Treatt PLC (LON:TET) has continued to perform well, with the good business momentum continuing into H122. As previously flagged and as consumers emerge from the pandemic, the performance in FY22 is expected to return to more normal beverage trends, with H2 seasonally stronger than H1, and a shift back to on-trade beverage consumption. In addition, the higher-margin healthier living categories are also expected to perform better in H2, which will be reflected in the split of profitability. We raise our revenue forecasts to reflect the strong momentum, but our profit estimates remain broadly unchanged, due to mix considerations and cost inflation.

Share price performance

Business description

Treatt provides innovative ingredient solutions from its manufacturing bases in Europe and North America, principally for the flavours and fragrance industries and multinational consumer goods companies, with particular emphasis on the beverage sector.

Demand still strong

Demand remains strong, with expected revenue growth of 11% at constant currency for H122, to £66.3m. This has been driven by citrus, where Treatt has grown a number of longstanding relationships with large beverage companies, demonstrating its strong market position. Revenue growth was also strong in both synthetic aroma, and herbs, spices & florals, in part driven by higher demand for protein flavourings. Treatt’s business remains diversified as it continues to win new business with both new and existing customers, and both directly to consumer goods companies and indirectly through flavour and fragrance houses. Crucially, H1 has ended strongly and the momentum has continued into H2, with stronger growth coming from the higher-margin healthier living categories. Margins are therefore expected to be materially stronger during H2.

UK relocation nearing completion

The new UK facility is fully open, and the operational commissioning continues. According to previous guidance, most of the manufacturing will be up and running by mid CY22. Treatt has also invested in substantial inventory holdings (c six months trading), which has helped it to successfully navigate a number of supply chain challenges.

Valuation: Trading at a premium to peers

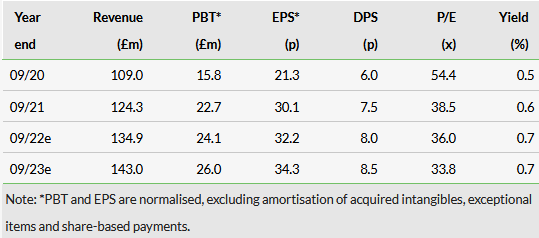

We note that the current share price is discounting medium-term sales growth of 4.5%, falling to 2.5% in perpetuity, with a WACC of 5.7% and a terminal EBIT margin of 20.0% (vs 17.2% in FY21). Our earnings estimates remain broadly unchanged following the trading update. Treatt trades at 36.0x FY22e P/E and 27.8x FY22e EV/EBITDA. It trades at a c 30% premium to its peer group on a P/E basis and a c 40% premium on EV/EBITDA, though it trades in line with peers if we exclude those that are more exposed to lower-margin commoditised products.

Click on the PDF below to read the full report: