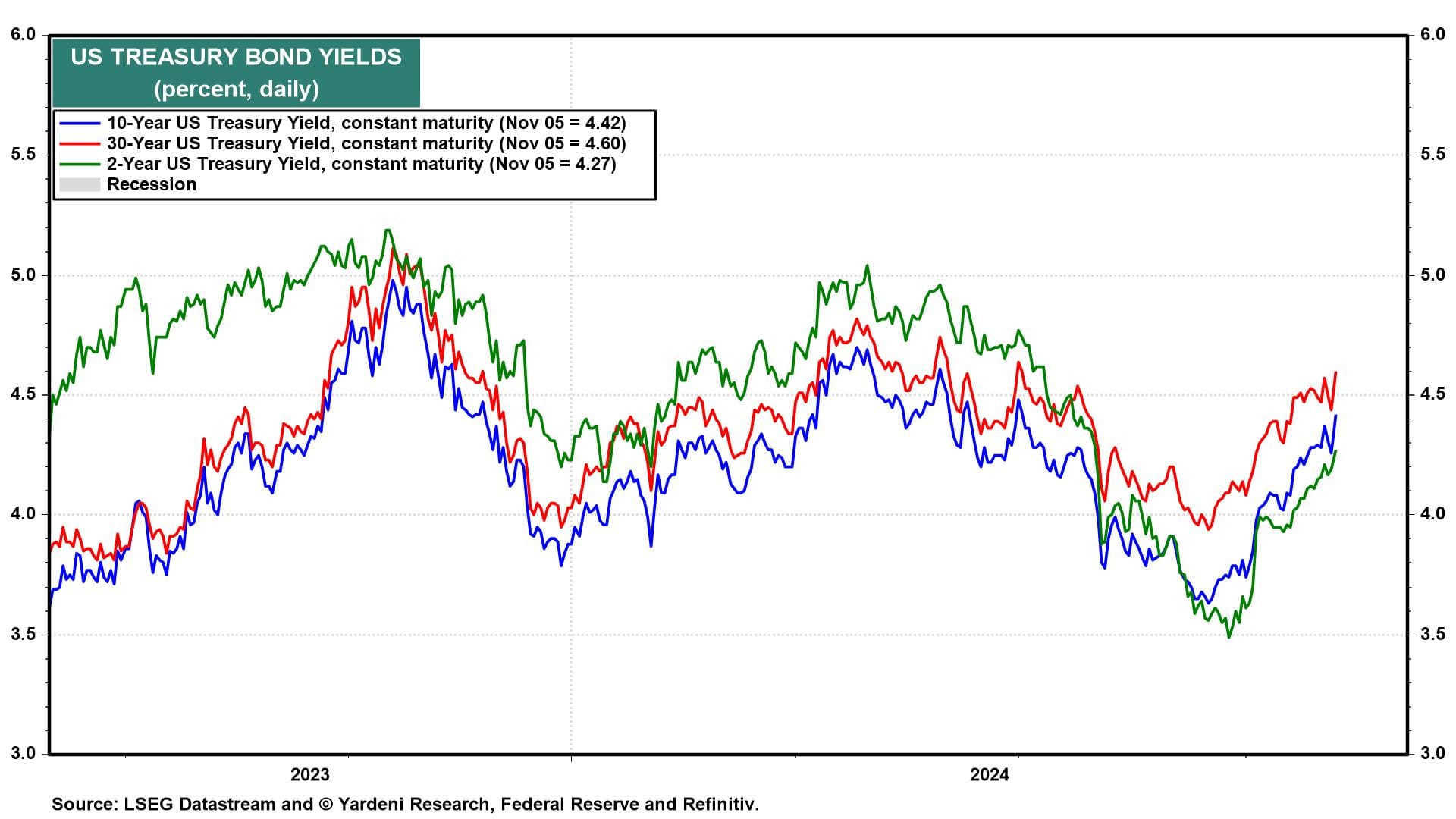

Treasury yields jumped as the yield curve steepened. The Bond Vigilantes are pricing in higher growth, inflation, and government borrowing. The 10-year yield rose 15bps to around 4.40% and the 30-year yield rose 18bps to roughly 4.60% yesterday (chart).

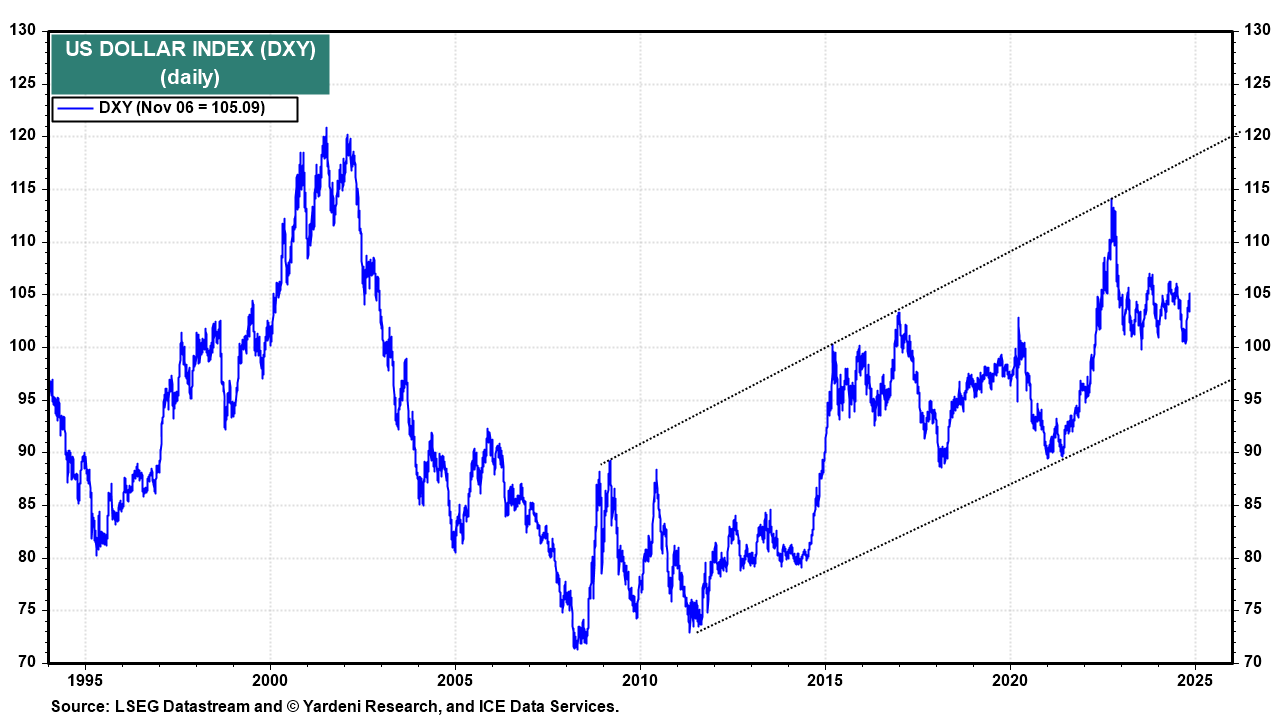

The dollar was up 1.7% yesterday as foreign investors concluded that Trump 2.0 should be bullish for the US economy and US assets (chart). We're sticking with our investment recommendation to Stay Home rather than Go Global. In other words, overweight the US in global stock portfolios.

For now, we're also sticking with our subjective probabilities for the following three scenarios: Roaring 2020s (50%), 1990s-style stock market meltup (20%), and 1970s-style geopolitical crisis with a possible US debt crisis (30%). But we are considering raising the odds of the Roaring 2020s scenario as a looser regulatory environment and lower corporate and income taxes under Trump 2.0 should boost investment and propel productivity-led economic growth.