By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

- The Next FX Policy Trade

- RBNZ Cuts and Talks of Doing More

- USD/CAD Gives Up Post BoC Gains

- AUD Hangs Tight Ahead of Employment Report

- 3 Factors Behind the Rise in USD/JPY

- Quiet Trading for EUR/USD

The Next FX Policy Trade

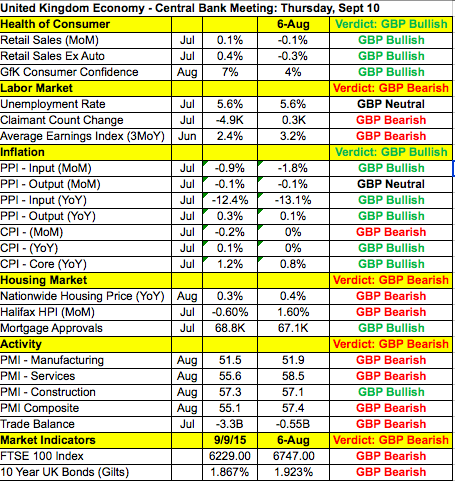

For currency traders, only one thing really matters in determining the medium-term direction of a currency and that is the outlook for monetary policy. We have had 2 rate decisions in the past 24 hours followed by a Bank of England meeting on Thursday. Based on the recent increase in U.S. rates, investors have not given up on the possibility of a September rate hike from the Federal Reserve but the chance is low and the decision is close based on the uncertainty in the global economy. The U.S. economy itself is doing well with the latest JOLTs data, one of Yellen's favorite labor-market indicators hitting a record high. Yet the Chinese economy is slowing and despite Premier Li Keqiang's reassurance that growth is in the "proper range," the government is worried. The difficulty of the Fed's decision explains why there has been little consistency in the performance of the U.S. dollar. The Bank of Canada and Reserve Bank of New Zealand's interest-rate decisions are discussed below but the next focus will be on Thursday's Bank of England meeting. The BoE is widely expected to keep policy unchanged but with the minutes set for release, the tone along with the number of policymakers voting for a rate hike will have a big impact on the currency. After falling for 9 straight days, sterling experienced a very strong recovery. However the hesitation in the markets Wednesday reflects the concern that UK policymakers have even less reason to favor an early rate hike this month than last. While consumer spending picked up, it remains very weak. Jobs were lost in the month of July as average hourly earnings declined. Manufacturing- and service-sector activity slowed significantly in August with the trade balance ballooning. This deterioration along with global market uncertainty will make it very difficult for the hawks to flip their votes in favor of tightening. As such, we believe the risk is for a renewed decline in sterling with the next FX policy trade being short GBP/USD for possible move below 1.52.

RBNZ Cuts, BoC Leaves Rates Unchanged

The Reserve Bank of New Zealand cut interest rates for the third time in a row, citing weakness in inflation and growth. While the move was anticipated by many economists, the decline in NZD/USD indicates that not all traders were positioned for a cut. What made the RBNZ rate decision particularly negative for NZD was the central bank's comment that further easing seems likely and further NZD depreciation is appropriate. In other words, not only has the RBNZ lowered rates but they are looking to increase monetary stimulus if economic data continues to weaken. The central bank also lowered its inflation and growth forecast for 2016, reinforcing their negative outlook for the economy. We now look for new lows in NZD. Meanwhile the Bank of Canada left interest rates unchanged but the impact on the Canadian dollar was short-lived as investors latched onto the more than 3.6% decline in oil prices, which fell on the back of a weaker US demand forecast from the Energy Information Administration. With that in mind, the BoC statement was neutral with a tinge of optimism. According to the central bank, consumer spending and the firm U.S. recovery will underpin growth with the lower currency absorbing the impact from weak resource prices, allowing for exchange-rate sensitive exports to regain momentum. Having lowered rates at the last meeting, there was very little justification for another move, especially given the uptick in jobs, manufacturing activity and oil prices. The BoC made no mention of another rate cut, which implies that they are comfortable with keeping rates unchanged for the time being. In fact we do not expect the central bank to lower rates again in this cycle. While the trend of oil prices is very important, USD/CAD should be trading lower given the optimism of the central bank. Australian employment numbers were scheduled for release Wednesday evening and given the rise in the employment component of all 3 PMIs, there was a reasonable chance that the data would surprise to the upside.

3 Factors Behind the Rise in USD/JPY

In the last 24 hours, we have seen strong gains in USD/JPY and the move can be attributed to 3 key factors. With Chinese stocks rebounding, there has been a general improvement in risk appetite and as a risk currency, USD/JPY stands to benefit when investors are more optimistic. U.S. rates have also moved higher, encouraging the rally in USD/JPY. But the primary reason for Wednesday's strength comes out of Japan. The Nikkei jumped 7.7% on Wednesday, its largest one day rise in 7 years on the back of Prime Minister Abe's promise of tax cuts in the coming year following his reelection as Prime Minister on Tuesday. The Chinese government also indicated that they would proceed with "stronger proactive fiscal policy" to counter slowing economic growth. This encouraged gains in Chinese stocks and in turn Japanese stocks. However according to Nikkei, one of Japan's most widely read newspapers, the Bank of Japan could lower its outlook for exports, which would revive concerns about the economy. Looking ahead, the sustainability of USD/JPY's gains will hinge on the market's demand for dollars and risk appetite. Unfortunately with U.S. stocks turning negative mid session Wednesday, the latter isn't likely to provide much ongoing support for the currency pair.

Quiet Trading for EUR/USD

Once again, euro ended the day unchanged against the U.S. dollar. No major Eurozone economic reports were released and the only official comments were from ECB member Praet, who sees growth slowing after the first quarter of 2017. Given how far off 2017 is, his comments had very little impact on the euro. The Swiss franc also rebounded sharply after falling aggressively in recent days. There's not much to say about the single currency pair outside of the strong possibility that it will remain range bound for the rest of the week -- at least as long as there aren't any ground-breaking developments.