Supermarket Income REIT's (LON:SUPR) (SUPR’s) development continues apace. Including the three recently announced acquisitions (c £150m before costs), we forecast up to £600m of acquisition investment by FY24 as the proceeds of the recent £200m (gross) equity raise are deployed and the cash proceeds from the JV maturity are recycled. Acquisition yield have compressed with a positive impact on net asset value. With a low average cost of capital, we expect SUPR to grow without diluting dividend growth, while benefiting from further scale economies.

Share price performance

Business description

Supermarket Income REIT, listed on the special funds segment of the London Stock Exchange, invests in supermarket property, primarily let to leading UK supermarket operators, on long, inflation-linked leases. The investment objective is to provide an attractive level of income, with the potential for capital growth, with a 7–10% pa total shareholder return target over the medium term.

Further accretive acquisition

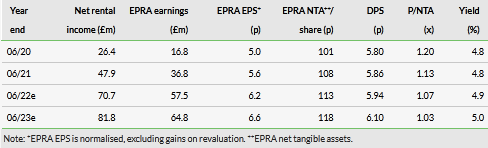

FY21 results confirmed the benefits of increasing scale, with a further reduction in the EPRA cost ratio to 16.8% from 19.2%. Since closing the £200m September equity raise, c £150m has been deployed and we forecast a further £150m by end-FY22, including associated debt. Current market acquisition yields, averaging c 4.5%, are ahead of our estimate of the ‘break-even’ yield of 4.3%, above which SUPR can grow without diluting dividends. As the maturity/unwinding of the Sainsbury Reversion Portfolio approaches (calendar H123), in which SUPR has a 25.5% joint venture interest, we forecast material capital uplifts and a cash return of c £180m for recycling into an additional c £300m of investment on a geared basis. Our net asset value (NAV) forecasts do not assume further yield compression or increasing asset prices although many property agents and analysts expect this.

Visible income and growth potential

SUPR’s portfolio of UK supermarket assets, with long leases and predominantly upward-only, inflation-linked rents, is let to strong tenants. SUPR mainly targets omnichannel stores (combining in-store and online fulfilment) that can benefit from both the forecast long-term growth of grocery sales and the increasing popularity of online. The positive impact on supermarket operator sales, especially online, during the COVID-19 pandemic is forecast to have a sustained effect and has enhanced operator financial strength. This has been reflected in all of SUPR’s rental income due being collected in advance with no defaults, deferrals or rent reductions. Income visibility is strong with good prospects for capital growth, driven by rental uplifts as well as strong investment market demand for supermarket property.

Valuation: Secure income with capital potential

SUPR provides visible growth in DPS with good potential for further capital growth. The FY22e DPS of 5.94p represents an attractive yield of 4.9%, a slight premium to the average of a selected peer group of other long income REITs. The yield and inflation indexed rents support the 13% premium to end-FY21 NAV.

Click on the PDF below to read the full report: