Stocks finished the day higher yesterday , with the S&P 500 rising by around 1.2%. It was a curiously odd rally because the China markets were smashed earlier, with Hong Kong dropping more than 6% and the Chinese Yuan rising to over 7.30 to the dollar. That is a big deal, and the China 5-year CDS, yes credit default swap, increased by 13 handles to close above 130, its highest level since 2016.

The S&P 500 peaked at 3,810 on the cash market yesterday and hit wave three’s 38.2% retracement mark. Given the sideways nature of this market since the middle of September, it is possible this could be a wave four sideways consolidation. For that to work, the index must hold around this 3,800 cash level.

On top of that, this 3,800 level marks the 50% retracement from the September 12 peak.

It also marked the 78.6% retracement from the September 21 peak.

Yesterday, the index came within 6 points of touching its upper Bollinger band, an overbought signal.

Inflation

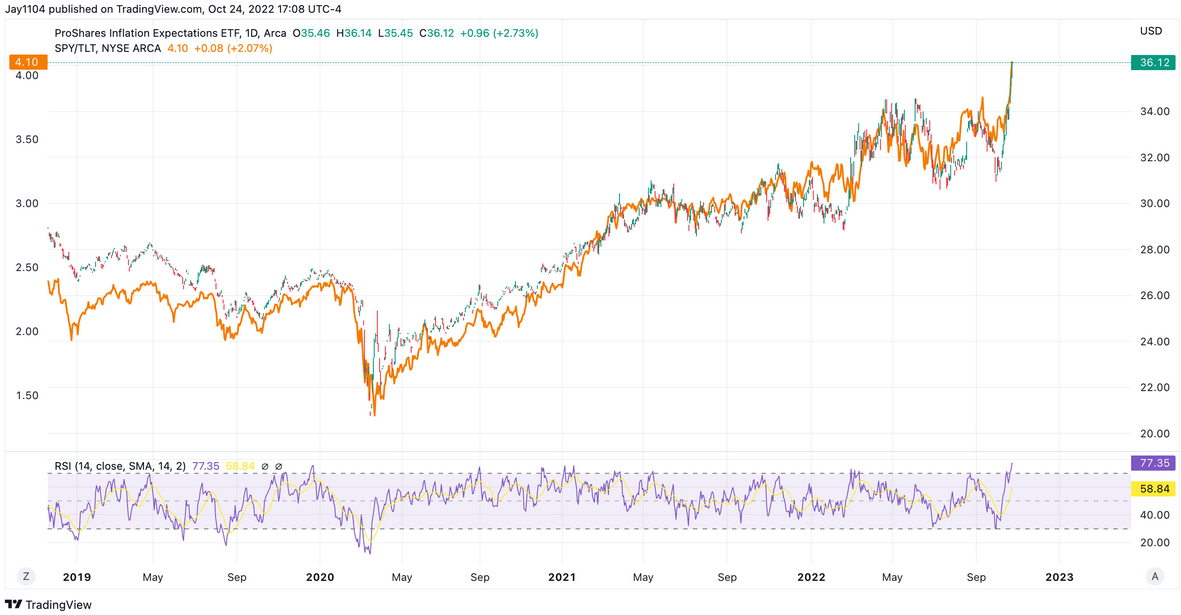

There are plenty of good reasons for the S&P 500 to stop here. What is interesting here, too, is that long-term inflation expectations are exploding higher, with the RINF ETF rising rapidly.

What is interesting is that you realize that the chart of the RINF looks an awful lot like the SPY (NYSE:SPY) to TLT ratio I posted yesterday. What this would suggest to me is that the reason the market is rising is that inflation expectations are rising.

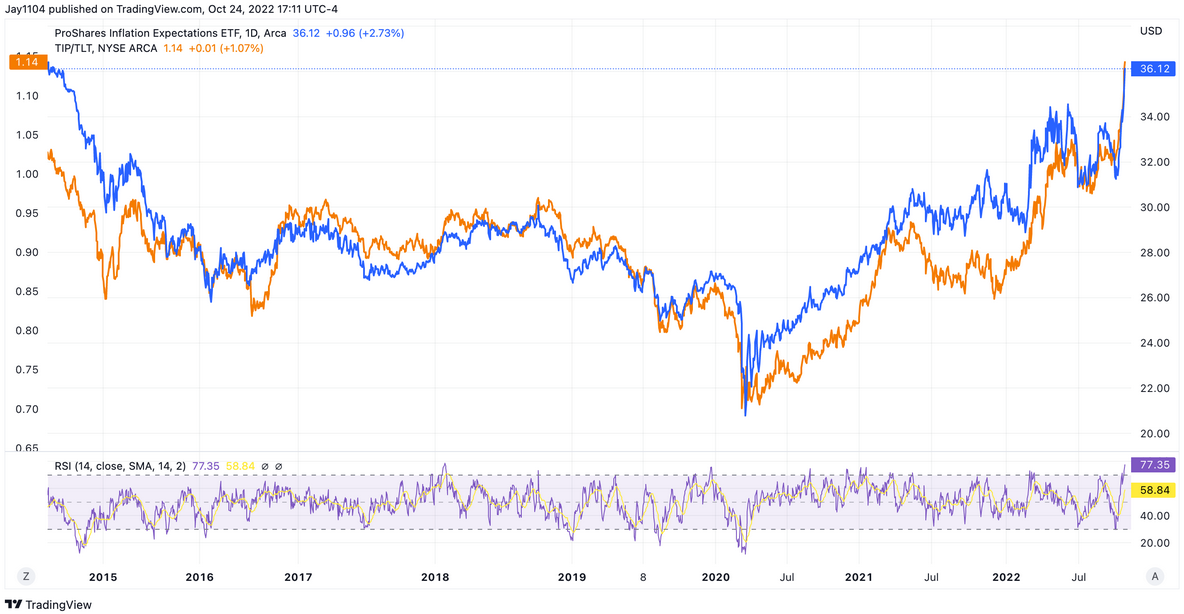

Inflation expectations are rising because the 30-year rate is soaring higher, but real yields stay put, causing the spread to widen and inflation expectations to increase. So this tells us two things: either inflation will get wildly out of control again, nominal rates have risen too far, or TIP rates haven’t advanced enough. The TIP to TLT ratio is another way to measure inflation expectations.

I guess if I had to choose based on the technical patterns, the TIP ETF probably needs to start dropping to rein in inflation expectations, and once the TIP ETF starts to drop, the stock market is likely to reverse course. Of course, the TLT could also begin to rise, which could also sink inflation expectations and stocks.

What is ironic here is that the headlines say that the market is rising due to the expectation of slower rate hikes. But indeed, it grows on expectations of higher inflation rates, which would suggest the Fed will not do its job in bringing inflation down. Why would the market rise on higher inflation rates? That is easy because sales and earnings are derived in nominal terms, and if inflation runs hot, then sales and earnings will run hot, which is good for stocks.

It is another way of saying that the Fed will not pivot because the market is telling it not to pivot, and every time the stock market rises, it is yet another indication to the Fed that it doesn’t have a handle on inflation. It will need to raise rates even more.