Monday 26th August

Tuesday 27th August

Wednesday 28th August

Thursday 29th August

Friday 30th August

We’ll know the outcome from the Jackson Hole Symposium

Ultimately it appears that Powell’s speech on Friday (ie later today) is the main attraction. Traders are feverishly trying to decipher whether the 25 bps cut really was just a ‘mid cycle adjustment’, or there’s further easing to come. Yet the outcome of the talks could well spill over to next week, which could make early Monday trading more interesting than usual. Particularly if Powell is more dovish on the economy, given the latest set of tariffs.

G7 Summit comes to a close

The summit takes place between Saturday and Monday, with the final two days providing closing statements from central bank heads and key figures.

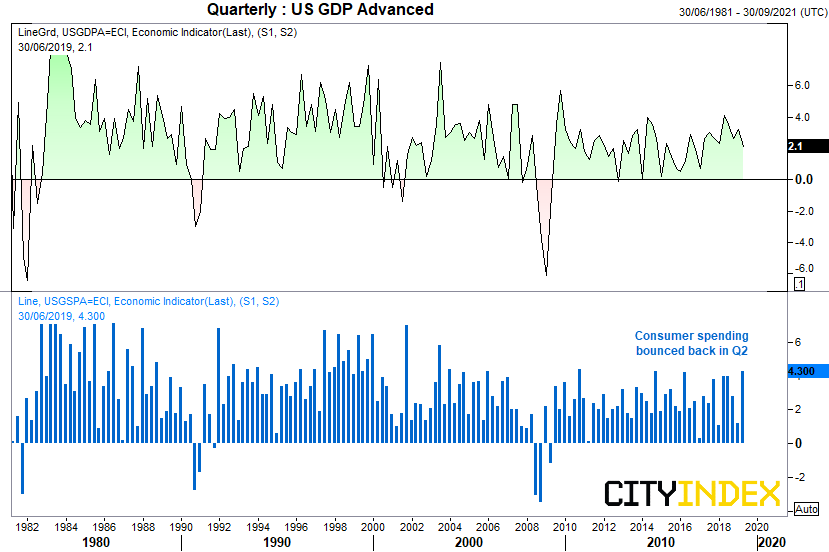

US GDP, 2nd Estimate: USD pairs, US Indices

GDP for the second quarter grew at 2.1%, not quite as slow as had been feared. Consumer spending jumped at its fastest rate since Q4 2017 (up from 1.1% in Q1) although business investment contracted by 0.6%, its first negative print since Q1 2016. If we’re to see GDP revised lower, it could weigh on UD sentiment as calls for Fed to act sooner would be in the rise again.

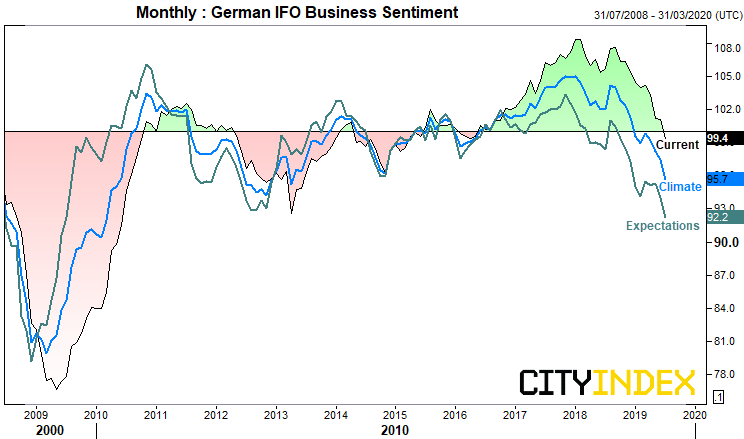

German IFO Business Sentiment: Euro crosses, DAX

Most indications for Germany are pointing towards a recession, and the IFO reads pull no punches on this. The current conditions index has weakened for four consecutive months, with July’s data contracting (pessimism) for the first time since May 2016. Yet this was to be expected, given the IFO climate index has contracted since March, is at its weakest since 2013 and IFO expectations are their lowest since 2019 (having nose dived for the past 12 months).

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient.

Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.