Triple Point Social Housing REIT (LON:SOHO) delivered strong performance in H121. Its portfolio of long lease specialised social housing assets continues to perform as expected, delivering consistent financial returns and generating strong, externally assessed social value. Although the share price has recently weakened on a revived debate about the sustainability of the lease-based provider model, we forecast no financial impact and expect SOHO to meet its FY21 DPS target (a yield of 5.4%).

Share price performance

Positive outcomes driving demand

Our January initiation note provides a detailed overview of SOHO’s strategy and the specialised supported housing (SSH) market. In summary, the shortage of SSH is forecast to increase, yet compared with the alternatives of residential care or hospitals, it improves lives in a cost-effective manner. The Good Economy consultancy independently estimates that every £1 invested by SOHO will generate almost £4 in social value. At a national and local level it is government policy to offer supported housing to more people and private capital is crucial in meeting this need. For those individuals receiving SSH, rents are funded by central government and paid, via the commissioning local authorities, directly to the Approved Providers (APs), which lease the properties from SOHO and manage them. In some cases, APs have struggled to keep pace with the rapid growth of the sector, attracting regulatory scrutiny. We believe this is aimed at delivering sector sustainability (by improving their governance, operational performance and financial strength). This should benefit the security of contracted rents and long-term growth of the sector.

Available capital and strong pipeline

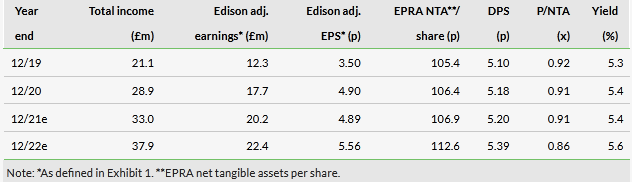

H121 NAV total return was 2.4%, continuing the trend of consistently positive quarterly returns since IPO in 2017. Supported by the award of an investment-grade credit rating from Fitch, the refinancing of short-term, floating rate debt with long-term, fixed-rate debt eliminates interest rate risk and enhances the quality of earnings by locking in a positive spread between debt cost and rental income. It also provides an additional £65m of debt capital to fund acquisitions from a pipeline of opportunities amounting to more than £150m. The additional debt cost reduces our forecast earnings and DPS cover, but we expect FY22 DPS to be substantially covered by cash earnings as the additional debt capital is deployed.

Valuation: Robust, attractive, growing income

FY21e DPS of 5.20p represents a yield of c 5.4%, with good prospects for inflation-indexed growth, while the shares trade broadly in line with net asset value. Combined with robust rent collection, this is in our view attractive in a continuing low interest rate environment.

Click on the PDF below to read the full report: