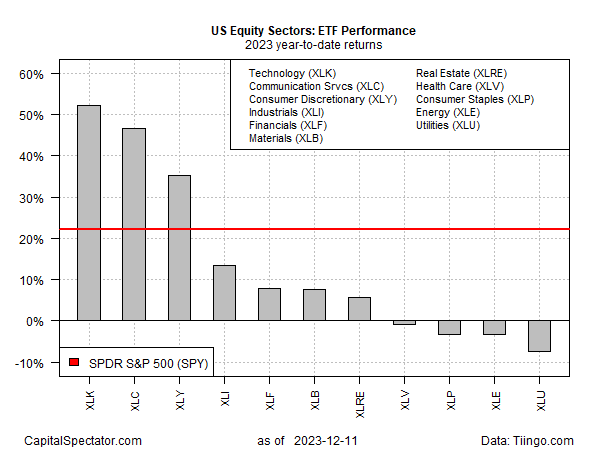

Key drivers of the strong performance for the US stock market this year are technology (NYSE:XLK) and consumer discretionary (NYSE:XLY) sectors, based on a set of ETF proxies through Monday’s close (Dec. 11). By contrast, health care, consumer staples, energy and utilities are the sector losers in 2023.

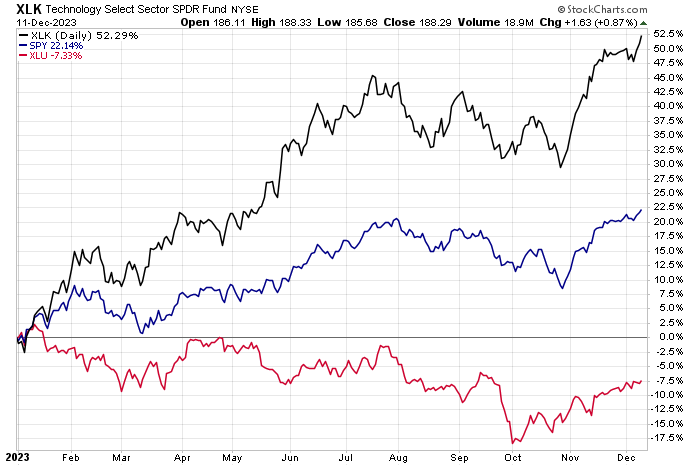

Technology ETF XLK is leading the field with a white-hot 52.3% year-to-date gain. That’s more than double the overall stock market’s rally this year, based on S&P 500® ETF Trust (ASX:SPY).

The spread between the tech’s lead and the year’s biggest loser – utilities (XLU) – is a hefty 60 percentage points.

The dominance of tech stocks worries some analysts, who say that the market is vulnerable when a small share of equities is driving most of the wealth creation. A healthy sign that the recent rise in the S&P 500 Index will continue in the new year would be if the rally broadens beyond the mega-cap names.

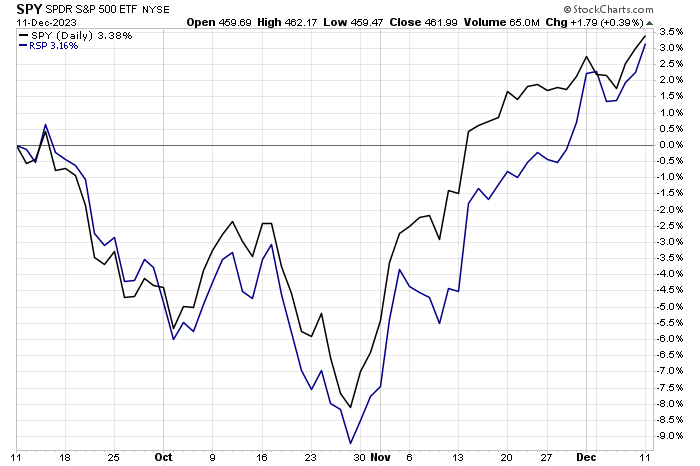

One way to monitor the breadth of market activity is by comparing the market-cap-weighted SPDR S&P 500 ETF (NYSE:SPY) with its equal-weighted counterpart RSP). On that front, there are tentative signs that a broader rally may be unfolding as RSP keeps pace with its tech-driven counterpart over the past three months.

Looking at the SPY-RSP horse race for the year-to-date window, however, still highlights a huge gap in favor of SPY and so by this measure the jury’s still out on the trend analysis for market breadth.

But Ryan Detrick, chief market strategist at the Carson Group, sees signs that the rally is broadening. Last week in a research note he observed an “extremely rare” signal that a record high for stocks is approaching after 60% of S&P 500 names reached new 20-day highs. The event counters the view that the mega-cap tech firms are dominating the stock market, he reasons.

“Last week, we saw a very rare breadth thrust, which suggested many stocks were surging, which tends to be a signal of impending strength,” he advises. “This is extremely rare and showed a lot of buying has taken place recently, not just in a few large stocks.”