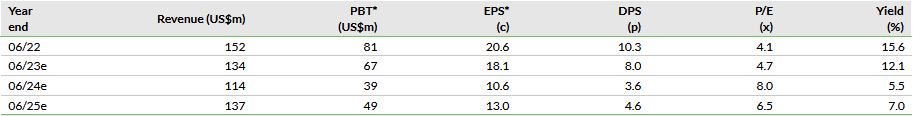

Sylvania Platinum (LON:SLPL) has announced a 50:50 joint venture (JV) with Limberg Mining Company (LMC), called Thaba, to process platinum group metals (PGM) and chrome ores from LMC’s historical tailings dumps and run-of-mine (ROM) ore. It is expected to start production in H225 and will for the first time see Sylvania receiving a chromite concentrate revenue stream on its own account. Sylvania is investing US$32m in capital expenditure and US$5m in working capital from its large cash resources (of which 50% is a loan to LMC to be paid back from JV cash flow after production commences) in exchange for c 6,500koz of forecast PGM and 200kt of chrome concentrate production pa over 10 years. We value Sylvania’s 50% share of the JV at 17.2p/share, resulting in a 29.5% increase in our total valuation to 135.4p/share.

Strong long-term earnings upside

As a result of the Thaba JV, we have made upward adjustments to our EPS forecasts for FY24 and FY25. In addition, we have incorporated higher net interest income, allowing for the impact of higher interest rates on Sylvania’s cash balance, even including estimates for the JV-related capital outflows. The increase in interest income, combined with interest on the LMC loan and proportionate consolidation of the JV, has resulted in a 16% increase in our FY25 EPS forecast to 13.0c. However, with the JV moving into full production in FY26, we forecast 29% growth in FY26 EPS. We expect the JV to contribute 13.7% of Sylvania’s EBITDA in FY26 and see this contribution increasing over time due to our expectations of a reduction in production levels at Sylvania’s current operations over time.

Valuation: 29.5% uplift to 135.4p/share

We value Sylvania at 135.4p/share, up from 118.2p/share previously. Our valuation for the company’s producing assets is unchanged at 104.4p/share, as is our exploration asset valuation at 13.8p/share. We value the JV at US$115m and Sylvania’s share at 17.2p/share. The increase in the valuation is driven by the additional c 9% PGM production and 200kt a year of metallurgical-grade chromite using a mine gate price of US$102/t. We take a conservative view in our chromite assumptions for valuing the JV. Current spot prices at mine gate of US$200/t are historically high. Pre-2020, these prices were around US$150/t. If chromite prices continue to stay at current levels or fail to fall to US$102/t when production starts in H225, this would present upside to our valuation.

JV agreement

Sylvania has entered into a JV agreement to process PGM and chrome ores from historical tailings dumps and ROM ore from the Limberg Chrome Mine, located on the northern part of the western limb of the Bushveld Complex in South Africa. The JV will trade and operate as Thaba. The Thaba JV represents a major step in the delivery of Sylvania’s growth strategy and is a significant step forward for Sylvania in expanding its operations and leveraging its expertise in the recovery of chrome and PGM concentrates, adding attributable annual production of c 6,500 4E PGM ounces and introducing 200,000 tonnes of chromite concentrate to Sylvania Metals’ existing annual production profile over 10 years.

Important points of the JV are:

- Sylvania Metals has entered into a 50:50 JV agreement to recover chromite and PGM concentrates from ROM ores and historical tailings deposited in the Tailings Storage Facility at the Limberg Chrome Mine.

- New processing infrastructure will include a new secondary fine chromite and PGM beneficiation plant.

- Sylvania Metals will share equally in both the PGM and chromite concentrate revenue and it is estimated by the company that the Thaba JV will produce approximately 13,000 4E PGM ounces (approximately 15,500 6E PGM ounces) and 400,000 tonnes of metallurgical grade chromite concentrate per year over the initial 10 years of the JV, which the parties may negotiate to further extend.

- The Thaba JV will increase forecast annual production of 4E PGM ounces by approximately 9% and add chrome to the company’s commodity portfolio.

- The capital and establishment costs (‘upfront capex’) of the Thaba JV of approximately ZAR600m (c US$32m) will initially be funded by Sylvania Metals from its existing cash resources. The initial working capital facility required by the Thaba JV following commissioning will be advanced by Sylvania Metals (c US$5m).

- Sylvania Metals will manage the Thaba JV on behalf of the partners who will collectively apply their respective PGM and chrome expertise to maximise recovery efficiencies and production.

- The project execution phase will be 18–24 months, with first production expected in H225.

- The attractive investment return indicated on the Thaba JV exceeds the company’s internal rate of return hurdle rate of at least 20% per annum and has a cash pay back within three years of commissioning, based on current long-term consensus pricing.

- It will be the first PGM beneficiation facility on primary chrome ore and tailings on the northern part of the western limb of the Bushveld Complex and will be an enabler for further growth opportunities in the region.

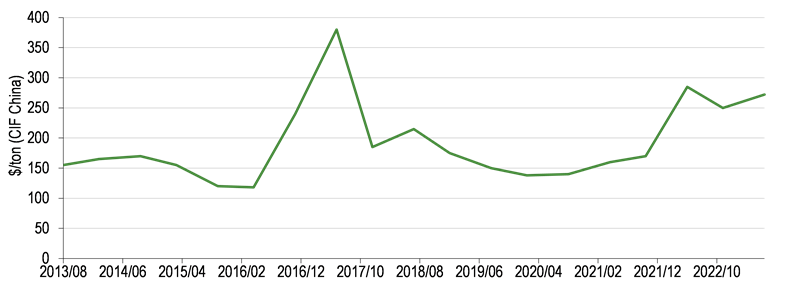

The chromite market: Taking a conservative view

Chromite is used in the manufacture of ferrochrome, which is used in turn in the production of stainless steel. The main market for South African chromite is China. Prices of chromite are reported on a cost, insurance and freight (CIF) basis, which means the seller is responsible for covering the costs, insurance and freight of the buyer’s shipment while in transit, and is paid at the buyer’s port. Prices for South African chromite vary depending on the chrome content of the ore. The JV will be delivering concentrate with 40% to 42% chrome content. Current chromite prices are c US$280/t CIF for the 40% to 42% ore (Exhibit 1). This price will include the rail or road transport cost from the Thaba JV plant in north-western South Africa to a port like Richard’s Bay. We assume this would cost c US$43/t and c $7/t in port fees, totalling c US$50/t. The shipping cost from a port in South Africa to a port in China is c US$20/t, plus c US$10/t marine insurance, totalling US$30/t. Hence the mine gate price that SLP would currently receive is around c US$200/t (ie the current CIF price of US$280/t minus US$50/t (free on board, FOB) minus US$30/t CIF adjustments).

Chromite prices have been trading over US$200/t CIF since January 2022 and are currently at around US$280/t. However, from 2013 to 2021, CIF prices averaged around US$180/t. Hence, taking off the c US$80/t transport and freight costs we have indicated above, we have used US$102/t at mine gate in our valuation, a price that is the same as SLP used in its base case assessment of the value of the JV.

Valuation

The Thaba JV adds 29.5% to our valuation for Sylvania. Our value for Sylvania’s producing assets remains at 104.4p/share, while we continue to value the exploration assets at book value of 13.8p per share. We value the JV at US$115m (17.2p/share for Sylvania), resulting in a total valuation for Sylvania of 135.4p/share.

Valuation of Thaba JV: 17.2p/share

Edison values operating mining resources companies at a 10% real discount rate based on the dividend discount model (DDM), allowing for a constant currency approach to forecasts.

Our longer-term forecasts used in our DDM allow for maximum supportable dividends towards the end of our explicit forecast period (FY40), which results in a 100% payout ratio in FY40 and implied thereafter.

The key driver of our valuation is Thaba’s ability to pay dividends, which we have forecast to commence in FY28. This is supported by a healthy and growing cash balance, which we forecast to reach US$38m by FY28, and we forecast earnings to rise from US$8.8m in FY26 to US$9.8m in FY28. The valuation presents upside if a higher pay-out ratio occurs during earlier years.

Our valuation for the JV is US$115m or £90m at the current exchange rate. Sylvania’s 50% share of the valuation is worth 17.2p/share. Our valuation assumes an FY26 earnings multiple of 10.7x.

Financials

In our 3 August 2023 report (Lower rhodium prices overshadow strong production), we moderated our forecasts for Sylvania, largely on the back of lower rhodium prices and the rhodium price outlook. The Thaba JV presents new upside potential for Sylvania, which we have included in our forecasts and has a meaningful impact for Sylvania in FY26 in particular, when we forecast 30% growth in EPS.

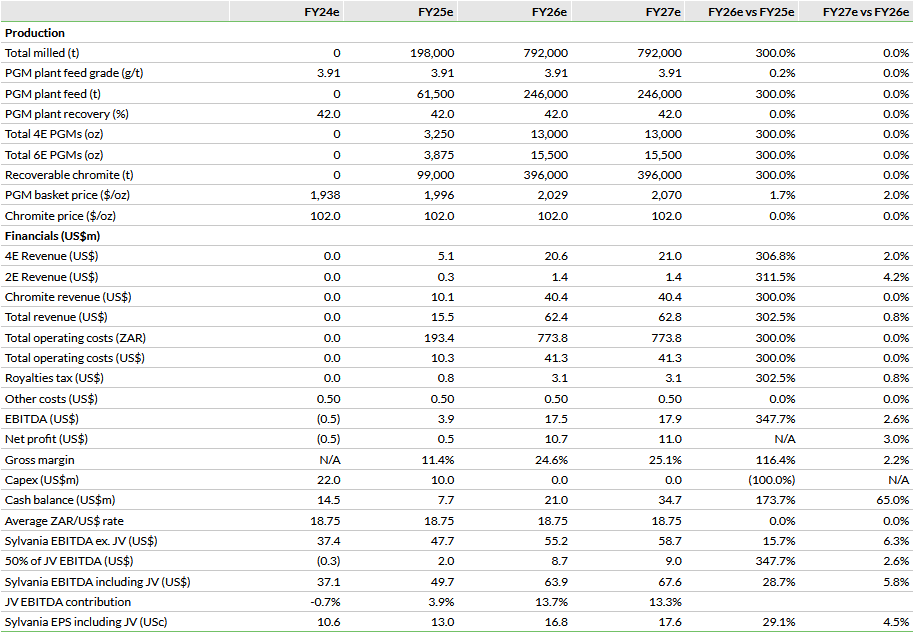

Thaba JV earnings forecast to rise to US$8.7m in FY26

Exhibit 2 below includes our three-year forecasts for the Thaba JV, including production (guided by the JV announcement and management), our price forecasts and revenue, our operating cost forecasts and the resultant bottom line, include forecast earnings of US$8.8m in FY26.

The JV is to be funded by a capital injection from Sylvania for 50% of the start-up costs and working capital, with the residual being funded by a loan from Sylvania to LMC, which will then inject it into the JV. The loan is forecast to be fully repaid by FY35 via equal instalments, starting in FY26, with interest earned positively affecting Sylvania’s financial results.

Capital expenditure of US$32m will be incurred evenly over the next two years.

The JV is planned to start production in H225 with the first year of full production in FY26. Fifty percent of PGMs and chromite produced will be attributable to SLP.

The PGM plant feed grade is forecast by SLP to be 3.91g/t (the mined chromite plant feed grade will be lower), which translates into a conservative 42% recovery. Total 4E produced is estimated at 13,000oz with 6E at 15,500oz. Half of this production will be attributable to Sylvania, which currently produces 4E of 75,000 oz. Over time and outside of our explicit forecast period, we project an increase in recovery, trending towards the +50% achieved in Sylvania’s current operations.

Recoverable chromite of c 400,000t pa for the JV will see Sylvania for the first time having chromite as a saleable product. The mine gate chromite price assumption of US$102/t is conservative in our view as current prices are in the region of US$280/t CIF.

We forecast US$15.5m in revenue during FY25, based on one quarter of production, which then ramps up to US$62.4m in FY26. Thereafter we assume production levels are maintained at the FY26 levels, although we assume revenue (outside of our explicit forecast period) benefits from higher 4E recovery.

Operating costs are based on a total operating cost of ZAR977/t (guided by SLP) and a treatment rate of ore of 66,000 tons per month, giving an annual operating cost of ZAR773.8m. This should be improved upon but we have used this cost over the life of the JV.

Royalties are formula based and depend on the profitability of the operation, but average around 5% of revenue or about US$3.1m. At start-up, these are close to zero but increase to a maximum of 5% as full production is reached provided that the operation is profitable.

Gross margin is conservatively forecast at 24.6% in FY26, but would be as high as 40% if current chromite prices were to persist. We forecast a small profit of US$0.5m in FY25, followed by US$10.7m in profits in FY26.

By FY26, we forecast that Sylvania’s 50% share of the JV will contribute 13.7% to its combined EBITDA, reducing to 13.3% in FY27 due to rising PGM basket price forecasts. Over the longer term, this contribution is forecast to increase driven by higher JV recovery and falling production in Sylvania’s current operations as dump operations reach end of life (from FY33, we forecast that the JV will contribute 35% of Sylvania’s EBITDA).

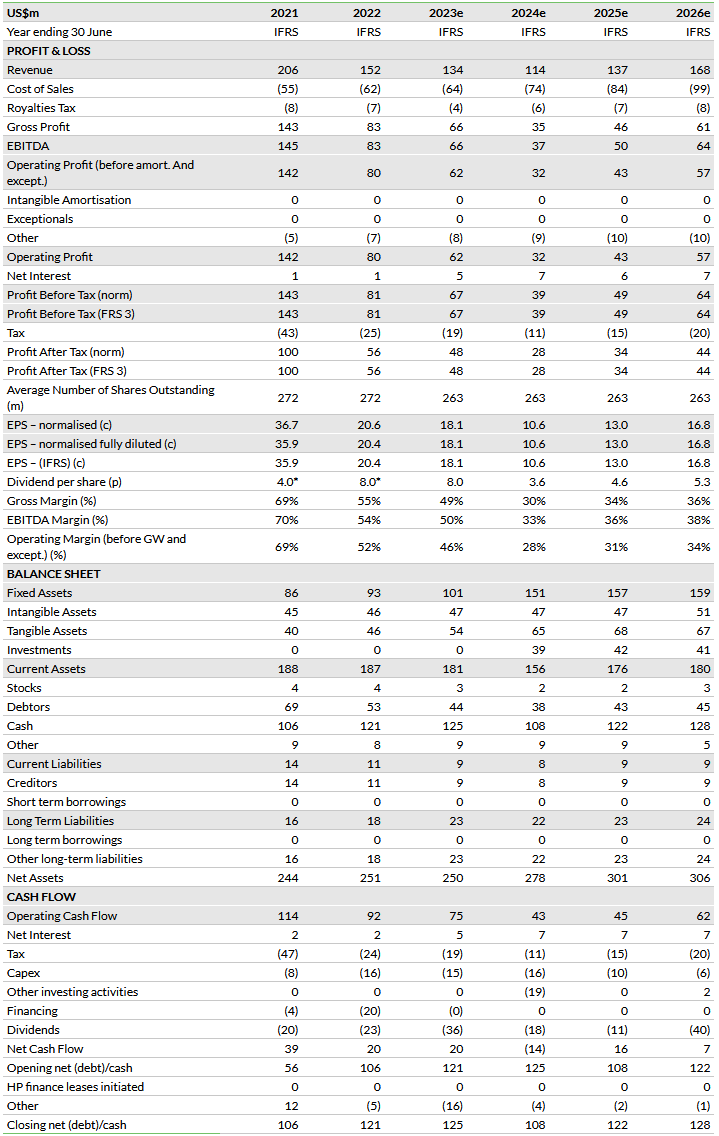

Sylvania forecasts have been lifted

Exhibit 3 shows our financial forecasts for Sylvania, including its 50% stake in the Thaba JV. We have lifted our FY24 and FY25 earnings because of more aggressive interest income assumptions for Sylvania from two sources. Firstly, we have incorporated higher interest income due to the currently prevailing high interest rates on Sylvania’s cash balances. Secondly, due to Sylvania’s loan to LMC (currently attracting a 11.75% pa interest rate), the inclusion of the JV has further enhanced our interest income forecasts. The combined impact of these changes, plus a proportionate consolidation of the JV, lifted our earnings forecasts by c US$6m pa from FY24 to FY26. As a result, we have increased our FY24 EPS forecast by 18% to 10.6c and our FY25 forecast by 16% to 13.0c.

We understand that the Thaba JV will be accounted for by Sylvania using proportional consolidation, which means the addition of 50% of each relevant JV line item as per Exhibit 2 to each relevant line item as per Exhibit 3 below. The JV is forecast to go into full production in FY26, driving a 22.5% increase in Sylvania revenue (allowing for its 50% of the JV production). After allowing for the associated JV cost and other increases, our FY26 EPS has been lifted to 16.8c, which represents 29% growth on the FY25 base.

General disclaimer and copyright

This report has been commissioned by Sylvania Platinum and prepared and issued by Edison, in consideration of a fee payable by Sylvania Platinum. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2023 Edison Investment Research Limited (Edison).

Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS

United Kingdom