- After two years of the pandemic-driven buying spree, a change in consumer behavior has left retailers with billions of dollars of unsold inventories

- Walmart sales are improving thanks to robust back-to-school sales, lower fuel prices, and buying by customers seeking bargains

- Target, which generates more sales from discretionary items, is the hardest-hit retailer, with its margins plunging

The latest earnings reports from Target (NYSE:TGT) and Walmart (NYSE:WMT) indicate that the worst could be over for the two largest U.S. retailers. Despite growing inventory difficulties, sales remained resilient amid the challenging macroeconomic environment of the last quarter.

Walmart, the world’s largest retailer, posted better-than-expected EPS thanks to robust back-to-school sales, lower fuel prices, and more buying by wealthier customers seeking bargains.

During the earnings call, the Bentonville, Arkansas-based company also told investors its yearly profits wouldn’t decline as much as it expected three weeks ago when it issued a profit warning.

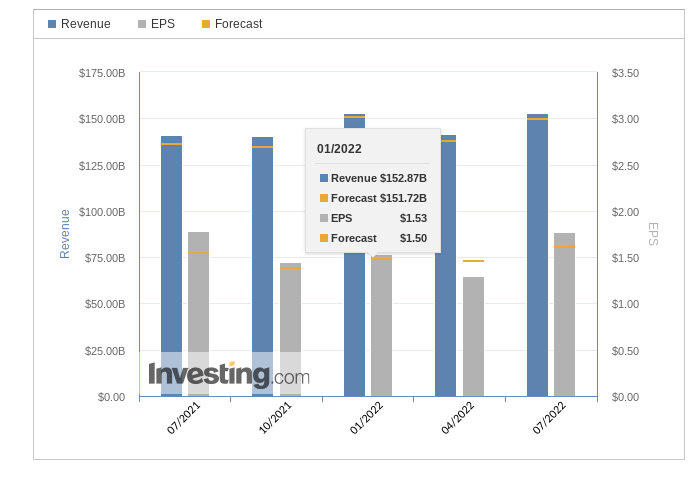

Source: Investing.com

The Minneapolis, Minnesota-based Target maintained its outlook for full-year revenue growth in the low- to mid-single digit range and an operating margin of about 6% in the year’s second half.

Inventory Glut

After two years of the pandemic-driven buying spree, a sudden change in consumer behavior due to four-decade high inflation has left Walmart and Target billions of dollars of unsold inventories, hurting their margins and share prices.

Target appears to be the biggest victim of this consumer rebalancing act. The company’s net earnings fell 90%, while its operating margin declined to 1.2% in the quarter that ended July 30.

The Minnesota-based giant, which generates more sales from discretionary items than Walmart, was forced to aggressively discount its excess inventory in areas such as kitchen appliances, patio furniture, and bikes to get out of this inventory quagmire to avoid more losses.

A Glimmer Of Hope

As recession risks remain high, risk-averse investors should avoid putting their money in these retail giants.

But if you have a higher risk tolerance, I see a bargain in Target’s beaten-down stock, which has lost about a third of its value over the past year. Walmart has mostly recovered its earlier losses, and its shares are down only about 8% during the same period.

Furthermore, there are many grounds for optimism when it comes to Target. First, the retailer has been dealing more aggressively with its inventory issue than its peers. According to Target’s CFO:

“If we hadn’t dealt with our excess inventory head-on, we could have avoided some short-term pain on the profit line, but that would have hampered our longer-term potential.”

That aggressive action puts Target on a path to recovery as the retailer could be one of the first to experience a margin recovery, given it acted so decisively.

While raising its price target by roughly 25% to $195, Wells Fargo said in a recent note that investors are too pessimistic about the stock. Its note adds:

“TGT took the earliest and biggest margin hit in retail, suggesting relatively lower risk from here and a faster recovery.

Investors seem too pessimistic on recovery earnings; we see EPS of $12.70 when the dust settles in 2023 vs. a buy-side bar that seems closer to $11.”

On the macro front, there are also positive developments. With U.S. inflation slowing, some of the pressure on discretionary spending should abate, benefiting Target more than Walmart because it generates about 80% of its sales from non-food items. Target told investors its back-to-school season, often an indicator of fall and winter business, had been encouraging.

Another great reason to buy Target’s stocks now is the company’s impressive dividend appeal. The retailer has steadily increased its dividend every year for the last 50 years, covering crises such as the dot-com collapse of the early 2000s, the financial crash of 2008-2009, and the COVID-19 pandemic.

While delivering cash to investors each quarter, the discount store has maintained a conservative payout ratio of about 30%, showing more cash-distribution runway.

In June last year, Target announced a whopping 32% hike in its payout, scaling its dividend to $0.9 a share quarterly with an annual yield of 2.3%.

Bottom Line

Target remains on track to overcome its short-term challenges and resume its normal margin expansion. The current weakness provides an attractive entry point to long-term investors.

Disclosure: The writer doesn’t have a position in stocks mentioned in this article.