ADP today printed at 237,000, raising expectations that tomorrow’s non-farm payrolls will easily reach the 230,000 job-gain target, following May’s 238,000. The numbers increase pressure on the FOMC to increase interest rates in September toward the 0.75% target for the end of the year. Unfortunately, job cuts have been particularly fierce, especially in the oil and manufacturing sectors. Layoffs annualized could rise by 42.70%, based on data from the Challenger Job Cuts report, with June showing 44,800 jobs lost compared to 41,000 in May. The data may tip unemployment from tomorrow’s expectations of 5.40% to the present level of 5.50%.

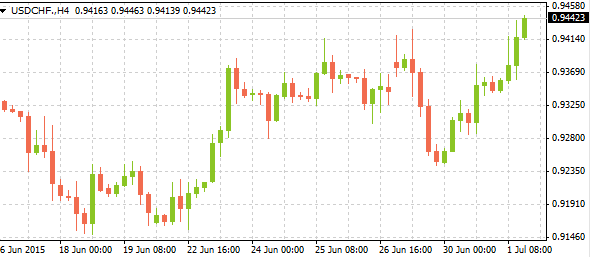

A more pressing concern is weakness in the manufacturing sector, especially following today’s upward revision of the manufacturing PMI – still the lowest since 2013. In spite of optimism in the ISM report, official numbers portray a strong dollar impinging upon growth and a broader expansion of the economy. The USD has been rising strongly against the Swiss franc, the euro, the yen and the pound sterling, with gold dropping correspondingly toward 1-month lows in almost total disregard for the situation in Greece and China. Oil prices are retreating to 3-week lows. Dollar momentum is likely to continue well into the holiday session prior to July 4 celebrations, barring any surprises from tomorrow’s NFP.