Sylvania’s Q224 and H124 results were overshadowed by a lower PGM basket price, which resulted in a 10% reduction in revenue. With the delay in the PGM price recovery we expected, we have pared back our forecasts, particularly for platinum and rhodium. This, combined with Sylvania’s weaker-than-expected Q224 results, has resulted in a 30% reduction in our FY24 EPS estimate to 7.4p, with cuts of 23% and 14% for FY25 and FY26, respectively. Our new valuation is 118p/share, down 13% from our previous 135p/share. With exploration assets valued at book value and conservatism in our Thaba joint venture (JV) valuation, our valuation offers upside as projects graduate from exploration to production over the coming years.

Q224 results pressure due to decline in basket price

Q224 revenue faced pressure, due to slower holiday season production and a lower PGM basket price, but recorded a 6% increase after a positive quarter-on-quarter change in sales adjustment. With operating costs well controlled, EBITDA was up 57.5% q-o-q but off a very depressed Q124 level and well below our expectation for a recovery in the quarter. Sylvania (LON:SLPL) remains set to achieve full-year 4E PGM production of 74,000–75,000oz. We have cut our PGM price forecasts due to increased supply from recycling in China. However, our outlook is neutral as Chinese electric vehicle sales are strong.

Near-term forecasts cut, but long-term upside

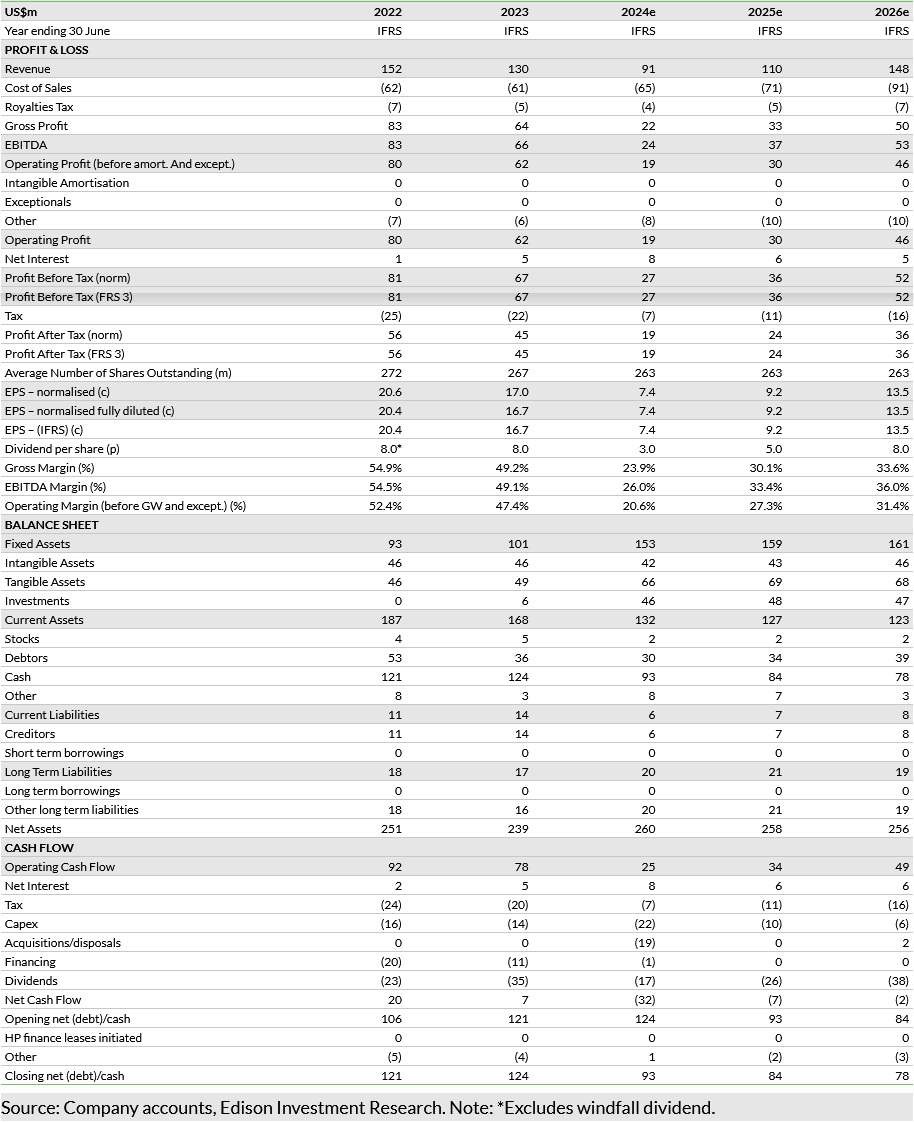

Due to the lower PGM basket price for Q224 and a delayed recovery, reflected in our new forecasts, we have cut our FY24 EPS forecast by 30% to 7.4p, FY25 by 23% to 9.2p and FY26 by a more moderate 14% to 13.5p. These forecasts conservatively allow for the Thaba JV to ramp-up to full production in FY26. We have not yet made any allowance for Volspruit, the Far North Limb and Hacra North projects to move from exploration towards production, although we expect meaningful progress from preliminary economic assessment to preliminary feasibility study over coming months. These projects offer upside not fully captured in our current forecasts and valuation.

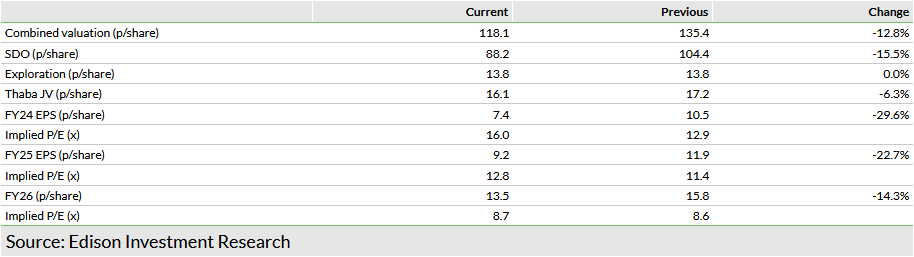

Valuation: 118.1p/share; SDO down 15.5% to 88.2p

We value the Sylvania Dump Operations (SDO) at 88.2p/share, which is down 15.5% on our previous valuation of 104.4p/share on the back of lower PGM forecasts. We have also reduced our valuation for the Thaba JV by 6% to 16.1p/share, with chromite dependence limiting the PGM downgrade impact. We continue to carry exploration assets at book value of 13.8p/share, but flag that the completion of the PFS could result in upside.

Delayed recovery in PGM prices

The investment case for Sylvania Platinum (Sylvania) is mainly based on a low-risk dump retreatment operation to which we ascribe the bulk of the company’s valuation. It also has exploration assets in the northern part of the Bushveld Igneous Complex of South Africa. A preliminary economic assessment (PEA) is being conducted for Volspruit, following an updated mineral resource estimate (MRE), recently released. This will be followed by a preliminary feasibility study (PFS) over coming months. In August 2023, the company announced a Thaba JV with Limburg Mining Company (LMC), which will diversify Sylvania’s production to include chrome concentrate from H225.

Quarterly results below our expectations

Our Q224 forecasts were overly optimistic on production and the platinum group metals (PGM) basket price, offset by lower-than-expected operating costs.

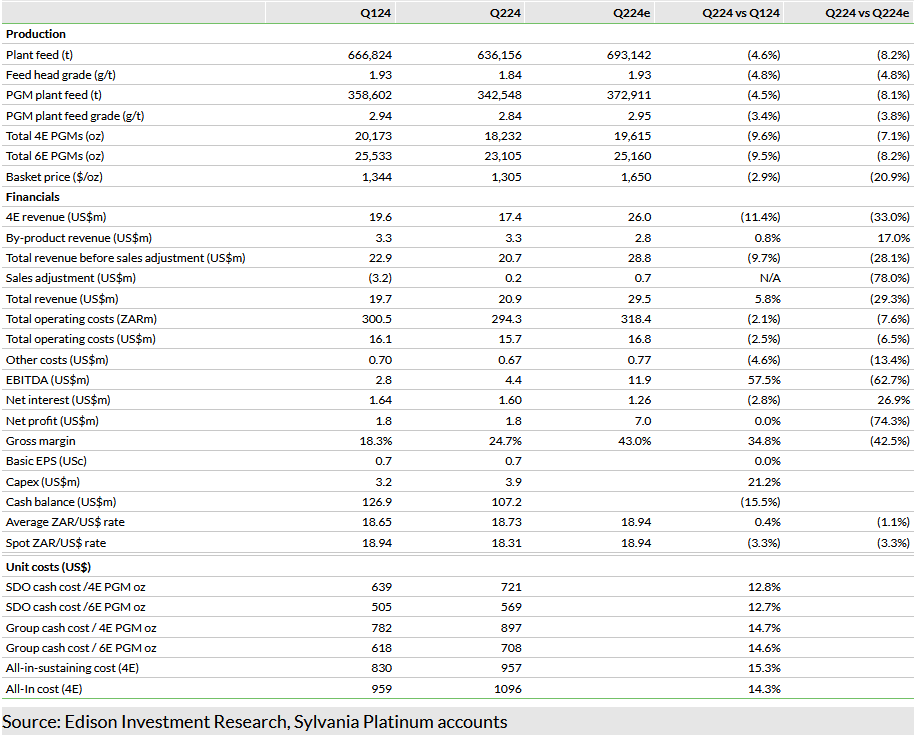

Exhibit 1 shows the quarterly results and the differences between them and our prior forecasts.

- Q224 production was lower than Q124, with both plant feed and PGM plant feed 4.5% down, affected by mine closures during the festive period, which resulted in lower current arisings and feed materials as well as lower grades. Q124 production was also slightly overstated due to production held as work-in-progress at 30 June 2023.

- Combined with a slightly lower feed grade, this resulted in a 9.6% reduction in total 4E PGMs to 18,232oz and a 9.5% reduction in total 6E PGMs to 23,105oz. We expect an improvement in recoveries over coming quarters, driven by Lannex and supported by Mooinooi.

- Our optimism for PGM basket prices in Q224 was not delivered, with the actual basket in the quarter undershooting our expectation by more than 20% (and also 2.9% lower than Q124).

- 4E revenue was 33% lower than our forecasts (11.4% lower than Q124), but thanks to 17% higher than forecast by-product revenue (the company has been receiving a higher-than-expected share of the 2E basket price over recent quarters), the combined impact was for total revenue 29% lower than our forecast (5.8% higher than Q124 due to a reversal in sales adjustment).

- Operating costs were well controlled, ending the quarter 2.5% lower than Q124 in US dollar terms and 6.5% lower than our forecast.

- While EBITDA was up a strong 57.5% on Q124, this was off a low base and at US$4.4m, missed our forecast of US$11.9m by a wide margin.

- Cash levels remained strong at US$107.2m, despite dividend and tax payments amounting to US$21m over the period.

Changes to PGM price forecasts

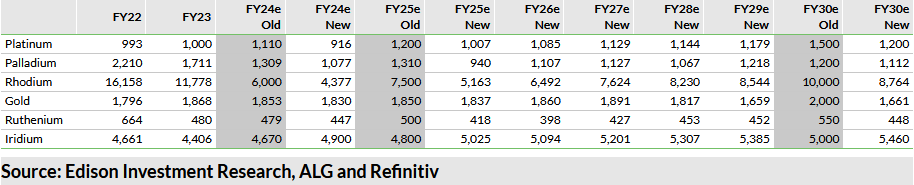

Following the recent weakness in platinum and palladium prices, together with the lack of and expected recovery in rhodium prices, we have reduced our PGM forecasts across the board, except for iridium, which has held up well.

Demand for PGMs dropped last year and has remained low because of increased recycling of PGMs, particularly in China. Chinese vehicle sales for the first time topped 30 million in 2023, which included around 10 million EVs. It has also become the biggest consumer of palladium and rhodium for autocatalysts for the last c 8 years. As a result of being scrapped after an average life of about eight years, the large number of cars together with the high volumes of palladium in their autocatalysts are now likely to result in an increase in recycled palladium and rhodium. This recycling is the main reason behind the fall in demand for palladium and rhodium in China, which has been the primary consumer of newly mined palladium and rhodium up until now. This is unlikely to change if China continues to recycle metal for most of its needs particularly if EVs make further inroads into that market at the expense of internal combustion engine cars. EVs are likely to see an increase in China this year and this combined with the recycling is likely to be negative for palladium and rhodium demand for 2024 at least. Demand for PGMs from the rest of the world is likely to also be muted in 2024, as inventories remain high for most PGMs with the exception of iridium.

Our updated commodity forecasts are given in Exhibit 2.

In the longer term, we see significant headwinds for EVs in most countries except China, particularly in North America, which in the last two years has become the largest consumer of palladium and where EVs are still shunned. European consumption of palladium and rhodium will likely increase with EURO 7 for heavy duty vehicles beginning in 2025, and limited EV penetration because of high purchase and insurance costs and rapid depreciation. Import duties on Chinese EVs may also see those EVs having to be sold internally. The rest of the world only accounts for 10% of total EV production and with stringent gasoline emissions legislation being implemented from 2025 to 2032 all over the world, PGM demand is likely to rise and therefore prices should follow over this period.

Forecast revisions

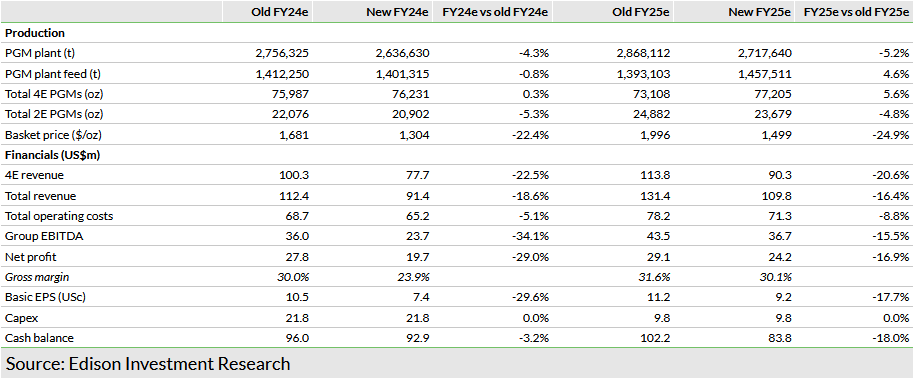

Our forecast revisions are shown in Exhibit 3. We have cut our FY24 plant feed forecast by 4.3% and PGM plant feed by 0.8% on the back of the lower than forecast production in Q224. Due to an expected improvement in recoveries, we have lifted 4E PGM production modestly.

The biggest change to our FY24 forecasts results from the downgrades to our PGM forecasts, with our FY24 basket price now expected to be 22.4% below the previous level. This translates into a 22.5% lower 4E revenue, which is partly offset by an increase in by-product revenue (we have increased the forecast share of 2E basket price that Sylvania receives to be more in line with the strong experience over recent quarters). Total FY24 revenue is now forecast at US$91.4m, which is 18.6% lower than our previous estimate.

Thanks to good cost control during the first two quarters of FY24, we have pulled back our operating cost forecast for the full year by 5.1%. Despite this, we now forecast a gross margin of 23.9%, down from 30%, and a 29.6% lower EPS. Our cash balance is forecast 3.1% lower at US$85.7m, with the net profit impact moderated by a more favourable working capital result, as was demonstrated during Q224.

In FY25, we forecast an improvement in revenue to US$109.8m on the back of higher basket prices, resulting in a recovery of gross margin to 30.1%, but still well below recent history. We forecast an EPS of 9.2p, which is 23% lower than our previous forecast of 11.9p.

We forecast a strong revenue uplift in FY26 (see Exhibit 5), partly due to an increased PGM basket price, but mostly due to the Thaba JV going into full production. We forecast a further improvement in gross margin to 33.6%. Our new EPS forecast of 13.5p is 14% lower than our previous estimate of 15.8p.

Cash is forecast to decline during FY24 as a result of the capital injection into the Thaba JV. It remains very healthy though and following a lower-than-expected dividend trajectory for FY24 and FY25, we forecast a return to 8p/share in FY26, with potential sufficient headroom to declare a windfall dividend again in FY26.

Exploration assets steadily moving towards production

Sylvania has published an updated MRE for its projects on the northern limb of the Bushveld Igneous Complex. The results include revised MREs for the Volspruit North and Volspruit South ore bodies, including rhodium and ruthenium, both of which had previously not been assayed. The MRE is in line with the Joint Ore Reserves Committee (2012) standard.

For the Volspruit North project, the new MRE represents a 10% increase in the indicated tonnage from the previous MRE report of October 2022. A more defined geological model has also resulted in a 4% MRE grade increase with the addition of rhodium grades improving by 7%.

The MRE for the Volspruit South project is the first one completed since the mineralised zones have been redefined and, as expected, it reports approximately a third of the tonnages at almost double the grades previously reported by Sylvania’s consultant, Integrated Geological Solutions in 2012.

The company has embarked on a PEA of the Volspruit Project to assess what value the addition of the Volspruit South resources, and the rhodium and ruthenium resources, might add to the overall project. Metallurgical test work is being undertaken on fresh core that was drilled during CY23. Based on the results of the scoping study and metallurgical test work (expected Q424), a decision will be made on progressing the project to a PFS phase during FY25.

While these developments could result in upside potential for exploration assets, long-term production and our valuation, Sylvania has not yet implemented any changes to the book value of its exploration assets and we have opted to take a similar conservative approach in our valuation.

The Thaba JV is on track for commissioning in Q325.

Valuation

On the back of our lower PGM price forecasts, we have moderated our EPS forecasts, which has resulted in a 12.8% reduction in our valuation for Sylvania from 135.4p/share to 118.1p/share. Our valuation is made up of an SDO valuation, a valuation for Sylvania’s 50% share of the Thaba JV and a value for its exploration assets (carried at book value).

Our PGM forecast changes have resulted in a 15.5% reduction in the SDO valuation to 88.2p/share, with a lesser impact on the Thaba valuation (6.3% lower at 16.1p/share) due to its high exposure to chromite, where no forecast changes were made. The exploration asset carrying value has remained unchanged at 13.8p/share.

While the implied forward P/E multiple of our new valuation has increased based on FY24 and FY25 EPS forecasts relative to our previous valuation, the FY26 forward P/E is largely unchanged.

_____________________

General disclaimer and copyright

This report has been commissioned by Sylvania Platinum and prepared and issued by Edison, in consideration of a fee payable by Sylvania Platinum. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2024 Edison Investment Research Limited (Edison).

Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS

United Kingdom