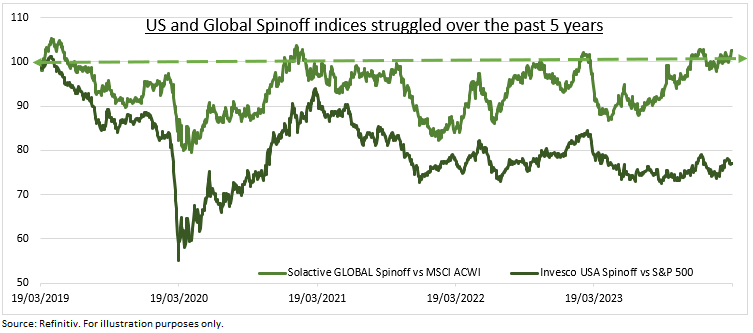

SPLIT UP: Company spin offs are leading corporate activity. Unilever (LON:ULVR) demerging its ice cream unit incl. Ben & Jerry’s. Holcim (SIX:HOLN.ZU) its US aggregates business. Lennar (NYSE:LEN) its land holdings. Cummins (CMI) its filtration business. GE (GE) nearing end of its successful split. Whilst Reddit (RDDT) continues the only glacial IPO, and M&A market, re-opening. Yet spinoffs have a mixed performance record (see chart). Blamed on passive investing, leaving small spin offs as orphans, or on activists, spinning off weak businesses. And as conglomerates make a stealth comeback, from big tech to private equity, and traditional Berkshire Hathaway (NYSE:BRKa) (BRK.b).

SPIN OFFS: These aim to add value by better corporate focus and incentives whilst unlocking conglomerate valuation discounts. They are often tax-free, and the parent maintains a minority shareholding. As management and activist investors focus on generating returns in an uncertain macro environment. Industrial conglomerate GE (GE) has been one of the most aggressive, and successful recent proponents. Splitting itself into three after over 130 years of existence. It’s healthcare division (GEHC) has soared since listing in early 2023. And on April 2nd it is splitting its GE Vernova (GEV) power-generation business from the remaining GE Aerospace business.

CONGLOMERATE: Spin-offs fashion masks come back for once unfashionable conglomerates. Just in different guises. Whether as ‘big tech’, from Instagram to YouTube. Where any breakup could be a shareholder bonanza if history is a guide. Rockefeller did not become a billionaire until Standard Oil was broken into 34 companies in 1911. Whilst the Baby Bells telecom sum was greater than parts in its 8-way split in 1984. Or as private equity, which may be the ‘new conglomerates’, with multiple diverse businesses and $2 trillion ‘dry powder’ to invest. Whilst Berkshire Hathaway (BRK.b) is the biggest non-tech stock in S&P 500.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Spin-offs return to fashion

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.