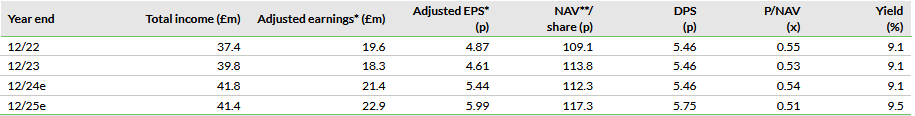

Q324 DPS was fully covered by adjusted earnings and despite a delay in resolving rent collection with My Space, one of the two recent problem tenants, we expect this to remain the case. My Space has ceased its partial rent payments since June but rent collection on the assets re-tenanted from Parasol to Westmoreland is expected to increase. With a My Space resolution taking longer, our forecasts for FY24 are reduced but are sufficient to cover DPS., while the shares continue to yield more than 9%.

Note: *Excludes revaluation movements and non-recurring items and adds back non-cash loan fee amortisation. **Throughout this report, NAV is EPRA net tangible assets per share.

Westmoreland transfer on track

Through H124, the vast majority of SOHO's (LON:SOHO) portfolio continued to perform as expected with just two (of 27) tenants in material rent arrears. Of these, Parasol continued to pay the rents agreed under its creditor agreement until August, when the assets leased to it were transferred to Westmoreland. SOHO says that for the period post-transfer to end-FY24, rent collection is expected to increase in line with previous guidance. Disappointingly, My Space, which had been making partial rent payments in H124 (we estimate less than half that due), has for now stopped all rent payments. SOHO continues to work towards a transfer of the assets to an alternative provider, which should see a substantial increase in the rents collected. Meanwhile, the agreed sale of a portfolio of properties for more than £20m, which had been expected to complete in November, has been delayed as the purchaser seeks to close on the funding. While the delay supports near-term rental income, it pushes back the expected, accretive share repurchases.

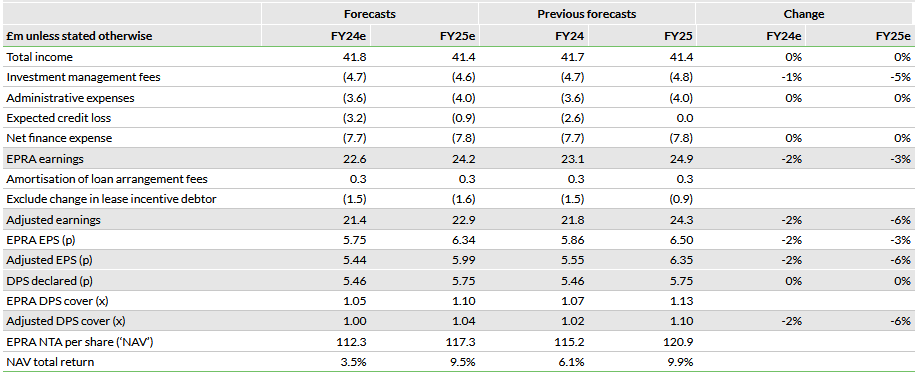

Reduced forecasts but fully covered DPS

Perhaps conservatively, we now assume no resolution to the My Space situation until mid-2025. As a result, our FY24 adjusted earnings estimate is reduced by 2% and FY25 by 6%, although we expect FY25 earnings to be growing as a result of indexed rent uplifts and the Westmoreland transfer. We assume the portfolio sale completes in early FY25, with £20m of share repurchases spread across the year. The My Space situation negatively affected the Q324 external property valuation, which decreased by £5.7m or 0.9%, with yield widening continuing to offset the positive impact of rental growth, as in H124. Q3 NAV per share fell 1.4% to 110.8p. We have adjusted our NAV forecast accordingly but still anticipate valuation growth in FY25, driven by rental growth, the impact of re-tenanting and a more favourable UK commercial property backdrop as interest rates moderate.

Valuation: Not factoring in a rent collection recovery

We forecast FY24 DPS to be fully covered by adjusted earnings. This is reflected in a yield of more than 9%, while the discount to NAV remains more than 40%.

Changes to Forecasts

Resolving tenant issues

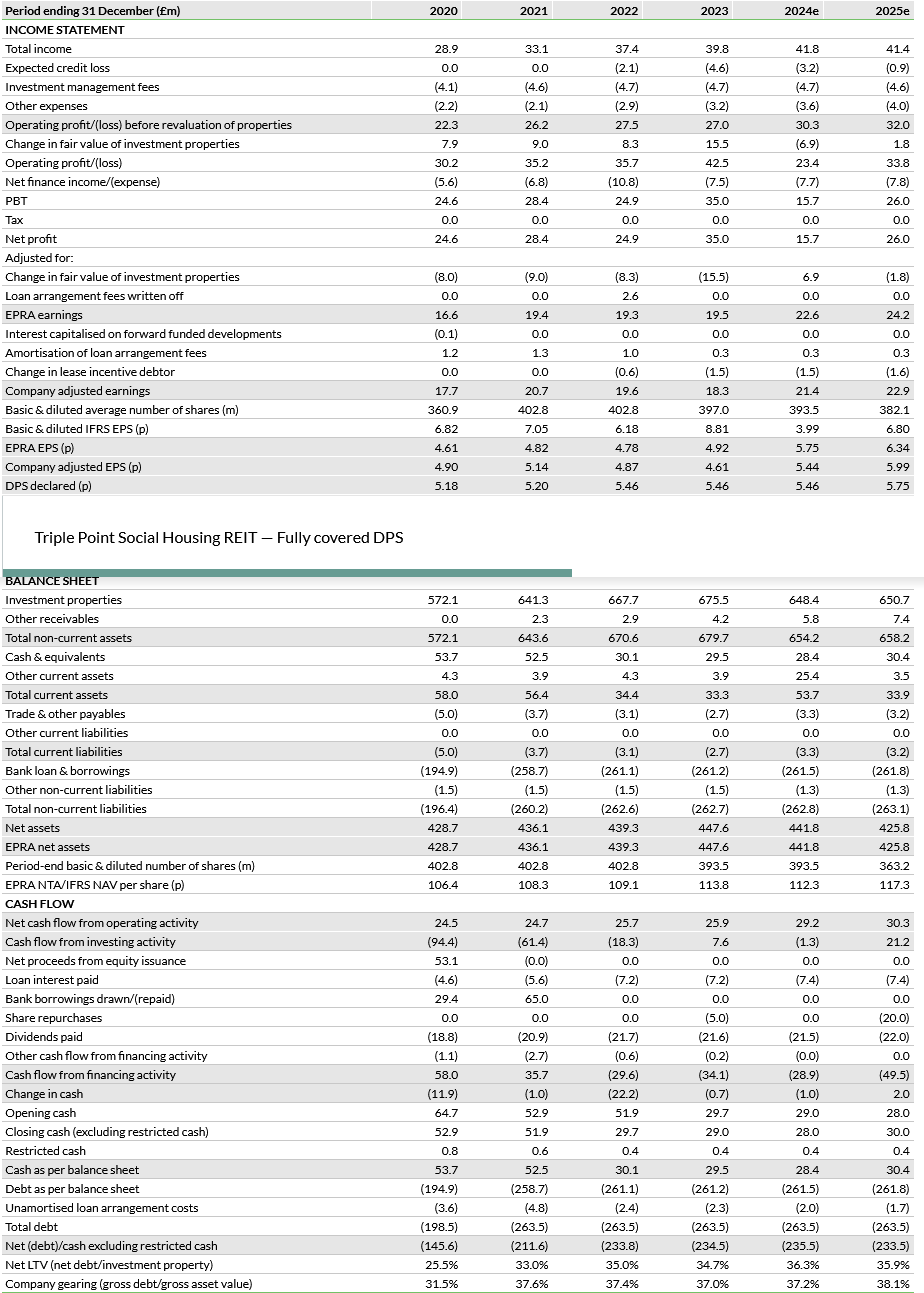

During H124 rent collection increased to 93.3%, compared with 88.1% in H123 and 90.2% for FY23 as a whole. This improvement was primarily the result of the creditor agreement with Parasol (9.6% of H124 contracted rents or c £4.1m), as a result of which it paid 60% of the full contracted rent (with the balance reflected as a lease incentive), continuing up until the transfer of assets to Westmoreland in August. SOHO indicated that under the terms of the transfer, rent collected (from Westmoreland) would increase to between 75% to 85% of existing contracted rent during an initial stabilisation period (expected to last approximately 12 months from the date of transfer). It has confirmed that it expects rent collection for the post transfer period ending 31 December 2024 to be line with this. Beyond the stabilisation period, the company has said that it expects rent collection to increase further, to up to 90% of the existing contracted rent.

My Space accounts for just over 8% of contracted rents or c £3.5m pa. We estimate that less than half of this was paid in H124 with the balance fully provided for as an expected credit loss. The further reduction in collections from My Space in H224 is therefore reflected in our forecasts below as increased expected credit losses, in H224 and H125. From the beginning of H125 we assume a re-tenanting of the assets on similar terms to the Westmoreland transfer.

Continuing rental uplifts

All of SOHO’s rents are linked to either the CPI (92%) or RPI (8%) with an increasing overlay from SOHO’s new risk-sharing lease clause (for details see our March 2024 update), which has now been rolled out to most leases. The clause sets rent uplifts at the lower of the relevant inflation index and the prevailing government policy towards social housing rent increases. For 2025/26 and the years to 2030/31, the government has determined that social housing rents can increase annually by up to CPI plus 1% and is consulting on the appropriate term over which this policy should be extended. The new government has previously indicated that it expects social housing rents to increase by CPI plus 1% annually for the next 10 years. This means that SOHO’s rents should continue to track inflation even if the rate of uplift has moderated materially.

For the current year, two-thirds of SOHO’s rent reviews have been linked to the September 2023 level of CPI of 6.1%. In September 2024, the annual rate of CPI increase was 1.7% and this will be the basis for most of SOHO’s FY25 rent reviews. The September dip in CPI (the annualised increase to August was 2.2%) has a small impact on our forecasts, which had previously assumed 2.0%.

Exhibit 1: Forecast Changes

Source: Edison Investment Research

Management arrangements

Following a review of the company’s investment management arrangements, in September, Atrato Partners was appointed as the new investment manager, in place of Triple Point Investment Management. The board will provide details of the new investment management agreement in due course but has indicated that it expects this to deliver significant cost savings whilst maintaining the existing high levels of service provision. The formal transition is expected in January 2025 and in the interim period the board, Atrato, and Triple Point are working together to effect a smooth transfer, including in respect of the company’s plans for the transfer of the My Space leased homes to a new provider.

Exhibit 2: Financial Summary

Source: SOHO historical data, Edison Investment Research forecasts