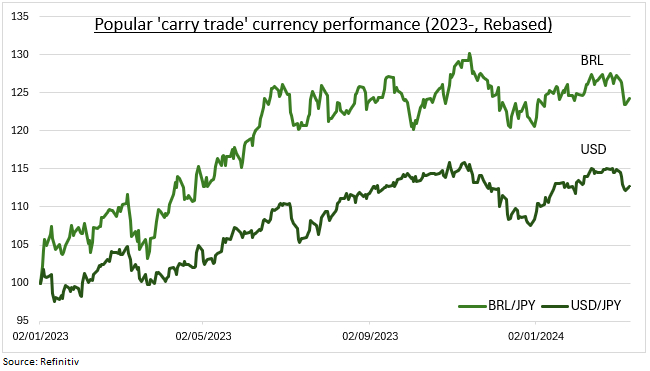

CHANGE: The ‘carry trade’ was a huge driver of currency returns in 2023. And has continued in 2024. With high yielders from the GBP to MXN the world’s top performers. But now faces twin headwinds. Of interest rate cuts in developed market G-10 and emerging market high-yielders, from US to Brazil. At the same time as the preferred low-yield funding currency, the JPY, faces its first interest rate hike since 2007. But the carry trade is down, not out. A push back in early rate cut expectations alongside 2-year lows in currency volatility has given a respite (see chart). Whilst carry rates remain attractive and other funding currencies, like CHF, are coming into view.

CARRY: The classic carry trade is to borrow money in a currency with low interest rates, like the JPY with its -0.1% policy rate. And invest in another with higher interest rates, like the BRL at 11.25%. Investors profit from the interest rate differential. And often from a strengthening of the latter currency, as it attracts inflows (see chart). The wide interest rate differential acts as a margin of safety for the investor. As well as helping to dampen currency volatility. Risks range from liquidity, with many emerging market crosses trading a tiny fraction of the $1.7 trillion daily of USD/EUR. To intervention, with only 31 of the world’s currencies classified as freely floating.

TODAY: 2023 was a banner year for carry, with total returns (interest and currency) as high as 40% for popular carry trades like MXN/JPY. Carry saw a new lease-of-life this year as rate cut expectations have been delayed. But we are near a tipping point. With midyear rate cuts coming from the Fed and ECB. At the same time as the world’s favourite funding currency, the cheap JPY, sees its first rate rise since 2007. But opportunities remain. The Swiss National Bank is leaning toward an early rate cut, that would make CHF a more attractive funding alternative. Whilst G-10 high-yielders GBP and NZD will be among the last to start cutting interest rates.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The ‘carry trade’ is down not out

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.