The German automotive industry is facing enormous challenges. For the first time in 30 years, Volkswagen (ETR:VOWG_p) is threatened with redundancies and plant closures. All of them, including BMW, Porsche (ETR:P911_p) and Mercedes-Benz, are struggling with declining sales figures.

But it would be a mistake to write off the German automotive industry. That would be a fallacy. As investors, we should now know exactly where we stand.

First, the difficulties:

Stagnating e-mobility

Demand for electric cars has slumped, mainly due to the end of the e-car subsidy in Germany. This is leading to underutilised plants and the threat of fines due to tighter EU fleet targets for CO2 emissions from 2025. According to industry expert Frank Schwope, the uncertain political situation is also contributing to customer uncertainty.

Weak economy

The general economic uncertainty is weighing on the sales market, particularly in Germany. New car registrations in August were down almost 28% year-on-year. The German Association of the Automotive Industry (VDA) expects the weak figures to continue in 2024, as the European car market is considered saturated.

Dependence on China

The high dependence of German manufacturers on the Chinese market, where they generate around a third of their sales, is increasingly becoming a problem. Demand in China is stagnating, while domestic Chinese brands are gaining ground in China and Europe with their technologically advanced electric cars. German manufacturers, especially VW, are losing market share.

High production costs

Rising energy and personnel costs are making the production of low-cost entry-level models in Germany unprofitable. According to Schwope, German production is increasingly focusing on higher-priced vehicles, while Germany is losing competitiveness as an industrial location in international comparison. Another serious factor could be that German manufacturers have missed the boat on producing important components such as batteries and software in-house. BYD and Xiaomi are a whole step ahead in this respect, and are thus able to reduce production costs in particular, which are up to 30% lower than those of German manufacturers.

High profit expectations

Although carmakers continue to make a profit, expectations regarding margins are high. Especially in the pandemic years, record profits were achieved due to the shortage of parts and the focus on high-priced models. According to Schwope, however, these cannot be maintained in the long term. Nevertheless, these targets are being used as a benchmark.

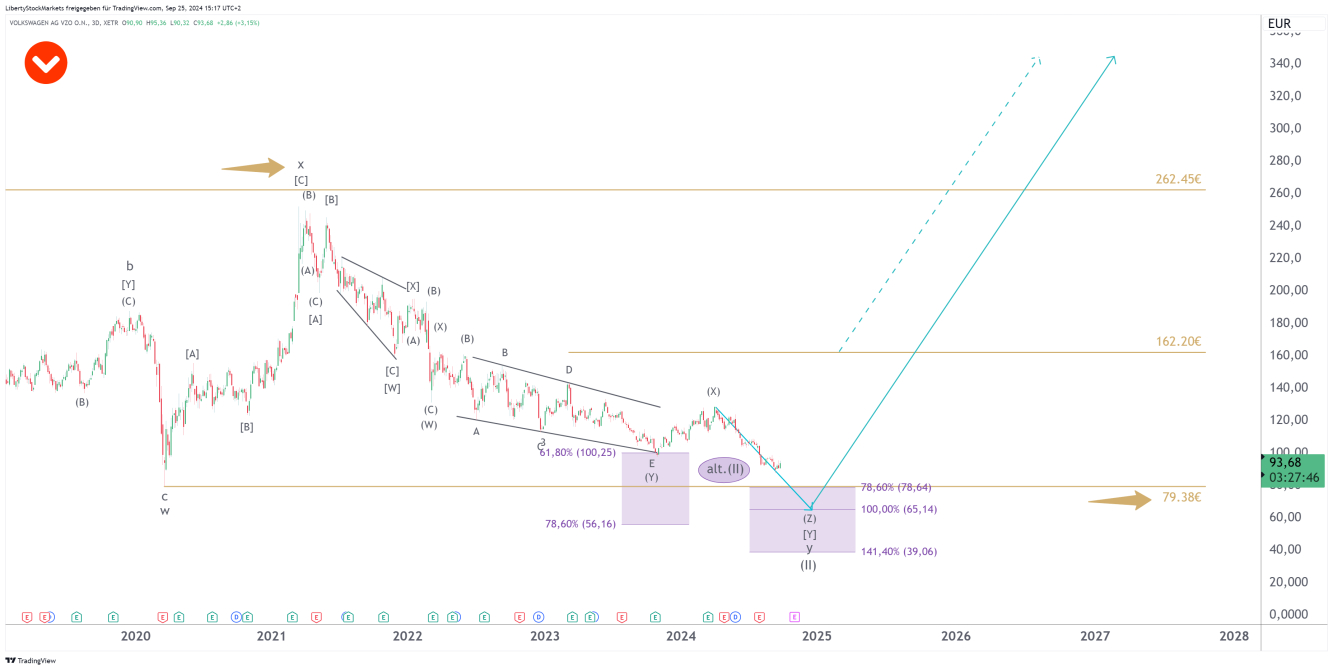

Volkswagen: At rock bottom?

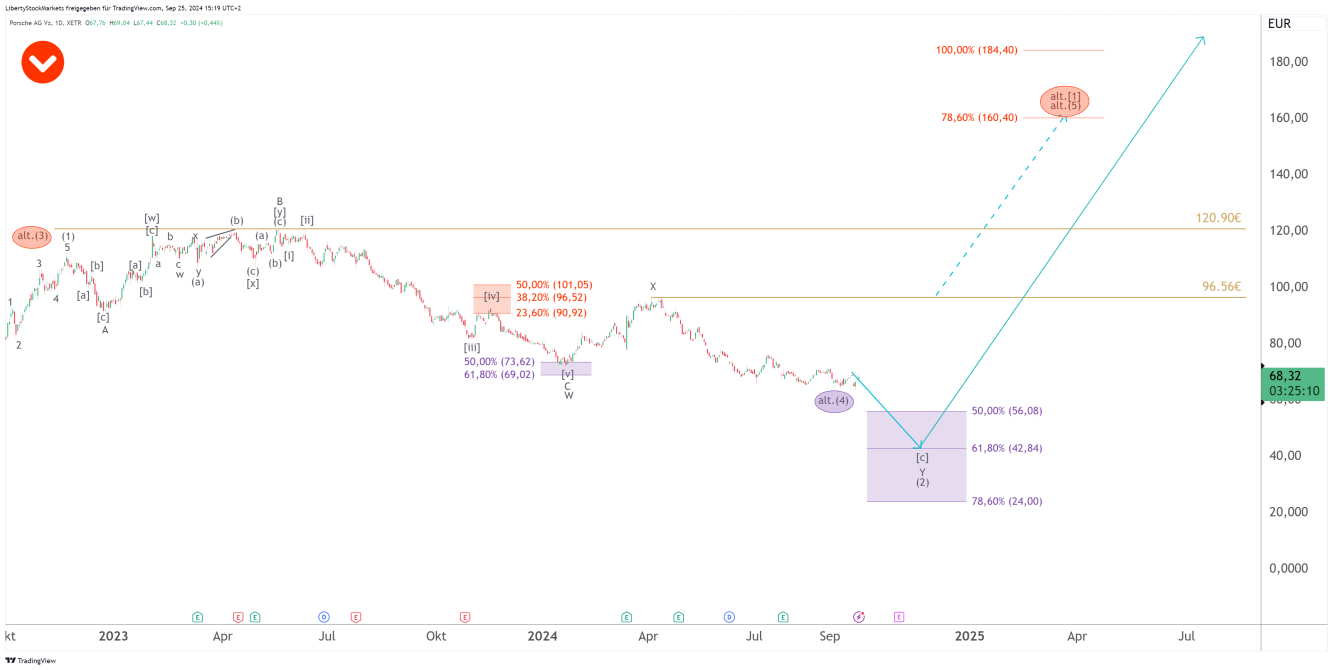

Volkswagen is facing its greatest challenges. Its market share in China is shrinking, its software subsidiary Cariad and the ID models are not competitive. New models, developed in collaboration with Xpeng (NYSE:XPEV), will not be released until 2026 at the earliest. VW is fighting for market share, while Chinese manufacturers such as BYD, Nio and Xiaomi are scoring points with cheaper and technologically more advanced electric vehicles. This also applies to Porsche. A Porsche drives, it drives well, even very fast and also this through curves. But in terms of digitisation and infotainment, all Volkswagen models lag behind their Chinese competitors. And that is exactly what the Chinese want. They are mainly stuck in traffic jams and cannot drive fast through curves.

And so it is no surprise that both stocks, those of VW and Porsche, still have a long way to go – downwards. There could be a recovery phase in the meantime, but we see the targets for both stocks falling well below their current levels.

At VW, we expect a sustainable trend reversal at the earliest below €79.38. This is an important price level. It marks the previous low of the major correction in which, in our view, the VW share has been stuck since 2015. We still see the ideal target at around €65. So there is still a long way to go. The price is currently trading around €93.

The situation is not much better for Porsche. The stock is currently trading at around €68. The target here is also in the south at around €42. Unfortunately, there is nothing to be said for at the moment.

BMW and Mercedes-Benz: still in the race, but with problems

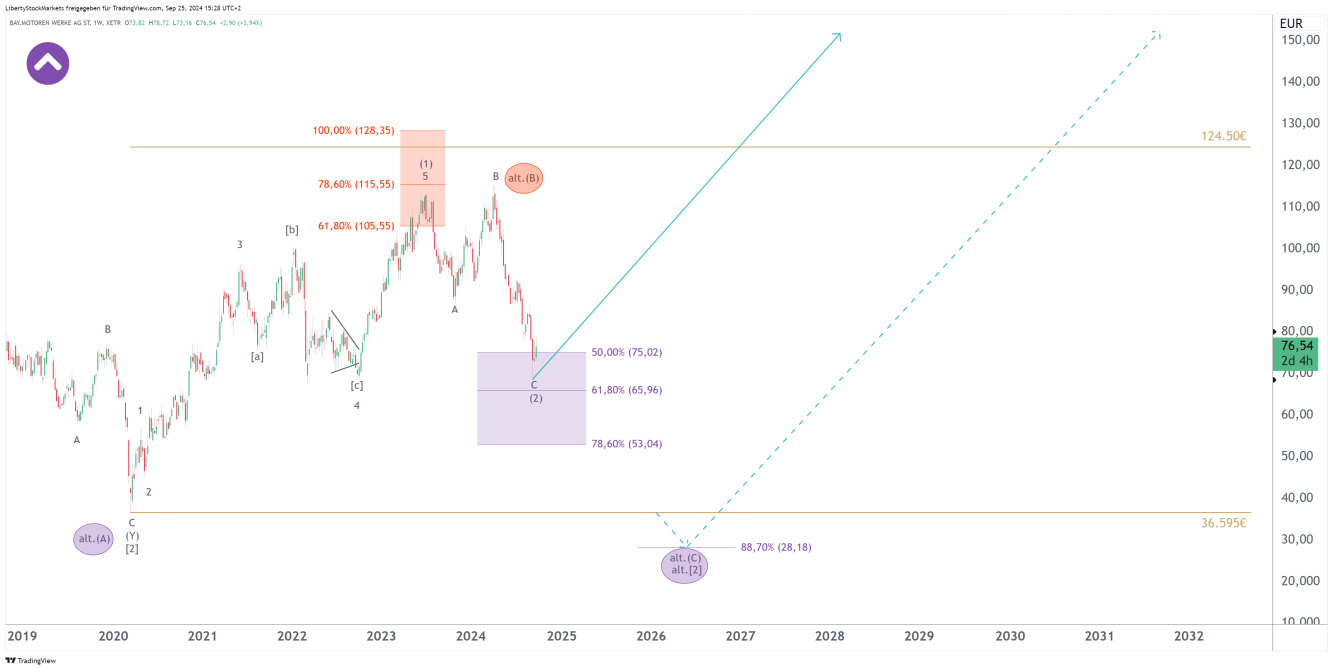

BMW recently revised its profit estimates downwards due to recall campaigns and weak demand in China. Despite these difficulties, BMW remains well positioned due to its technological openness to both combustion engines and electric drives. In particular, the New Class could mean a real turnaround for BMW. For the share, too, by the way.

BMW is the only share with a real chance of a sustainable trend reversal. And it could happen any day now. We recently bought BMW shares for our portfolio. Since then, the stock has risen.

The BMW stock has followed our forecast perfectly. It fell into the purple box between €75.02 and €53.04 and reversed its trend there. We bought more. Admittedly, there is still a high downside risk for this stock. Should the stock, contrary to expectations, drop sharply, it could also fall to the region around €28. We see this risk, but we see it as less likely than a sustained increase in the stock.

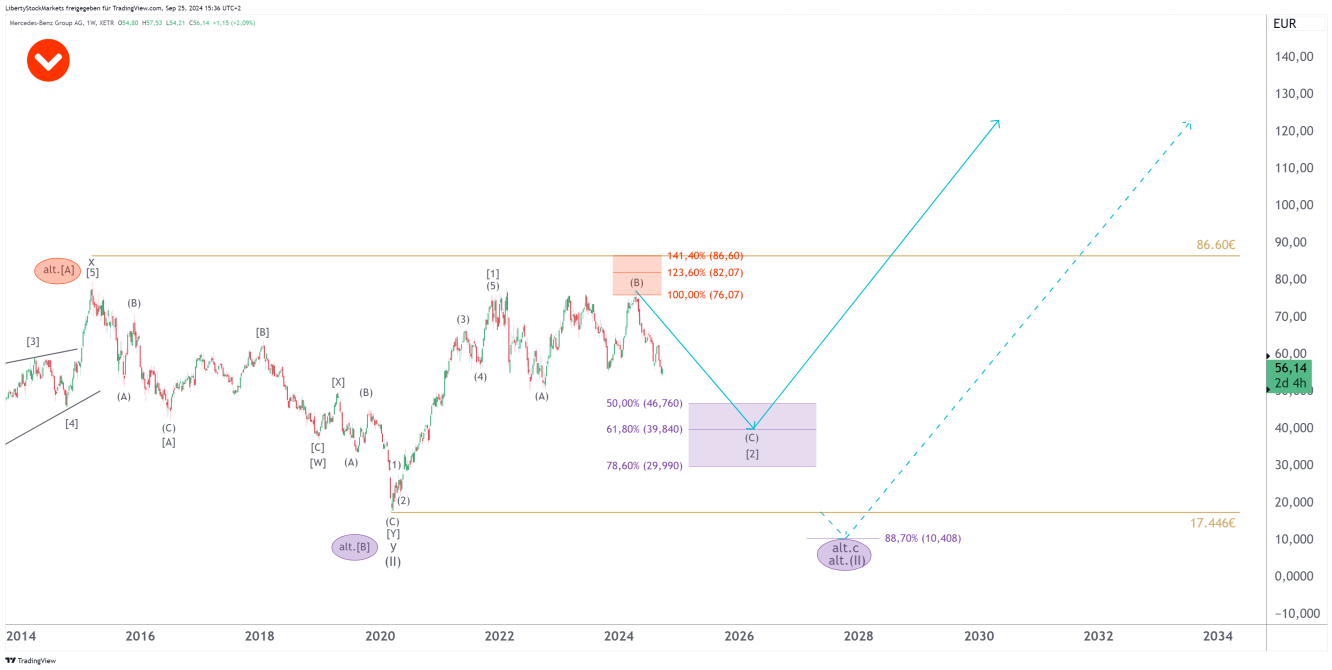

Mercedes-Benz, on the other hand, had to lower its profit margin forecast for the Mercedes-Benz Cars division, causing the stock to fall to a two-year low.

The Mercedes share is also following our forecast exactly. It is likely to consolidate a bottom soon. We see the ideal range for this in the purple box between €46.76 and €29.99. If it reacts upwards there and confirms the low, we will buy the share.

Although all German carmakers are in some kind of crisis, it does not hit them all equally hard. In detail, there are serious differences that we can use to our advantage.

Of course, you can make it easy for yourself and find everything bad, but then you miss out on enormous opportunities. The corrections will pass faster than most people might think. You can find more analysis of the stocks mentioned here and many more (including BYD and Xiaomi, for example) on our website by clicking on the link above next to my profile picture.

Disclaimer/Risk warning:

The information provided here is for informational purposes only and does not constitute a recommendation to buy or sell. It should not be understood as an explicit or implicit assurance of a particular price development of the financial instruments mentioned or as a call to action. The purchase of securities involves risks that may lead to the total loss of the capital invested. The information provided does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either explicitly or implicitly, for the timeliness, accuracy, appropriateness or completeness of the information provided, nor for any financial losses. These are expressly not financial analyses, but journalistic texts. Readers who make investment decisions or carry out transactions based on the information provided here do so entirely at their own risk. The authors may hold securities of the companies/securities/shares discussed at the time of publication and therefore a conflict of interest may exist.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The crisis in the German automotive industry: a huge opportunity!

Published 25/09/2024, 15:16

The crisis in the German automotive industry: a huge opportunity!

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.