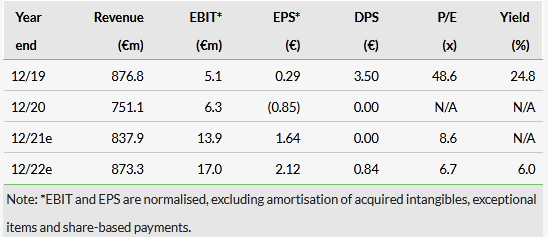

Stern Groep's (AS:ARTN) 2020 financial and operational restructuring has placed it in a good position to cope with the uncertain car market in 2021. Opportunities to create further shareholder value range from M&A to high dividend pay-outs. We are increasing our EPS forecasts by 10.5% and 9.9% in 2021 and 2022 respectively, driven by the restructured organisation, digitisation efforts and an improving market environment. The valuation is undemanding, at 6.7x 2022e P/E.

Share price performance

Business description

Stern Groep is the fifth largest automotive group in the Netherlands. It has around 60 dealer and Stern Point car repair locations and revenues of over €800m. The company had 1,674 full- and part-time employees at year end 2020.

Strong H121 results despite COVID-19 impact

Stern’s H121 results were affected by the pandemic, with closed dealerships in Q1 and a recovery in Q2 when dealerships opened again. Used cars were in strong demand, as well as light commercial vehicles, while new car sales lagged as chip shortages limited supply. Average selling prices were higher, driven by demand for electric vehicles (Evs) and SUVs, which are relatively expensive. All in all, Stern’s H121 sales came in 9.8% higher year-on-year at €419.5m. Adjusted EBIT was €7.9m (H120: €6.4m), in line with our estimate of €8.1m. Government aid programmes supported Stern’s results in H1 and will continue until Q321, after which they will stop. Net profit amounted to €5.1m compared to a loss of €19.1m in H120. Supply chain issues relating to chip shortages for the OEMs bring uncertainty for H221 and therefore Stern did not provide specific FY21 guidance.

Increasing ROI, more used and rent/short lease

Stern sees OEM car distribution developing more towards an agent model, as opposed to the current dedicated importer/dealer model, in the coming years. This could imply lower working capital (less balance sheet risk) at the cost of gross margin for the dealers, but also a much higher return on investment. Moreover, Stern wants to concentrate more on used cars for which it has a relatively strong supply chain with Stern Rent (for which Stern seeks expansion) and the cooperation with ALD Automotive. In addition to this, there are other opportunities for Stern shareholders that could materialise: distributions of Stern’s ‘over-solvency’ of €44.8m (Q1: €39.5m, €7.9 per share), a sale/IPO of unlisted car insurer Bovemij (book value €3.47/share) and M&A, both as a target and a purchaser.

Valuation: Attractive on a standalone basis

Stern is trading at an FY22e P/E of 6.7x based on an anticipated recovery in profitability in the coming years. Compared to the peer group average of 11.3x, this reflects a large discount. Applying the average peer multiple and adding the book value of the stake in insurer Bovemij (€3.47 per Stern share) results in an implied valuation of €27.31/share (versus €26.70/share in March 2021).

Aiming for higher returns on investment

Despite uncertainty in the car market, there are a number of opportunities that could start to crystalize value for shareholders. For more detail, please see also Edison’s interview with CEO Henk van der Kwast.

In the last few years, Stern has been proactive in restructuring the organisation to keep up with the structural change in the automotive market. A key part of that has been the progress made in digitalisation of sales and service operations, in which it was lagging Dutch peers. Looking forward Stern now sees OEMs moving towards an agent model, which implies a large change in the operating environment compared to the current dedicated dealer model, and this could trigger further consolidation. Furthermore, Stern believes that the interest in rent/short lease and relatively new used cars will continue as modern car users want flexibility. To summarise:

1. Stern sees the automotive world developing more towards an agent model as opposed to the current dedicated dealer model in the coming years. Stellantis and Mercedes (in which Stern is market leader in the Netherlands) have already implied that they would act in this direction. This new operating model probably implies that there is no need for most of the new cars that are now on the dealers’ balance sheets, implying much lower working capital requirements. Of course, this would be at the cost of gross margin for the dealers, but return on investments will probably be much higher and balance sheet risk will be lower, implying higher valuations.

2. Operationally, the transformation from a traditional bricks and mortar car dealership to an integrated automotive service platform with a strong digital offering is progressing well. This is part of the effort of Stern to become cost and service leader in the Netherlands with a large offering in used cars. Used cars were a less important part of sales for Stern in the past, but these cars have become very popular since the start of the pandemic and the trend is expected to continue. Last quarter, used cars from lease partner ALD were advertised on Stern’s platform, which we believe is a signal that Stern’s proposition is maturing and adding extra sources of revenue. Furthermore, expansion of the short lease/rent activities, another focus point for Stern, will lead to a continuous flow of young used cars.

3. M&A offers optionality: Although we expect that talks with Scandinavian automotive group Hedin are still in the early stages, Stern is open to team up with an international group, as discussed in our interview with Stern CEO Henk van der Kwast. Alternatively, Stern also indicated that it could expand its Dutch activities again, especially in dealerships of strong car brands and in short lease/rent.

4. Stern’s balance sheet developed favourably in 2020 and that persisted into H121. Stern’s reported ‘over-solvency’ increased further to €44.8m, compared to €39.5m in Q121 and €29.5m at the end of FY20. Over-solvency refers to the difference between healthy (as determined by the company) and actual proportions of equity and liabilities on the balance sheet. The difference, expressed as an amount, is available to distribute to shareholders. Stern cannot pay a dividend in both 2020 and 2021 as a result of government restrictions because it uses COVID-19 related government support. However, we would expect a significant part of this amount to be paid to shareholders in the coming years. For now, we continue to model a dividend pay-out of 40% (€0.84 per share in 2022), but we would not rule out a significantly higher pay-out once government restrictions are lifted.

5. Privately owned car insurer Bovemij has indicated that it is working on a way to increase the liquidity of its shares. This could imply a liquidity event like a sale or IPO, which could benefit Stern shareholders. Stern, which is a 5% shareholder in Bovemij, indicated that its participation in Bovemij is not a strategic asset and hence it will probably be divested in such an event. With a book value of €3.32 per Stern share at FY20 (€18.8m for a 5% stake), this could represent a material increase of surplus capital.

Strong H121 results, despite pandemic impact

Stern’s H121 results were still heavily affected by the pandemic, with closed dealerships in Q1 and a recovery in Q2 when dealerships were opened again. Used cars were in strong demand (sector organisation VWE: +6.7% in H121), as well as light commercial vehicles (sector organisation RDC: +30% in H121), while new car sales (sector organisation RDC: +3.3% in H121) lagged.

For Stern this meant that H121 sales came in higher than our expectations at €419.5m, an increase of 10% y-o-y, compared to our estimate of €401.1m. Stern sold approximately the same number of new passenger cars in H121 compared to H120. As such, its market share decreased to 4.1% from 4.4% in H120, although it marks an increase compared the 3.8% reported over FY20. The flat volume development was partly caused by Stern deciding to postpone deliveries to January from last year as a result of lockdown measures at that time, which was offset by lower deliveries in Q2 as a popular EV model became available later in the quarter than expected. Average selling prices of new cars are clearly higher.

Gross margin for the group came in lower at 17.7% compared to 18.0% in H120, driven by mix effects because of relatively lower workshop revenues, as traffic on the Dutch roads did not recover as much as was expected, partly offset by higher margins for new and used cars.

Click on the PDF below to read the full report: