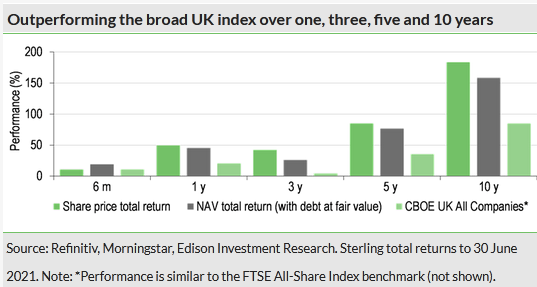

Law Debenture Corp (LON:LWDB) has reported on a successful first six months of 2021, building on its long track record of outperformance versus the benchmark over one, three, five and 10 years. Additionally, in its 42nd year of maintained or increased dividends, Q121 DPS increased by 5.8%. The portfolio benefited from its exposure to UK and international economic recovery and the IPS business delivered strong revenue growth and earnings growth in line with the mid- to high single-digit target.

Fund objective

The Law Debenture Corporation’s investment objective is to achieve long-term capital growth in real terms and steadily increasing income. The aim is to achieve a higher rate of total return than the broad UK stock market through investing in a diversified portfolio of mainly UK equities with some international holdings. The IPS business provides a regular flow of income, which augments the dividend income from the equity portfolio.

Bull points

■ Stable income from the IPS business is a significant contributor to total income and provides flexibility in portfolio construction.

■ Modest portfolio bias to value/cyclical stocks could lead to outperformance in a recovery.

■ Overseas allocation diversifies portfolio risk.

Bear points

■ There are some areas of IPS business that are economically and market sensitive.

■ Recent rotation towards value stocks may not be sustained.

■ Revenue reserves could be depleted if corporate dividend recovery is delayed.

Why consider LWDB now?

With the political and Brexit concerns that have dented global investment in the UK equity market receding, investor interest appears to be returning (evidenced by increasing M&A activity), perhaps encouraged by a low valuation in an international context and a more stable pound. LWDB’s highly differentiated business model adds investment flexibility and has delivered consistent long-term outperformance.

The analyst’s view

LWDB is a UK investment trust with an attached independent professional services operating business (IPS). Reinvigorated in recent years, IPS is cash generative and growing; it has funded 36% of dividends in the past 10 years (more in 2020), and its value, which has grown steadily in recent years, represents 16% of NAV. The IPS income contribution provides the portfolio managers with the freedom to select attractive lower- or non-yielding stocks while still meeting LWDB’s income objectives. In 2020, despite a 40% reduction in portfolio income, following the market trend, strong revenue reserves and c 10% growth in IPS earnings supported a 5.8% increase in DPS. The board targets a further increase in 2021.

Valuation

The significant re-rating of LWDB shares during 2020, reaching a premium of c 6% to NAV, has partly unwound but the current c 1% discount remains below the historical c 5–15%) range. The re-rating may well reflect investor recognition of the value of its differentiated proposition, highlighted by the long-term performance trend and dividend growth in a challenging environment. The Q121 annualised rate of DPS represents a yield of 3.6% and the board targets a Q421 increase.

Click on the PDF Below To The Read The Full Report: