The MISSION Group's (LON:TMGT) H1 trading update shows it is on track to meet FY22 guidance, with profits weighted, as is usual, to the second half. The trading backdrop is becoming more difficult, but the group’s collaborative approach is reaping rewards in new business and cross-selling opportunities. The client mix is also less weighted than peers to big-brand consumer names and more towards larger industrial and blue-chip names such as Aviva (LON:AV). The MISSION’s strengthened balance sheet allows for flexibility for organic investment and further bolt-on acquisitions to add capabilities or technologies. The share price has outperformed peers year to date, but the shares continue to trade at a substantial discount.

Managing tailwinds and headwinds

The MISSION is a beneficiary of the return of live events and of the relative health of the housebuilding sector, particularly as digital marketing of new developments gains ground. Specialist property agency ThinkBDW is well placed here. Other new business wins in the period include the drinks brands Bottlegreen and Shloer, as well as the multi-agency win of Phihong Technology in Taiwan. The closer collaboration between group agencies is allowing for more efficient pitching and execution, which is particularly important given the underlying inflationary pressures. Management’s view is that clients are being more circumspect and ever keener on getting a good return but continue to spend, with the US market particularly positive. Labour cost inflation is broadly being passed through in pricing.

Balance sheet strength gives flexibility

Net debt at the half year was £7.0m, down from £10.3m at end-FY21, post spend of £0.1m on the bolt-on acquisition of youth-focused agency Livity in February 2022. Outstanding acquisition obligations are now down to £2.6m, with the bulk of that (£1.9m) not payable until FY25. The group is clearly well within its KPIs of total bank debt and deferred acquisition obligations of less than 2.0x EBITDA and net debt to EBITDA of under 1.5x, based on FY22e consensus forecast EBITDA of £12.7m. The group has a £20m RCF, with £5m accordion, giving plenty of flexibility for organic investment and further bolt-ons, which are more likely than larger deals.

Valuation: Still well below peers

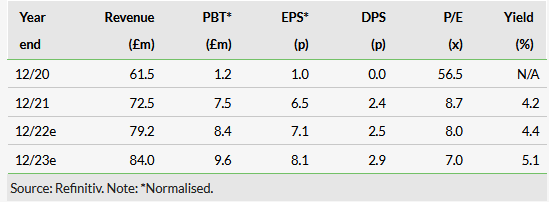

The MISSION Group’s share price is 11% below where it started the year, which is a considerable outperformance of other quoted smaller global advertising stocks that have retrenched on average by 25%. Nevertheless, the valuation still stands at a marked discount to the peer average of FY22e P/E of 13.2x and EV/EBITDA of 8.0x (FY23: 12.1x and 6.3x). Parity across both years implies a share price of 88p.

Consensus estimates

Share price graph

Business description

The MISSION Group is a collective of creative integrated and specialist agencies, employing 1,000 people in the UK, Europe, Asia, and the United States.

Bull

■ Collaboration and shared resource initiatives starting to provide benefits.

■ Balance sheet strength, with major acquisition payouts settled.

■ Breadth of client base.

Bear

■ Rising cost of talent.

■ Geopolitical uncertainties.

■ Limited free float.