The CPI report came in weaker than expected, and the big question is what this all means. For the most part, the reason nominal GDP growth has been so robust has been the high inflation rate. But it seems pretty clear that after the past two reports, the likelihood of nominal growth remaining robust is diminishing.

The real clue in all of this will be when 5-year breakevens break down. A move below that 2% band on the 5-year breakeven will probably be the first real signal that the bond market is pricing lower inflation and slower growth. This will be the indicator that tells us monetary policy is too tight.

Yesterday’s data also seems to support the view that a yield curve steepens as well. Two months of a rising unemployment rate and falling m/m inflation suggest that some slowing may finally be taking hold in the economy. Whether it is due to Fed policy or not is another question altogether.

Perhaps the higher prices have finally brought the economy to a breaking point. Regardless, if the 2/10 can get above -17 bps, it will have a lot of room to run, and that is when things become really interesting.

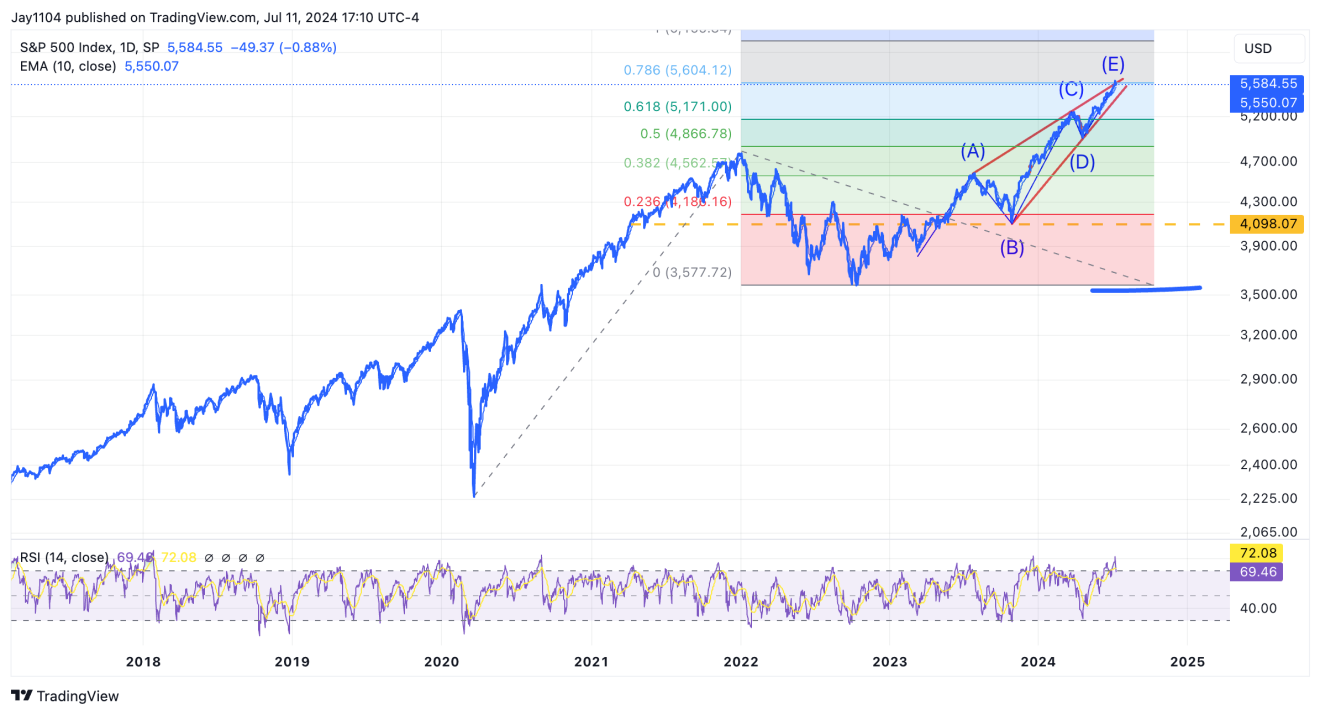

S&P 500's Giant Rising Wedge Pattern Coming to a Climax?

The giant rising wedge pattern in the S&P 500 that appears to have hit some climax in the past few trading sessions, with some pretty stretched technicals. I think I have shown this before, but here it is again; using a log chart and closing prices, we can see that the S&P 500 has a 78.6% extension of the March 2020 and October 2022 lows and what appears to be a nice-looking ending diagonal triangle. It looks nice, that’s for sure.

The odd thing was that even with the S&P 500 down about 90 bps on the day, there were 395 stocks higher and only 107 lower. So, this was a good day for the equal-weight S&P 500 and the Small-cap IWM. It is hard to say if yesterday’s move means anything, though, for the IWM because it couldn’t get above resistance around $212.

But also, we saw the same thing in June, when the small caps jumped following the CPI report, only to give back all of the gains in the days to come.

Nvidia, Nasdaq 100 Below 10-Day Exponential Moving Average

Nvidia (NASDAQ:NVDA) was down yesterday, closing below its 10-day exponential moving average; it could mean something or nothing. The last time Nvidia saw two bearish engulfing patterns a couple of weeks apart was in April, which led to a 20% decline in the shares. I’m not sure if that is what happened this time, but that is what happened last time.

The Nasdaq closed on the 10-day exponential moving average, and that has served as support on a few occasions, so if the level should break today, it could tell us that the trend in the Nasdaq 100 has changed.