VIEW: Stocks had a blistering start to 2024, with the S&P 500 annualising its best year in 70. April has been more challenging, as expected, and we are on the verge of an overdue market ‘pullback’. The proximate cause is a reset of Fed rate cut expectations and higher bond yields. We see this as a healthy breather, with extended weakness to be bought. The twin bull market earnings growth and still-coming rate cuts pillars remain in place. And significant cash on the sidelines. Our focus is the cheaper and more economically sensitive sectors and regions, from financials to Europe. A short term contrarian signal is VIX volatility over the 1 STD level of 28.

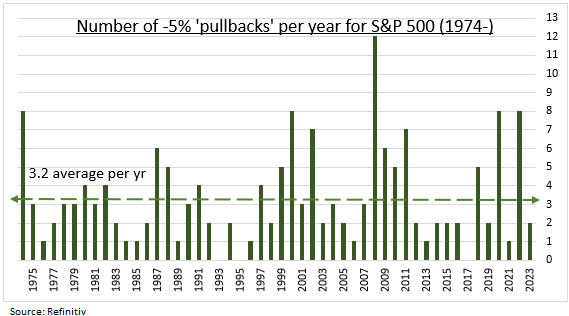

PULLBACK: Market sell offs come with the territory. There is no investment reward without risk. US stocks have seen long term average annual price returns of 10%, and stocks historically rise significantly more often than they fall. The S&P 500 has seen an average of three modest 5%+ ‘pullbacks’ a year (see chart). Much more often than 10% ‘corrections’. Or rare 20% ‘crashes’. Whilst the average intra-year S&P 500 drop has been a sizable -14%. Last year for example saw a -10% intra-year S&P 500 correction but ended up 24% for the calendar year. Whilst 2020 saw a much worse -34% intra-year plunge yet still ended up 16% for the full calendar year.

DRIVERS: Stock markets are in a short-term vice, squeezed three ways. 1) A repricing of later and lesser Fed rate cuts. With GDP growth stronger and inflation stickier. Driving bond yields higher and especially impacting those with high valuations, like tech (IYW), or high debts, like real estate (XLRE). 2) High geopolitical uncertainties, from Ukraine to the Middle East, have contributed to the US dollar (DXY) rally and the VIX rebound to long-term average levels. 3) The weaker technical backdrop of sharply rallied markets, high investor sentiment, and a statistically overdue pullback. With weak mid-year seasonality now arguably being pulled forward into April.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The overdue pullback arrives

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.