- As the rally hits new highs, the High Beta vs. Low Volatility ratio also reaches record levels.

- The Nasdaq and S&P 500 have posted strong returns in 2024, indicating further potential.

- A 5%-10% correction is possible, presenting buying opportunities amid low volatility.

- Unlock AI-powered Stock Picks for Less Than $8/Month: Summer Sale Starts Now!

As the rally keeps making new highs, investor everywhere are increasingly wondering whether it has a solid foundation, whether it is still sustainable, and consequently, whether it can continue.

Here is one of my favorite 'ratios' for identifying risk appetite/adversity - and it has reached new all-time highs:

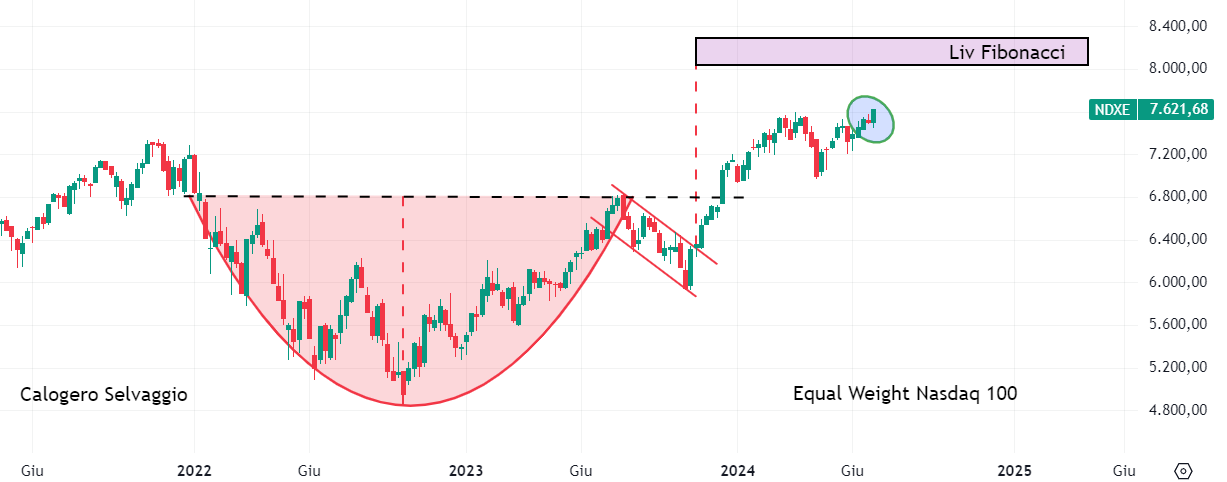

High Beta vs. Low Volatility reminds me a lot of the equally-weighted indexes of the NASDAQ, perhaps because they better represent the average stock than the more popular market capitalization-weighted indexes.

From the chart, we see that after March 2021, where High Beta sectors (at the numerator) recorded a new all-time high, they outperformed Low Beta sectors (at the denominator).

Throughout 2021, they attempted to exceed those levels until November 2021, where things reversed, i.e., Low Beta companies outperformed by taking advantage of the uncertainty in the economy (and this is also reflected in the low-rated companies). In June 2022, the trend again reversed sharply on high-beta sectors, anticipating a strong rally in equities.

I re-shared the report in mid-June, until then the 2021 levels had represented "insurmountable" psychological resistance, signaling the possible and final breakout. At present, a confirmed breakout would be the most bullish thing we could hope for in continuing the trend.

Not only that, speaking of Equally-weighted, the Nasdaq has recorded new highs.

From the chart, we see that the projection of the "cup and handle" pattern is going on. It was formed with a rather pronounced trend that led prices to form lows in 2022 and then reversed very gradually, forming a "bottom" first.

So, between 2022 and 2023, the first phase in which an accumulation occurs, until the start of the reversal movement that brought prices close to the "edge" of the cup, and then a correction formed the handle part.

Subsequently, in November 2023, the upward trend resumed with the confirmation of the reversal giving rise to the breaking of the edge of the cup (dashed black line) and initiating the positive projection of the figure that also corresponds to the Fibonacci extension levels, 1.414%.

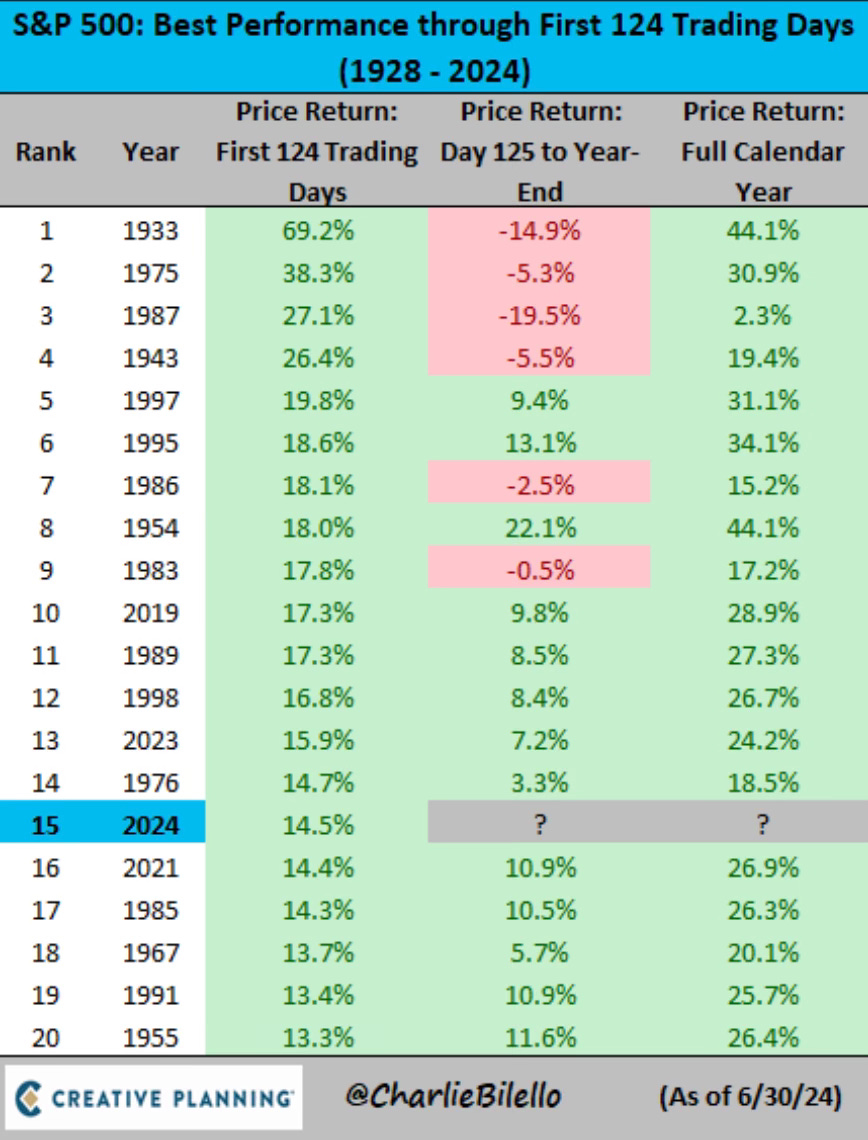

In addition, last week, short for the holidays, ended with the S&P 500 and Nasdaq with new all-time highs. The former has set new all-time highs three times, reaching 34 new highs so far in 2024. Since the beginning of the year, for those who may have forgotten, the S&P 500 has had a return of +17.3 percent while the Nasdaq +24.2 percent.

There is a good chance of further positive returns as the months go by (perhaps more moderate than the first part of the year), supported by both the Fed cutting rates and earnings that are set to rise further.

At the same time, one has to wonder whether the market might have had a healthy correction.

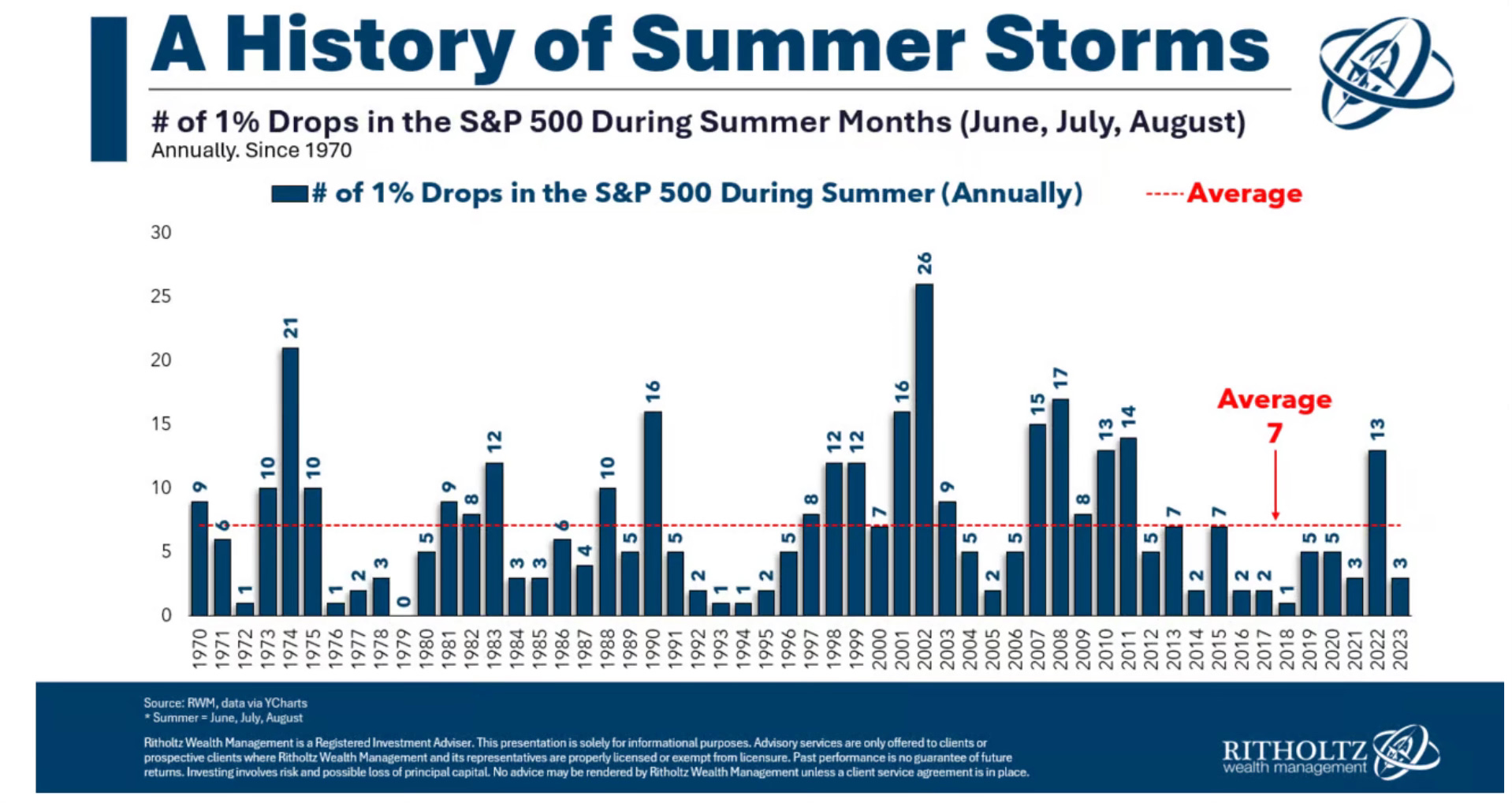

At this stage, there does not seem to be anything brewing to cause a worrisome or lasting decline, but we should not be surprised by a market catching its breath in the form of a routine and temporary 5%–10% decline. Given the positive fundamental environment, pullbacks could be a buying and rebalancing opportunity.

The chart highlights the historyof summer storms and the number of 1% declines in the S&P 500 during the summer months (June July and August), averaging 7%. Some volatility is gives to take into account at some point.

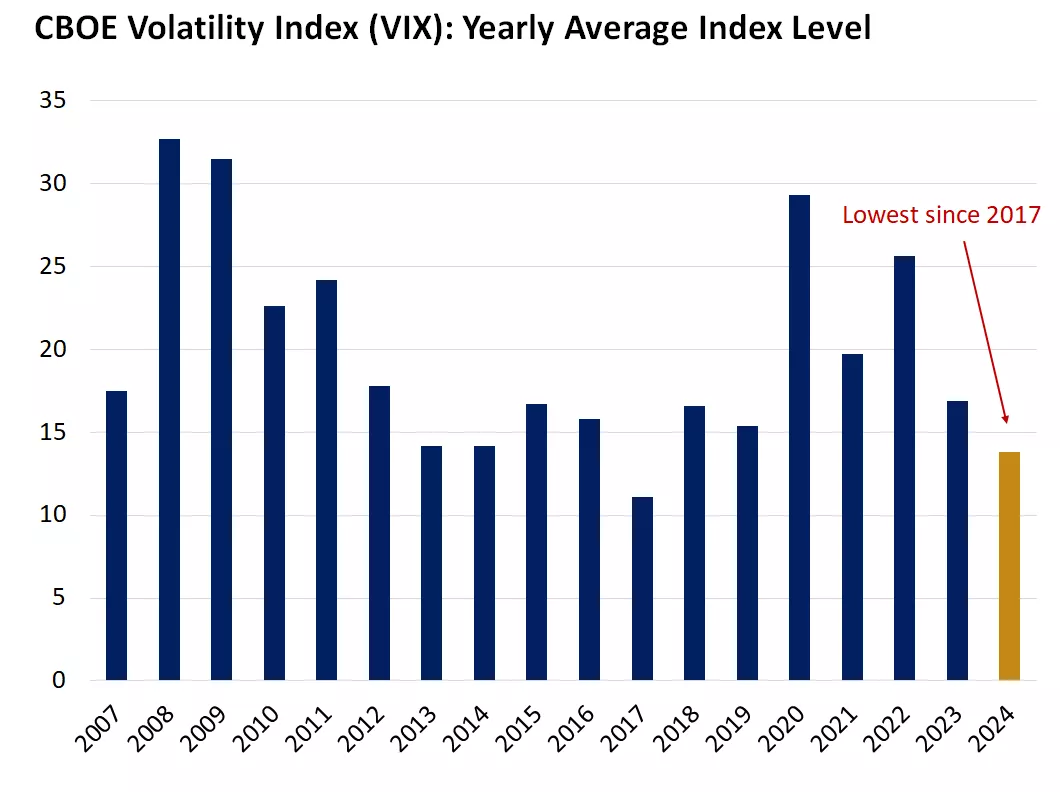

Although currently the VIX index (which measures market volatility and is often referred to as the "fear index") recently recorded its lowest daily reading since 2019. Looking at the annual average, 2024 saw a level of 13.8 i.e., the lowest level since 2017 and the second lowest annual average in the past two decades.

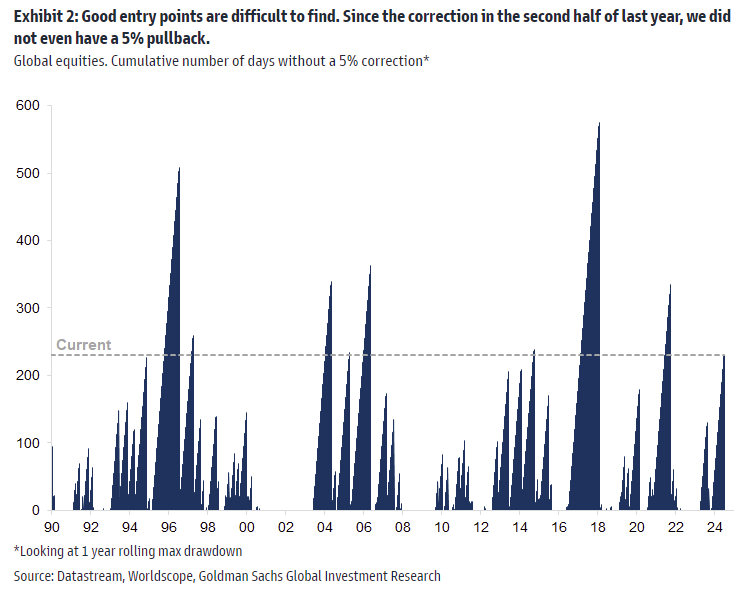

Finally, as we enter the second half of the year, a common question that may arise: what is the right time to start buying again?

Finally, as we enter the second half of the year, a common question that may arise: what is the right time to start buying again?

On the one hand, there are investors who are examining their portfolios, wondering if they are positioned correctly ahead of the second half of the year. Others have excess liquidity waiting for the opportunity to catch a pullback.

The latter are still waiting to buy the pullback, because it simply has not happened yet

One thing that is often forgotten when people think they are waiting far too long for a correction is that they are missing out on much of the climb. Also, historically the probability of having losses with the S&P 500 index on any given day is slightly worse than a coin toss (46%), but the probability of loss decreases by half if you extend the period to 1 year (26%) and to a greater extent in periods beyond 5 years (10%) and 10 years (5%).

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $7 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest; as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset is evaluated from multiple points of view and is highly risky, and therefore, any investment decision and the associated risk remain with the investor.