Treatt (LON:TET) has had yet another strong year, with momentum in the business continuing. Revenue growth was 14% during the year, or 18% at constant currency, and was driven by continued strength in the healthier living segments, although slightly below our forecasts. Margins also continued to benefit from the positive mix as Treatt’s products increasingly move towards more value-added solutions. FY21 PBT is still expected to be in line with prior guidance.

Share price performance

Flavours and fragrances continue to be attractive

The flavours and fragrances market continues to be attractive and Treatt successfully embraces the sweet spot. Its portfolio is well suited for the consumer trends of clean labels and more natural, better-for-you products. For example, the consumer shift away from categories such as beer towards products such as craft beers, alcoholic seltzers and cocktails – which all contain natural flavourings – serves as a material driver of growth for the whole flavour industry and for Treatt in particular. The return of the on-trade following the lifting of COVID-19 restrictions, coupled with an increase in new launches that were postponed from the height of the pandemic, has resulted in further growth, particularly in the tea category, which was up 113% in revenue terms.

Positive mix still driving margin improvement

Treatt’s continued focus on value-added products continues to be a driver of margin expansion as the group moves away from commodity products. Faster growth in the higher-margin categories was also of help during FY21 and hence management upgraded its PBT outlook with the H121 results. In terms of costs, increases in freight and logistics costs have not materially affected the group as it tends to transport concentrated product, hence logistics costs are less significant. The company reported ending FY21 with net debt of c £6m on a pre-IFRS 16 basis.

Valuation: Dividend uplift expected

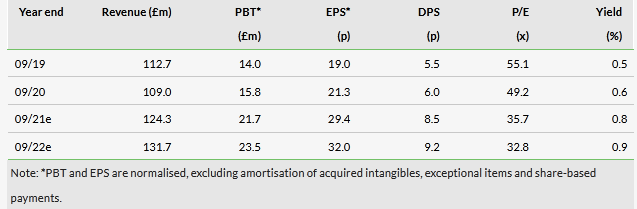

We note the current share price is discounting medium-term sales growth of 4.5%, falling to 2.0% in perpetuity, with a WACC of 5.7% and a terminal EBIT margin of 20.0%. We expect a significant uplift in the dividend in FY21 as the company has a very modest net debt position. Our earnings estimates remain broadly unchanged following the announcement. On a calendarised basis, Treatt trades at 32.8x FY22e P/E and 20.9x FY22e EV/EBITDA. On both P/E and EV/EBITDA multiples, it trades at a c 10% premium to its peer group.

Click on the PDF below to read the full report: