- Adobe's stock fell 11% after issuing weaker-than-expected Q2 revenue guidance, overshadowing a strong Q1 performance.

- Meanwhile, Williams-Sonoma stock rose 17% following a Q4 earnings and revenue beat, leading to analyst upgrades.

- And, Oracle stock climbed 11% post-Q3 earnings beat, fueled by high demand for its cloud services, despite fair value analysis suggesting potential overvaluation.

- Subscribe to InvestingPro now for under $9 a month and never miss another bull market again!

In this week's earnings recap, we delve into the latest quarterly reports from four industry giants— Adobe (NASDAQ:ADBE), Williams-Sonoma (NYSE:WSM), Oracle (NYSE:ORCL), and Dollar Tree (NASDAQ:DLTR).

We have analyzed these stocks using the power of InvestingPro, available now for less than $9 a month. So, let's take a look at what makes these stocks stand out and what analysts are saying about their prospects.

Adobe drops on weak guidance

Adobe Systems saw its shares drop 11% pre-market today following the announcement of Q2 revenue guidance that fell short of analysts' expectations, overshadowing the company's Q1 earnings that exceeded estimates.

In Q1, Adobe surpassed the analysts' prediction of $4.38 and achieved an EPS of $4.48. Year-over-year, revenue increased by 11% to $5.18 billion, ahead of the $5.14B forecast.

For Q2/24, Adobe anticipates an EPS range of $4.35 to $4.40, compared to the expected $4.38. The company forecasts revenue to be between $5.25B and $5.3B, below the anticipated $5.31 billion.

Digital media net new revenue guidance of $440 million also fell below the expected $460M. This guidance raised concerns about the impact of increasing competition on the company's growth.

Furthermore, Adobe disclosed a new stock repurchase program, allowing up to $25B in common stock buybacks.

The results preceded Adobe's upcoming investor day on March 26, where the company is set to introduce new products potentially countering concerns about competition, especially from OpenAI's text-to-video generator, Sora.

Williams-Sonoma stock jumps 17% following strong beat, analysts positive

Williams-Sonoma shares soared over 17% on Wednesday following the release of its Q4 earnings. The company reported EPS of $5.44, beating the analyst predictions of $5.14. The revenue reached $2.28B, surpassing the expected $2.22B.

For fiscal year 2024, Williams-Sonoma forecasts net revenue growth ranging between -3% to +3%, with comparable sales anticipated to be between -4.5% to +1.5%.

Moreover, Williams-Sonoma announced an increase in its quarterly dividend to $1.13 per share, up 25.6% from the previous dividend of $0.90, with an annual yield of 1.9%. Additionally, the Board of Directors authorized a new $1B stock repurchase program, replacing the existing authorization.

Following the earnings report, the company received several analyst upgrades. Morgan Stanley upgraded Williams-Sonoma from Underweight to Equal-Weight, highlighting the company's “underappreciated ability to hold its margin even in a weaker demand environment.”

Morgan Stanley (NYSE:MS) raised its price target from $155 to $270 and adjusted its fiscal year 2024 and 2025 earnings forecasts upwards, noting the company's capability for operating leverage amid a tepid demand backdrop.

Goldman Sachs also upgraded Williams-Sonoma from Sell to Neutral, acknowledging the retailer's sustained higher margins and better-than-expected trends for both Q4 and the 2024 outlook.

Oracle surges on Q3 beat, but fair value models suggest downside

Oracle shares soared 11% on Tuesday, following the announcement of its quarterly results which exceeded expectations, driven by robust AI demand for its cloud infrastructure.

In its Q3, Oracle reported an EPS of $1.41, surpassing analysts' expectations by $0.03. The company's revenue reached $13.3B, slightly above the consensus projection of $13.29B.

Following the results, Oracle received several analyst upgrades. Argus upgraded Oracle from Hold to Buy, setting a price target of $145.

The firm highlighted Oracle's significant achievement during the quarter, where its burgeoning cloud revenue outpaced its legacy license support revenue for the first time. This development underscores the anticipated dominance of cloud services in Oracle's revenue mix.

William Blair upgraded Oracle from Market Perform to Outperform, citing:

In our view, the positive demand commentary and strong bookings growth undergird the structural shift at Oracle that positions the company well for a sustained acceleration in top-line growth.

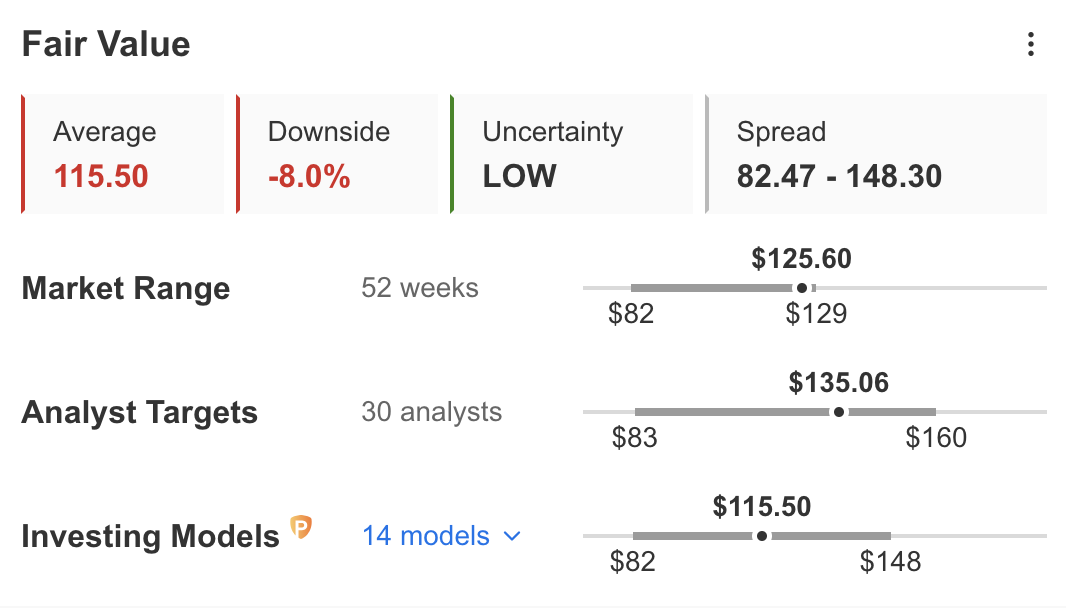

However, despite the positive momentum, InvestingPro's Fair Value analysis suggests Oracle's stock may be overvalued, projecting an 8% potential downside based on Investing models.

Source: InvestingPro

Dollar Tree misses, plans to close stores

Dollar Tree experienced a 14% drop in share price on Wednesday following its quarterly earnings report, which fell short of consensus estimates. Additionally, the company revealed plans to close several stores.

The discount retailer posted an EPS of $2.55 for Q4, not meeting the analyst expectation of $2.66. The quarter's revenue totaled $8.64B, slightly below the anticipated $8.66B.

For the fiscal year 2024, Dollar Tree anticipates net sales to be in the range of $31.0B to $32.0B, compared to the Street estimate of $31.65B. The company expects its diluted EPS for fiscal 2024 to be between $6.70 and $7.30, compared to the consensus of $7.04.

Additionally, Dollar Tree announced it would close 970 Family Dollar stores, as part of its strategy to revive its deteriorating business segment.

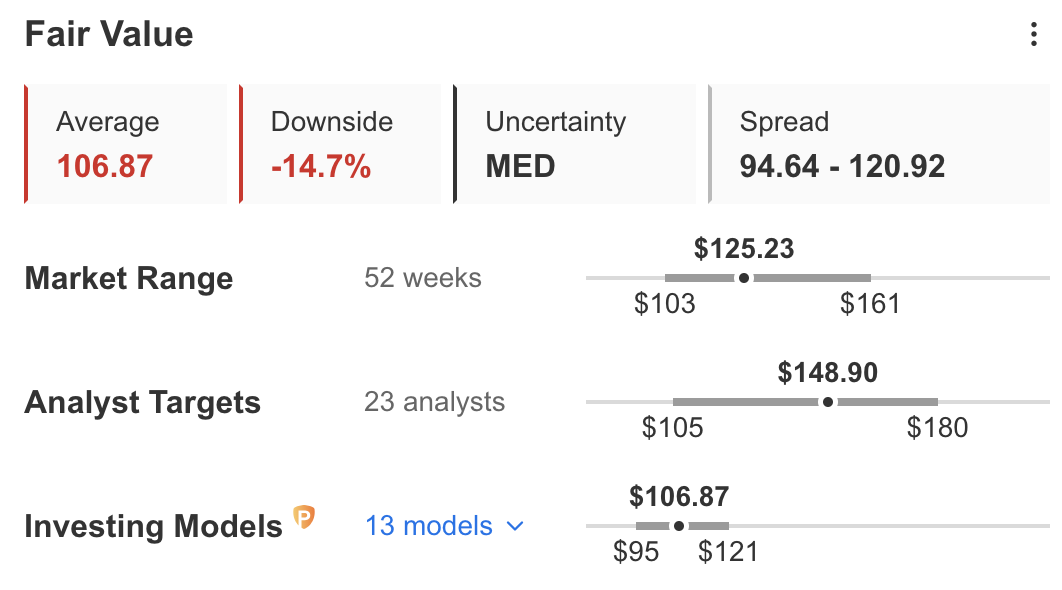

Despite the subsequent decline in share price, InvestingPro's Fair Value analysis indicates that Dollar Tree's stock might still be overvalued. The analysis forecasts a potential 14.7% downside, according to Investing models.

Source: InvestingPro

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

*Readers of this article get an extra 10% off our annual and 2-year Pro plans with codes OAPRO1 and OAPRO2.

Subscribe here and never miss a bull market again!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.