- Spotlight turns to Tesla's earnings earnings today.

- The stock has had a bumpy start to 2024 so far.

- In this piece, we will analyze some key negative and positive factors for the EV maker using InvestingPro's ProTips.

- Navigate this earnings season at a glance with ProTips - now on sale for up to 50% off!

While high-flying tech stocks keep pushing the market to new all-time highs, Tesla (NASDAQ:TSLA) remains yet to see sunny days in 2024. The behemoth EV maker is down 15.8% in the year, underperforming the Nasdaq 100 and the S&P 500 by a hefty margin.

However, as eyes turn to the Austin, Texas-based giant's earnings release today after the market closes, investors are holding onto high hopes that the company's fortunes may be about to change.

The lowering expectations for today's numbers may just serve the company right to fuel a rebound from the all-important $200 dollar technical support.

To understand where the company stands from a fundamental perspective going into the report, we'll take a deep dive into the company's metrics using InvestingPro's powerful ProTips tool for a comprehensive analysis.

ProTips - available only to InvestingPro users - seemingly summarizes the positives and negatives of a company by combing through a sea of data. Designed for both retail investors and pro traders, ProTips avoids calculations (and reduces workload) by translating a company's data into synthetic observations.

Subscribe now for up to 50% off as part of our New-Year Sale here!

Tesla's Fundamentals Mixed in 2023

Tesla's earnings per share is expected to come in at $0.74 while quarterly revenue is expected to be $25.7B today.

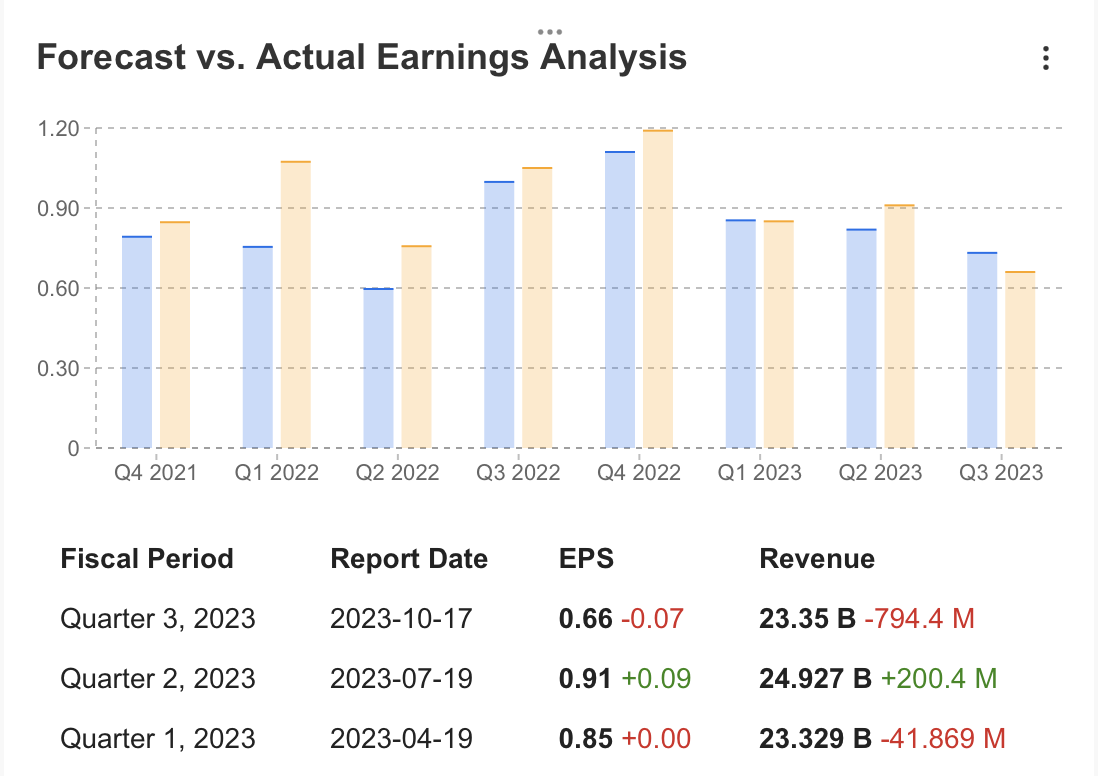

Source: InvestingPro

Looking at the estimates on InvestingPro, there is a 45% decrease in EPS and a 12% decrease in revenue forecast. In the last 3 months, 10 analysts have revised their opinion downwards, while 7 analysts have raised their forecast for Tesla's EPS.

Source: InvestingPro

The longer-term trend shows that Tesla has continued to post results in line with EPS estimates, while quarterly revenues remained a mixed bag, coming in below estimates in 2 quarters and above estimates in one quarter.

What Are Tesla’s Strengths and Weaknesses According to ProTips?

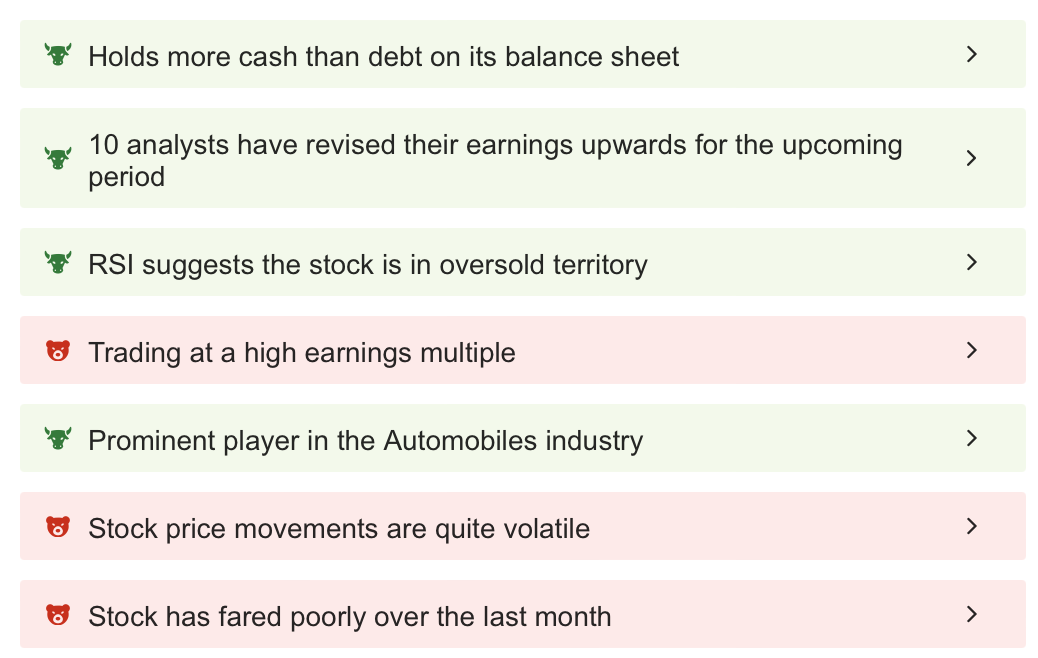

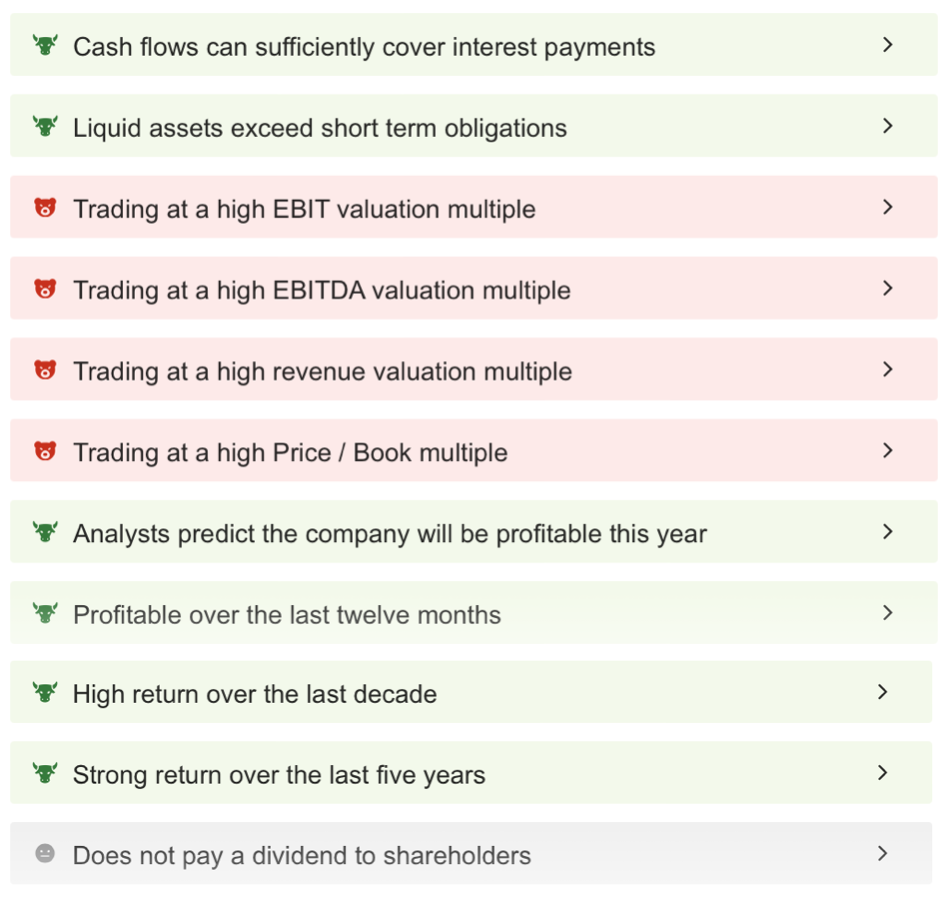

ProTips metrics on InvestingPro show that Tesla's strengths stand out against its weaknesses at the moment.

Source: InvestingPro

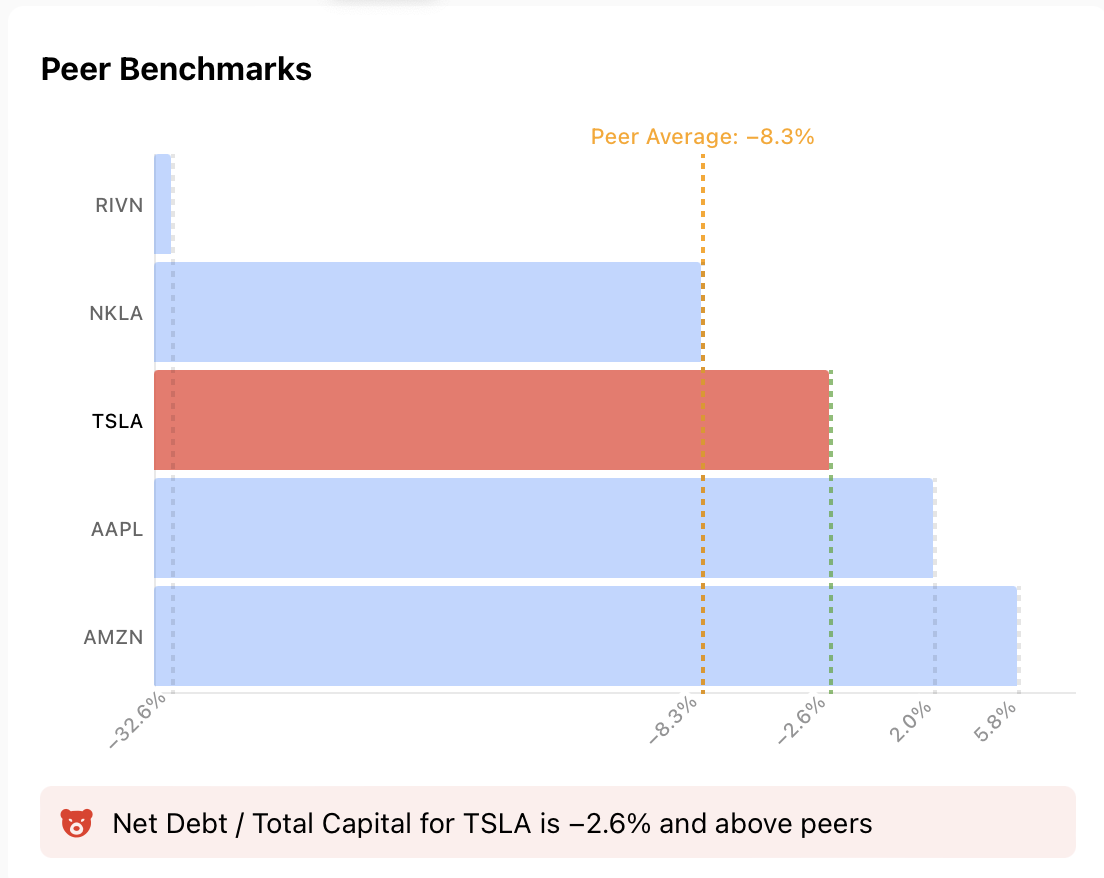

The amount of cash on Tesla's balance sheet is above the debt. Based on the Net Debt/Total Capital ratio, Tesla's value is calculated as -2.6%, which is higher than the average of peer companies.

As seen in the chart above, Tesla trails Apple and Amazon by Net Debt/Total Capitalization ratio.

This positive indicator suggests that Tesla, which has a higher cash-to-debt ratio than its peers, is in strong financial health and may be more resilient to unexpected expenses or deteriorating market conditions.

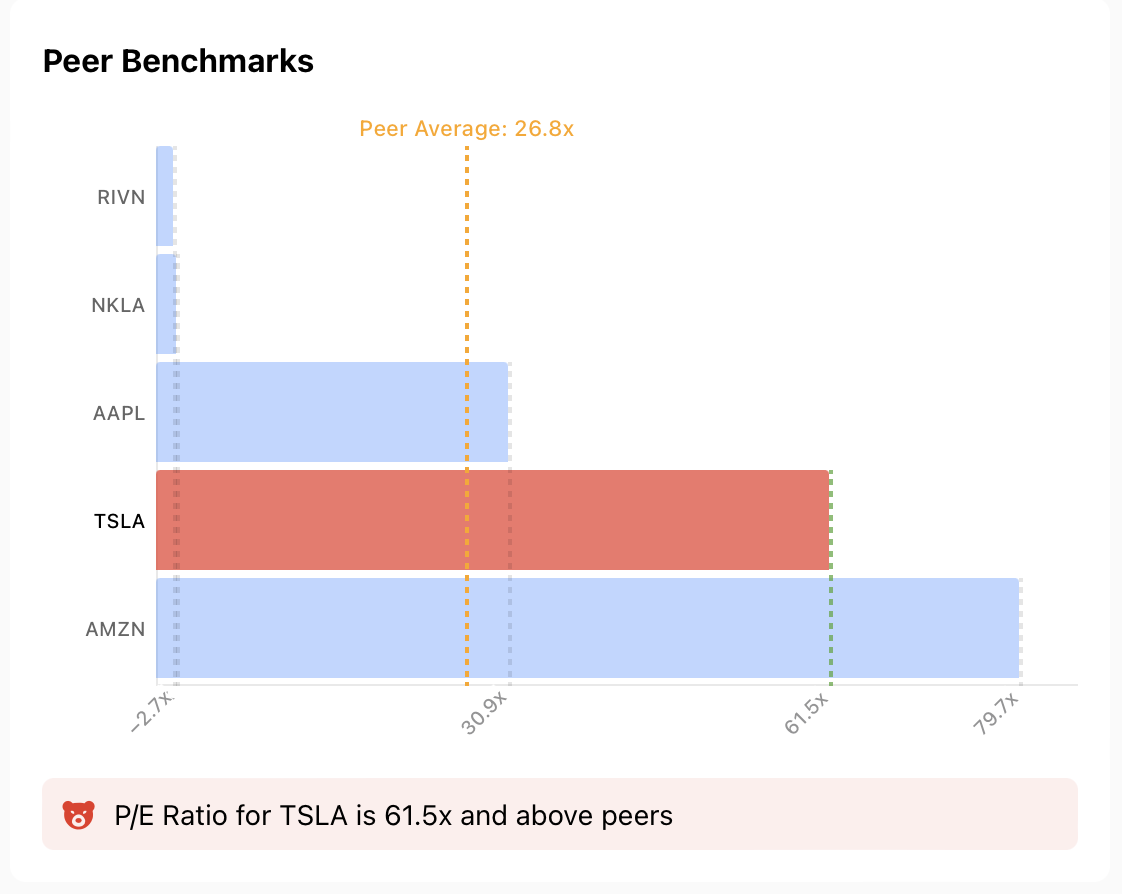

Source: InvestingPro

On the other hand, ProTips points out that Tesla continues with a high Price/Earnings ratio. This implies that the stock is overvalued relative to its current company earnings. Although this is not decisive on its own, it can be interpreted as a warning for the risk of correction.

Source: InvestingPro

However, historically, this is quite a healthy EPS metric for Tesla, given that the company's PE went well above the triple digits during the 2021 bull market.  Source: InvestingPro

Source: InvestingPro

Other Factors in Favor of the EV Maker

In addition to being one of the industry-leading companies, Tesla is currently technically in the oversold zone according to RSI.

The company boasts robust cash flows, sufficient to cover interest expenses. It has maintained profitability over the last 12 months, with optimistic expectations for sustained profitability.

Furthermore, the stock exhibits significant potential for delivering compelling long-term returns.

Source: InvestingPro

Tesla's Negative Factors

Alongside the company's elevated P/E ratio, notable weaknesses include a high share price volatility, lackluster performance over the last month, and an elevated EBITDA and EBITDA valuation ratio.

A lofty valuation relative to revenue, and an elevated Price/Book ratio are also unfavorable.

Source: InvestingPro

Bottom Line

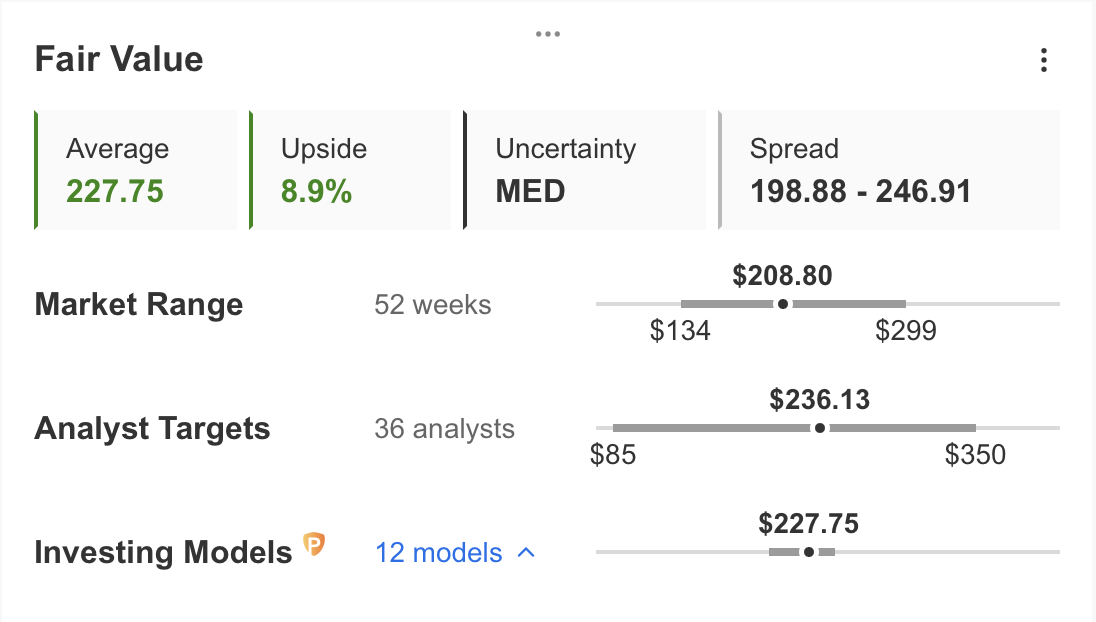

As a result, according to Tesla's latest financial results and share price, the fair value calculated on InvestingPro is calculated as TSLA share is currently discounted by close to 9% - which is remarkably solid for the company.

The fair value price is calculated at $227.75, while the consensus estimate of 36 analyses is $236.

Source: InvestingPro

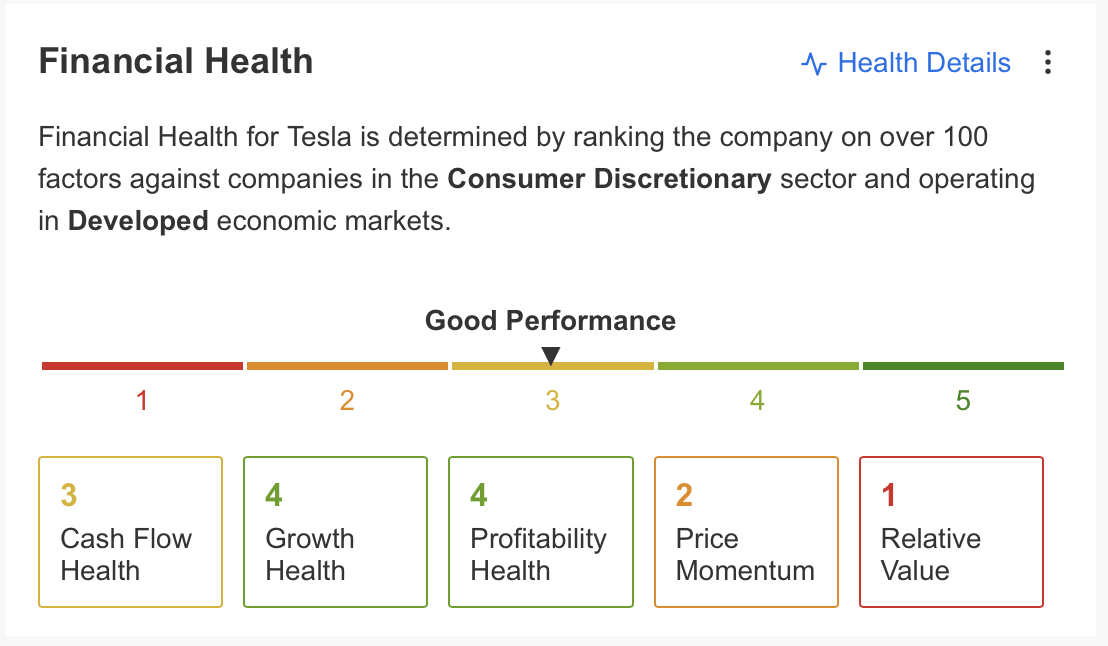

Tesla's growth and profitability health are also very good, while cash flow is good, while price momentum is weak compared to other items.

***

InvestingPro: Empowering Your Financial Decisions, Every Step of the Way

Take advantage of InvestingPro ProTips and many other services, including IA ProPicks strategies on the InvestingPro platform with a discount of up to -50%, until the end of the month!

Investing.com UK has a great offer for you! Enjoy an extra 10% discount over the current discounts we have on our 1 or 2 year plans with codes UKTopDiscount and UKNewYear2, saving up to 60%. Hurry up as the New Year’s offer end on 31/01/24!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple perspectives and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.