This article was written exclusively for Investing.com

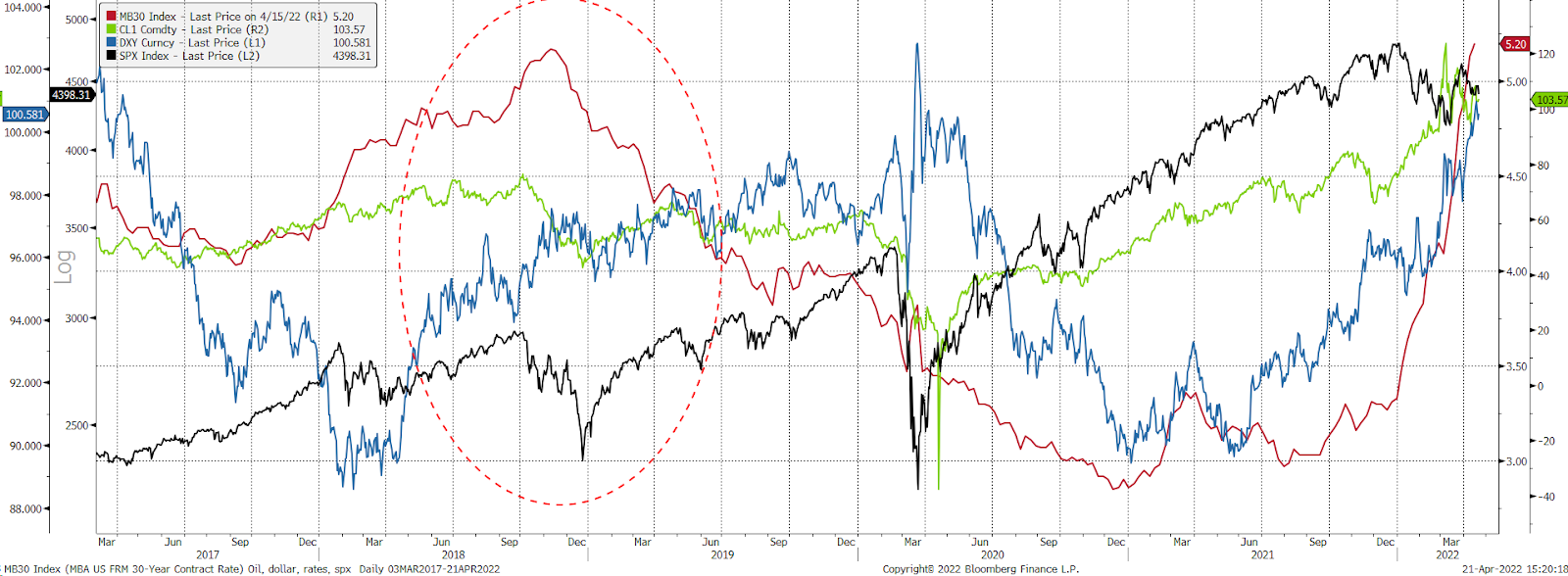

The last time mortgage rates were around 5%, the dollar index was over 97.50, oil was trading at over $75, and the 10-year rate was around 3%. That was in the fall of 2018 when the Fed was conducting quantitative tightening and increasing rates, which was quite literally when markets broke.

The S&P 500 plunged by around 20%, and the Fed had to back-peddle from rate hikes. It first held them steady and then had to cut rates and restart QE by the fall of 2019.

The Last Time The Market Broke

Just four years later, we again have mortgages rates over 5%, the dollar index is at 100, oil is trading over $100, and the 10-year rate is approaching 3%. On top of that, the Fed is now embarking on an even bigger rate hiking cycle and is very likely to conduct quantitative tightening at double the pace of the 2018 version.

If the markets broke in 2018, and arguably now they are worse, what will make this time around any better for markets? Rising oil prices, higher rates, and a stronger dollar will weaken global growth prospects, which should work to reduce inflation.

A Greater Strain

Much of the surge in oil is due to the war in Ukraine. However, the more prices stay high, while nations are losing purchasing power due to the stronger dollar, the harder it will be to sustain economic growth. We have already seen some of the effects of this—the IMF recently slashing its full-year 2022 global growth projections to 3.6%, from over 4%.

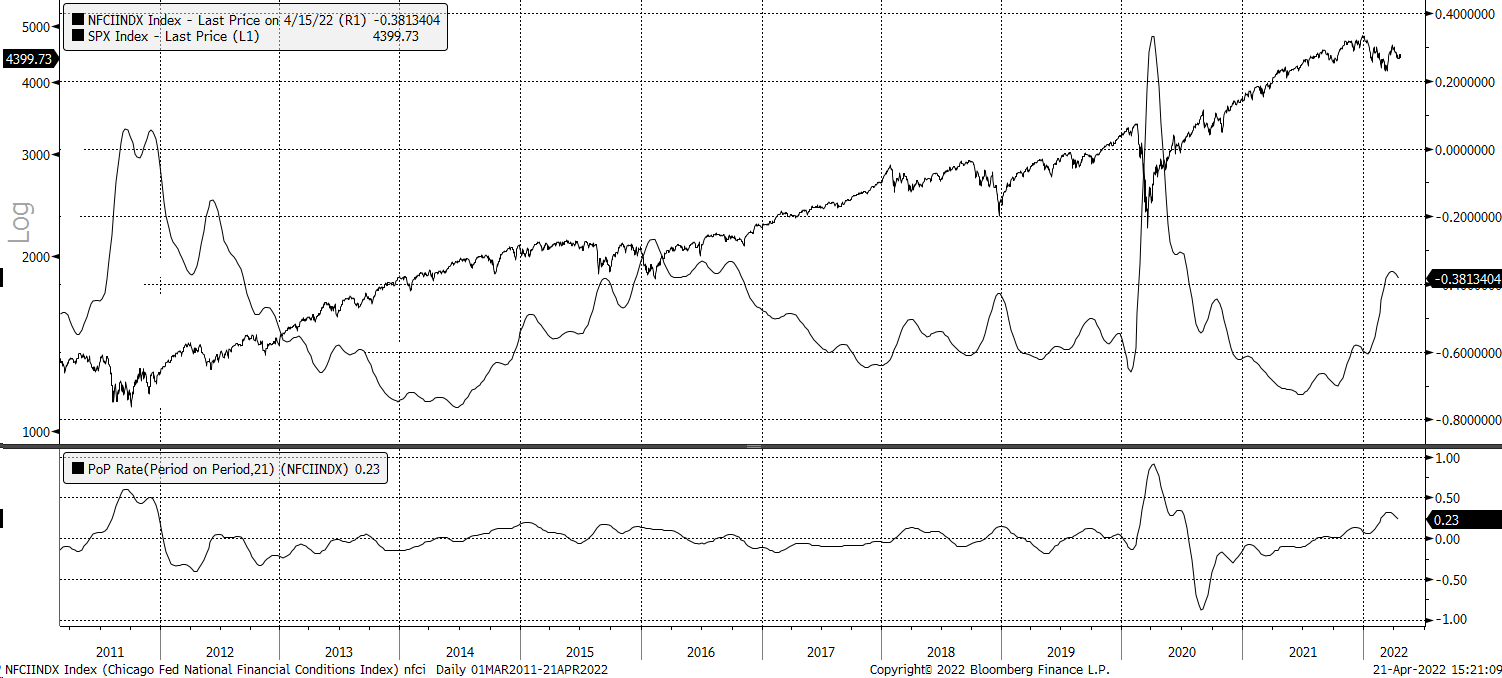

These higher prices will slow growth even in the US, with higher rates and energy prices making it more expensive. On top of that, the effects of higher rates will also work to tighten financial conditions, reduce the amount of leverage in the overall stock markets, and target asset prices overall.

The effects of this may already be showing up, and the Fed has only just begun. FINRA margin balances have fallen sharply from their October 2021 highs of $935 billion to $799 billion. As rates rise and financial conditions tighten further, leverage levels in the market likely will only fall more over time.

A U-Turn

The goal of this tightening policy, which is sending rates higher, is clearly to get inflation down. But it may very well be the case that the impact on demand may be more significant than what is intended. After all, look what happened just four years ago when the Fed had made a complete U-turn from running off the balance sheet and raising rates regularly to one where there was a pause just a month later, which led to rate cuts a few short months after that.

It seems likely that this ends in a similar way, with the Fed able to get a few rate hikes in, but the pain of higher rates, higher energy prices, and a reduction in leverage becoming too much for the markets to handle.

It may come down to just how much the economy can handle at one time. One of these changes may be enough, but when they all come together, it may be just way too many. It may be even more than what is needed to get inflation to break. It may even mean the Fed has to do a major U-turn faster than anyone expects.