The much-anticipated FOMC statement on Wednesday’s small 25 bps hike was greeted with open arms by the bulls, who already had pushed the FANG Gang up last month by an astonishing 40%+. Of course, Big Tech had been clobbered most of last year by rising interest rates and as I noted to Pro Shares members, was a short-term Buy from the December lows.

They have made substantial gains since. This is my advice to Pro Shares members on Meta in December:

UPDATE MON 12 DEC

A truly mega-contrarian play here. Not only is social media getting very bad press (again) but the whole metaverse thing seems to be stuck and going nowhere. So how can an analyst delving into the fundamentals justify a buy here? That is why I am not seeing buy advice in the MSM – a bullish sign.

But a tech analyst? That is a different story – see my charts below. The stand-out feature is the five downs on huge mom divs. So somebody is lapping these shares up. And that is probably the smart money.

On the wkly I have a five down with the fifth wave likely terminating at $88 on 4 November on a huge mom div.. And on the daily, I have a superb trendline with a likely complete small five down on another strong mom div. If genuine, as I suspect, my main target is the $200 region

ACTION You can go long (latest $116) with WL at $100

It made a high of $197 last week – bang on my target

But in the second reading, they noted the intention of the Fed needing to keep raising rates just to make sure inflation keeps falling. And thus on the day after the FOMC, we saw a total about-turn with shares falling off their perch, especially Big Tech. And latest earnings results and forward guidance of the giants Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), and Alphabet/Google helped temper the manic bullish projections of the FOMO crowd.

So does fighting the Fed still make sense as the bulls have been doing? We shall soon find out – and we got an inkling on Friday when the jobs data were blowout – and started my long-awaited dollar rally phase (see later).

Now with inflation in decline and many seeing a top to interest rates this year and then a decline, the bulls have an obvious reason to keep buying. But as Big Tech is now showing, meeting earnings expectations is becoming a challenge.

And recall the old market saw: “When everyone thinks something is obvious, it is obviously wrong”

Markets operate under their own rules – and they are not the same as for economic markets such as bread and shoes. For example in finance, rising prices attract more buyers ever more eager to own a position. The steeper the price rise, the more determined the buyers. In bread and shoes, rising prices deter buyers who seek cheaper alternatives and the buyers (aka consumers) lose interest

Most in the MSM do not understand this and persist in explaining rising prices in terms of more buyers than sellers. This is patently wrong as for every trade there is one buyer and one seller – equal numbers!

The reason prices rise is that the buyers are more urgent than the sellers (who like higher prices when selling anyway). When futures markets traded in pits in open outcry, you could tell which were the more urgent – in a bull run, the buyers made by far the loudest din (and vice versa)! Many floor traders used the din level as trade signals.

I believe Friday was the pivotal day I had been waiting for. It kicks off the dollar rally and very likely tops off the bear market rally in shares just when bullish expectations have become extreme. I see that MSCI emerging markets are seeing record investment inflows – a sure sign of hope over experience.

In addition, Bitcoin – that most speculative of investments – has enjoyed a surge in three weeks from $17,000 to last week’s $24,000 a gain of an impressive 40%.

And Tesla – my other litmus test for speculative mania – has doubled in the last four weeks! This at a time when the future of EVs was being thrown into doubt with sky-high electricity prices when filling up an EV costs more than that for fossil, not to mention the 20% – 30% premium for buying one.

Yes, folks, the old speculative juices have been in full flow with a frenzy of buying – and it was FOMO as the main driver.

But as stock markets resume their bear trends, they have full tanks of recent bulls who will be forcing prices lower with force as they see prices decline. That is how bear markets work – they fool almost everyone bulls and bears alike.

During the slump last year, many bulls had thrown in the towel at the October lows and pros were net bearish with major short positions. But this was precisely the condition where only a small buying pressure pushed prices up on a combination of new buying and short covering.

As prices rose into the new year, investors started to convince themselves that the Fed really did have their backs with talk of easing up on the rate hikes. And it was safe to go back into the water (we did – see Meta above).

Today, they are totally convinced inflation is last year’s problem and rates will ease back leading the way to a new era of bullish markets leading to new ATHs (yes, I have seen references to that forecast).

But now with the ‘everything rally’ concluding, the scene is set up nicely for yet another disappointment for the FOMO hopeful.

Gold (and Silver) have topped

One of the major participants of this rally has been Gold (and to a lesser extent Silver). This is another market where fundamentals such as supply/demand play a limited role except for interest rates (although that influence is far from strong). It moves on changes in sentiment (as do all others of course).

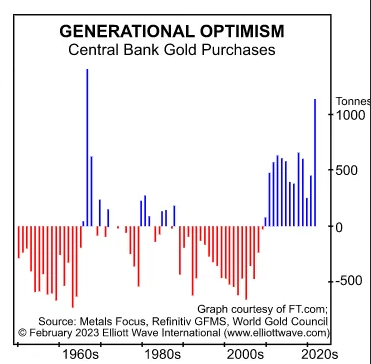

The big story on Gold in recent weeks is the heavy buying by central banks. This is one of the few data points in Gold that is recorded and is accurate (hopefully!). And central banks tell a valid story about market sentiment.

Here is the chart showing their activities over the years

In the last two days, Gold has lost $90 (5%) as traders have woken up to the Fed’s message – and that from Friday’s payroll data. The latest rally took the momentum and RSI up to heights where previously major tops were formed. Odds are now high a major top is now in place.

Another clue is that hedge funds are now about 3/1 long futures which is near an extreme. My outlook is for a renewed and lengthy bear phase.

So has the dollar finally turned?

I have been asking this question for ever, have I not? But now with the market suddenly easing back on its Fed pivot ideas, the answer is moving to the ‘affirmative’ side. And my tramline construction on the 4-hr chart provides major clues

The dollar made a new low on Thursday following the FOMC that traders took as a green light for the Fed to ease up on rate hikes. Many believe they will actually lower rates later in the year as inflation eases. Of course, this is at odds with what the Fed is actually saying. But that has never stopped those of a bullish bent from ignoring inconvenient truths!

And then on Friday, the spectacular jobs gains (on revisions) prompted a huge burst of short covering (and new buying) in what looks like a genuine reversal off my lower tramline support. Now visions of the Fed easing are vanishing before our eyes.

But what if inflation keeps falling – will the Fed pivot? And if so, will the dollar resume its collapse, as so many believe as inevitable?

I believe a more significant factor to watch now is not the easing of consumer price inflation as measured by commodity prices (crude oil/gasoline were hard down on Friday), but now the apparent ‘strength’ of the US economy will loom large. Jobs are apparently being created with wages/salaries still climbing fast.

With visions of the economy in danger of overheating if trends persist, the Fed will be in no mood to ease up on interest rate hikes (as they have always maintained). The immediate response of the US interest rate markets on Friday was to sharply raise yields.

Odds are now yields will continue higher – and will impact shares hard. This is the next big story in stocks.

But will this trend persist? One of the canaries in the tech mine is that the sector is seeing massive lay-offs as business weakens. Last week’s Amazon results – surely a litmus test for consumer demand -were weak. And Alphabet/Google’s cloud services also weakened.

With interest rates still rising and company earnings wobbling, many of the bullish expectations will fall flat. Last week I showed the chart of the rising US vehicle re-possessions and that is now being reported here in the UK as well. The rising rates are starting to impact the housing market with prices starting to decline especially in the regions where prices became insanely high.

So with this backdrop, can shares maintain their lofty FOMO levels? As one measure, Meta reached my $200 target that I believe will remain as a major high.

Now that traders have the weekend to digest all of last week’s macro data, I see the coming action this week as pivotal.

(chart courtesy www.elliottwave.com)

Central banks have a near-perfect track record in buying heavily into major tops – and this one is no exception. They are the last of the bulls to act since their decisions have to grind their way through innumerable committees that all have to agree that the market is in a bull run. And last/this year’s buying frenzy should cap off the major bull run and lead to major losses ahead.

Here is the weekly price chart

Unemployment is set to explode

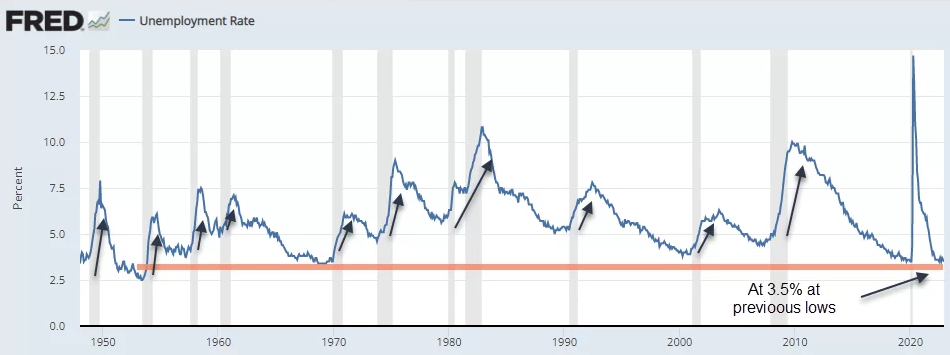

I showed this chart of the US Unemployment Rate recently

It reached a multi-decade low at 3.5% recently. This data point has always been a precursor to a recession (grey bars) when the rate starts turning up. With the massive tech lay-offs (that are ongoing), the next data point should be higher than 3.5% (unless the feds massage the numbers again, of course).

Many leading companies now have a hiring freeze. This follows the Great Resignation of last year when many ‘older’ workers simply quit their jobs and retired early. I see that process reversing this year as cost-of-living rises adversely impacting family budgets. Remember, although consumer price inflation may be falling now, prices are still rising at an unhealthy clip.

This may be the last year when summer holidays for the family abroad are standard as airfares are now massively up.

The spike in risk-on we have seen is now morphing rapidly into a much more conservative approach as was the case last year. The bear market relief rallies are about over as I peer over the cliff edge.