Stocks had a bizarre trading day on Friday, but as we have discussed in the past, a market on close imbalance can produce outsized moves late in the day, especially on a Friday at month-end. That is essentially what appears to have happened, with a large imbalance of about $7 billion in total to buy. This helped to push the market higher in the final minutes of trading.

These imbalances are one-and-done and provide no predictive value for what will happen the following day. In this case, the imbalance could have been associated with month-end rebalancing. Also, given the size of the intraday moves, traders using 0DTE options may have been forced to buy back positions from earlier in the day, squeezing the situation.

It isn’t to say that markets can’t continue higher today; at the same token, it wouldn’t be surprising to see the gains given back either, especially given how much economic data is due to come this week.

The Fed will be in a blackout period this week, and Treasury auctions will not be a factor in the afternoons. This means that economic data will be the more significant driver of market movements, and there will be plenty of economic data to come this week, with the job report on Friday being the highlight.

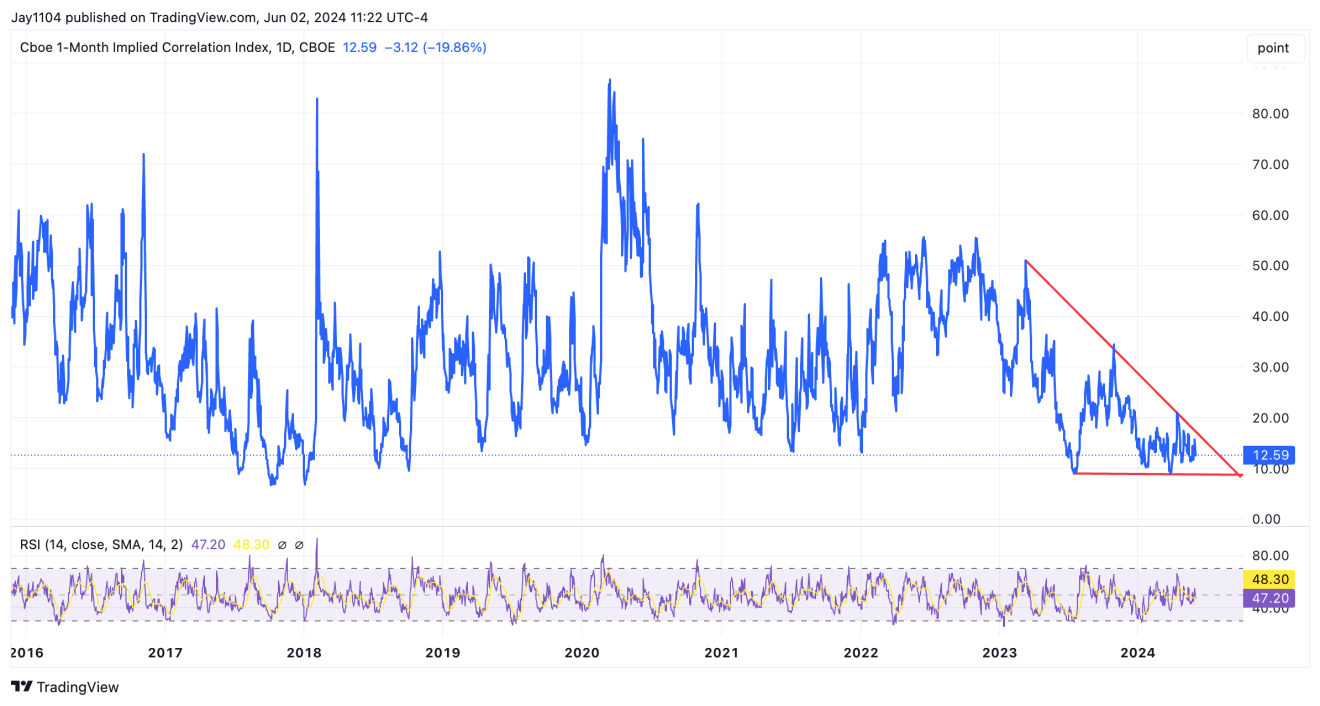

More importantly, it has become increasingly clear that the market is amid one giant trade, and there are signs the trade is possibly in the midst of a reversal, as measured by credit spreads, correlations, and skew. It seems that some of these are hitting historically low levels, and over the next two weeks, implied volatility will find it hard to move lower, given a job report, a CPI report, and a June FOMC meeting.

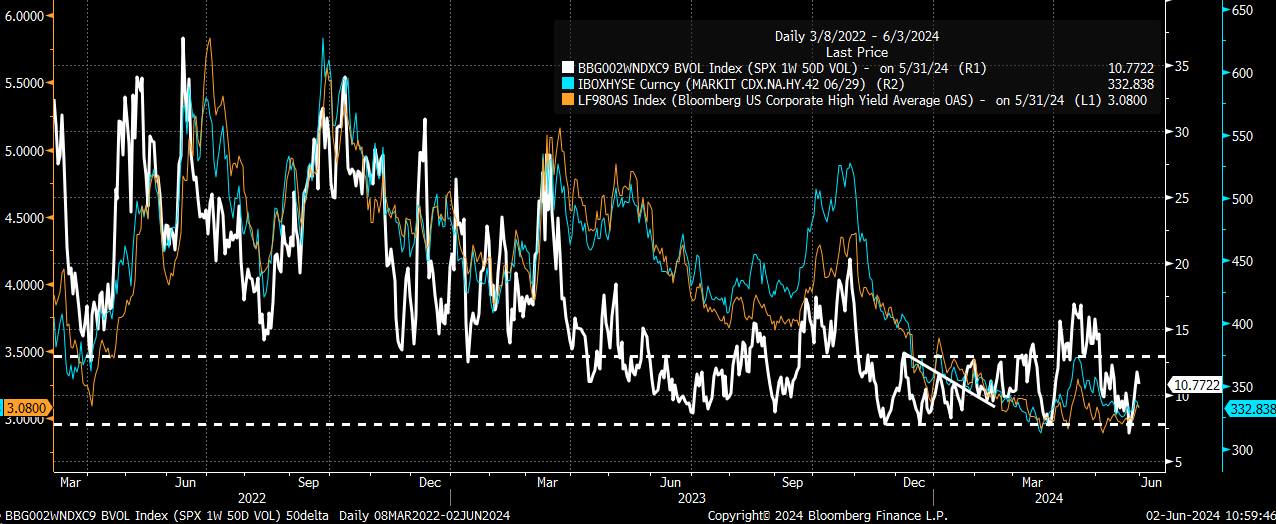

This means that the short-dated levels of implied volatility may rise this week, and the 1-week 50-delta S&P 500 option IV tends to also track closely with credit spreads, which have been trending higher over the past few weeks. With all the news coming, especially between the job report this week and the Fed meeting next week, the 50-day delta IV is likely to push higher over the coming days as investors look for hedges. This could widen credit spreads, as credit spreads and IV trade together.

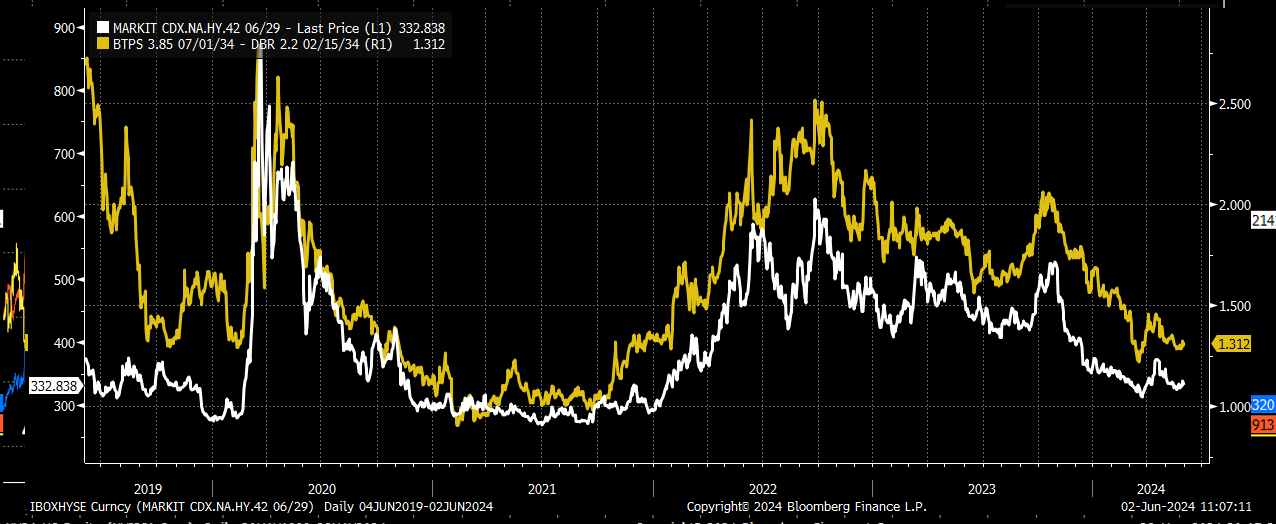

Additionally, this week, the ECB is expected to cut rates by 25 bps and will likely give the market clues about when the following rate cut will come. This may also have a hand in the historically tight credit spreads in Europe, such as the German and Italian 10-year, which is currently just 1.31%. We know over time that US credit spreads also trade with European credit spreads, and if the trend in the spread of German and Italian bonds is higher, then high yield spreads here in the US are likely to follow.

Also, the 1-month implied correlation index is also at historically low levels at this point, and it confirms and tells us the same thing that implied volatility and credit spreads are saying, which is that risk-taking is pretty much to the max. While these values could also go lower from historical standings, there isn’t much lower for them to go.

USD/CAD: Surge to Signal Risk-Off

Meanwhile, there is also a Bank of Canada policy decision this week. There is expected to be an 81% chance of a rate cut, with the market pricing in a second rate cut in October. The USD/CAD has also been on our radar and has been consolidating the last several sessions. The market appears to be waiting for clues as to when and how much the Bank of Canada will likely cut and how much spreads between the US and Canada could widen.

A push in the USD/CAD back above 1.385 would be a significant signal for risk-off overall, and a push higher in the USD/CAD would make sense if credit spreads and IV rise.

S&P 500 to Give Back Some of Last Week's Gains?

For all the hype around the equity market, the S&P 500 has gone nowhere since mid-March and is basically in the middle of the Rising Broadening Wedge we have been tracking now for a few weeks. Meanwhile, Friday’s rally only returned the index to resistance and nearly completed a 61.8% retracement. Being that the rally was driven by a market-on-close imbalance, it wouldn’t be surprising at all to see the move higher given back by Monday or Tuesday.