China's growing protests are sending oil and stocks down

It looks like in China there is no rest for the protests against COVID-19 lockdowns leaving investors in a feeling of uncertainty.

That has led the stock market as well as the oil to tumble.

According to the actual level of the Long-dated Treasury yields, which is below the Fed’s overnight benchmark range, traders believe that we are going to see a recession starting next year.

This week there are important data to be released such as the November US jobs number including the unemployment rate, but all eyes are on Powell who is going to speak about the Fed monetary policy and its effectiveness.

S&P 500 Technical Analysis - Daily Chart

The S&P 500 price has been rejected at the 200-day MA (green moving average).

We have been watching closely at this key technical level since it can signal a bull or a bear market.

The last time the price touched the 200-day MA was in mid-August and has been declining ever since.

Therefore, this rejection is a bearish signal and possibly a confirmation that the bearish trend will continue.

The potential support lines, that the bulls will have to defend are the 3900 level which is in line with the horizontal support and also the 21-day MA (blue moving average) and afterwards the 3800 level which corresponds to the 50-day MA (red moving average) and the bottom of the rising channel.

If the price can break above the 200-day MA, the next resistance levels are at 4086 and 4100.

The RSI moved lower to 58, but it's still indicating a Bullish trend.

Therefore we need to wait to understand if this is just a correction in this new uptrend and prices will be able to break the 200-day MA the next time, or if this is a confirmation that the overall trend is still bearish.

For this reason, we still need to be cautious right now, as the price has to break the main resistance levels above 4100 before turning to a bullish trend.

Fear & Greed Index

The market sentiment remains unchanged in "Greed" level at 64 out of 100.FedWatch Tool - FED rates probabilities.

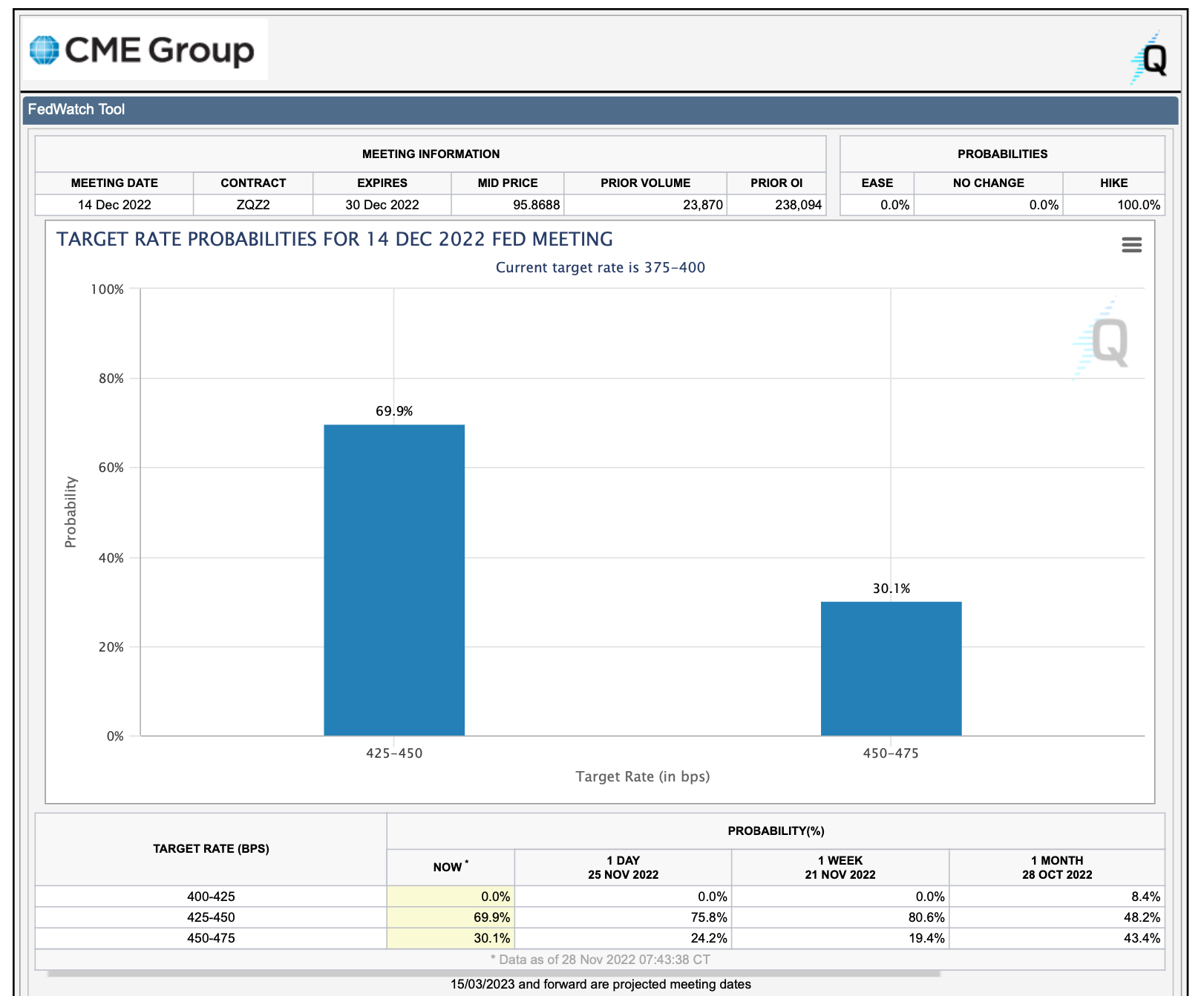

69.9% of investors are expecting the FED to increase the interest rates by 0.50% in the next meeting.

The remaining 30.1% are expecting a 0.75% rate increase.

The data show us that the number of investors expecting an increase of 0.75% is getting higher.

No other options are considered at this stage.

The next FED meeting is on 14 December 2022.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The S&P 500 falls following China's protests

Published 28/11/2022, 14:46

The S&P 500 falls following China's protests

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.