Key Points:

- Greece and Germany on a debt collision course.

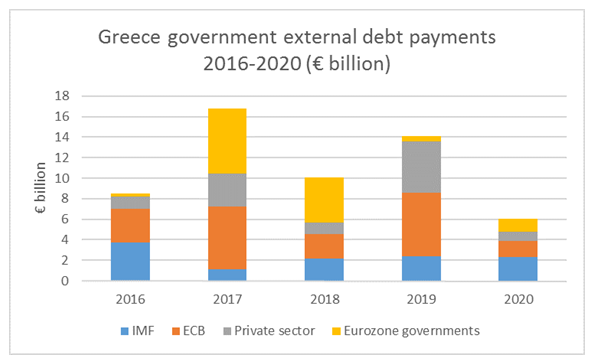

- Greece unlikely to meet budget or debt repayment schedule.

- The question is now political as to whether Greece remains part of the EU.

It appears that history is again turning full circle as the formerly ‘solved’ Greek debt crisis returns to raise its ugly head and again threaten the wider Eurozone. The past week has seen the IMF again enter the fray and suggest that a looming debt Armageddon could potentially pose a risk to the broader stability of the Eurozone. However, despite evidence that the previous bailout programs are not working, Germany is standing their ground and yelling a resolute no to any mention of debt relief for the embattled Greek nation.

Increasingly, the IMF is becoming unwilling to throw good money after bad by continuing to fund Greece’s survival,without the prospect of debt cuts to provide for a relatively achievable recovery for the nation. The renowned institution has, quietly behind the scenes, been pushing for a debt relief deal from Germany but is meeting staunch resistance. In fact, German Finance Minister Wolfgang Schaeuble has publicly suggested that the Lisbon Treaty blocks any form of debt forgiveness and that any moves in this direction would have to bring about a Greek exit from the common currency.

However, it remains to be seen just how far Germany is prepared to push Greece given that Britain will soon also exit the European Union. There is a definite split in the air between EU nations on how to deal with the errant Greeks, but it appears relatively clear that the nation will indeed fail to meet either their current budget or the debt repayment target.

It also begs the question as to the morality of asking the Greek people to continue accepting stark austerity measures when the money simply goes to Germany as part of the interest payments on borrowings and does little to reduce the current debt burden. Obviously, that is a highly untenable situation to have a European partner nation in effective debt servitude.

Given the fact that prior bailouts have not worked, and some of the other external pressures, we are rapidly reaching a critical juncture where both Europe and the Greek people will need to decide upon the way forward. Clearly there needs to either be debt forgiveness or an exit from the Eurozone.

The choices have now exited the realm of economics and we are now faced with a range of political questions. Politics is likely to decide the course of action in the coming months but one thing is for sure, continued German intransigence could be presiding over the first few dominoes to fall in the greater question of the EU’s survival.