Perhaps to the dismay to many on ‘Main Street’ – Wall Street has reacted to another multimillion loss of American jobs by pushing stocks firmly higher. Investors heard Jay Powell say more stimulus will likely be needed and then saw nearly 3 million more US jobless claims and put two and two together. The bet, for now, seems to be that more fiscal and monetary stimulus is in the offing and its being executed by buying shares and precious metals.

Shares

Shares in Europe are playing catch up with a late turnaround on Wall Street that happened yesterday after the European close. However, US futures are pointing to a flattish open later.

The FTSE 100 is chasing the gains on Wall Street bolstered by an 8% rise in BT shares on news it is looking to sell a stake in OpenReach. We suggested last week that the O2 / Virgin merger increased the chance of a BT breakup. It appears BT are getting ahead of any renewed regulatory pressure from its new big rival.

The DAX index was higher by over 1% in early trading with carmakers VW and Daimler responding positively to German finance minister Sholz saying a new stimulus package is coming in June.

Swiss pharmaceutical giant Roche is among the top risers on the SMI index after it announces plans to sell a digital screening tool for use with COVID-19.

The Dow Jones index saw a sharp turnaround yesterday led by bank stocks after it was reported Goldman Sachs (NYSE:GS) is eyeing the acquisition of another bank. Shares of Wells Fargo (NYSE:WFC) spiked over 7% on the chance they are the target. Wells would appear to be a perfect purchase for any company that can bankroll it. It’s formally the biggest bank in America but shares are depressed by the reputational damage done by the account fraud scandal, something Goldman’s branding could eventually resolve.

Forex

The euro is rising against the British pound and Swiss franc but little changed against the US dollar despite German Q1 GDP and French CPI data missing expectations. The prospect of German stimulus coming next month and growing hopes for a compromise on joint debt issuance at next week’s Eurogroup meeting are both forces for more upside in the single currency.

Commodities

Both gold and silver prices are pushing higher following Fed Chair Jerome Powell’s suggestion that further monetary stimulus will be needed. Extra dollars being printed and the rising possibility that the Fed eventually gives in to negative rates are positives for non-interest bearing assets.

The price of oil is moving higher with the rest of the commodity complex, with Brent crude topping $30 per barrel.

Opening calls

Dow Jones to open 54 points lower at 23,693

S&P 500 to open 4 points higher at 2860

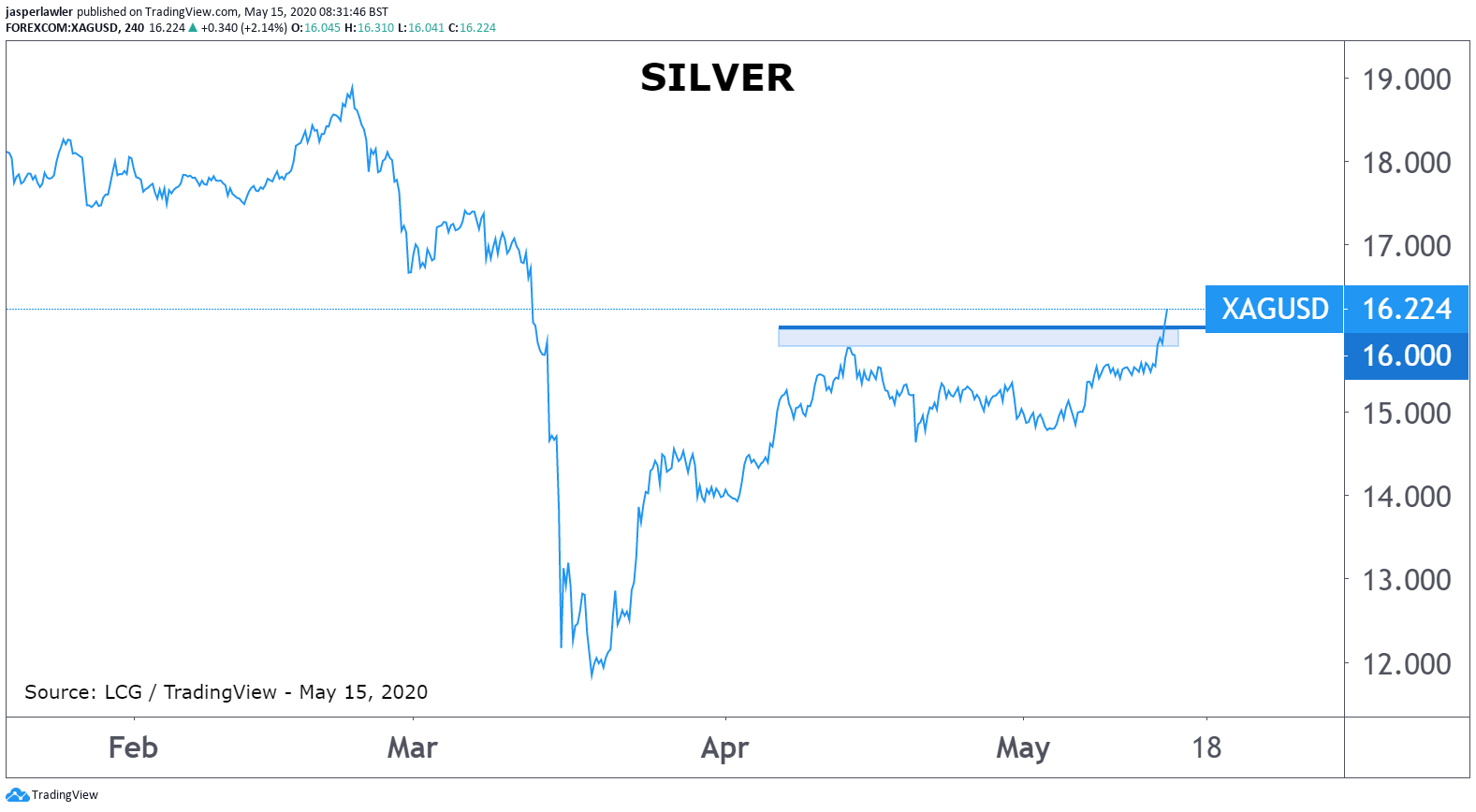

Chart: Silver (3-months)

The price of silver has hit a 2-month high, reaching over $16 per oz for the first time since the heavy sell-off in March.