- In 2023, the famous Magnificent 7 were responsible for much of the S&P 500's rise due to their weight in the index.

- But within the small-caps, 7 stocks had a great year as well.

- Let's take a look at these 'Small 7' stocks one by one and try and analyze their prospects.

- Looking to beat the market in 2024? Let our AI-powered ProPicks do the leg work for you, and never miss another bull market again. Learn More »

If anything has characterized 2023, it has been the strength of the technology sector in general and artificial intelligence in particular.

The so-called Magnificent 7's rally was responsible for the U.S. stock market having a great year, due to the weightage they have in the S&P 500.

The S&P 500 outperformed the S&P 500 Equal Weighted index by 12% last year, the second largest gap since 1971 (only 1998 had the largest gap at 16%).

Within the small-cap sector, we also have seven tremendous stocks listed on the S&P 600 Small Cap.

Let's take a look at these 7 stocks:

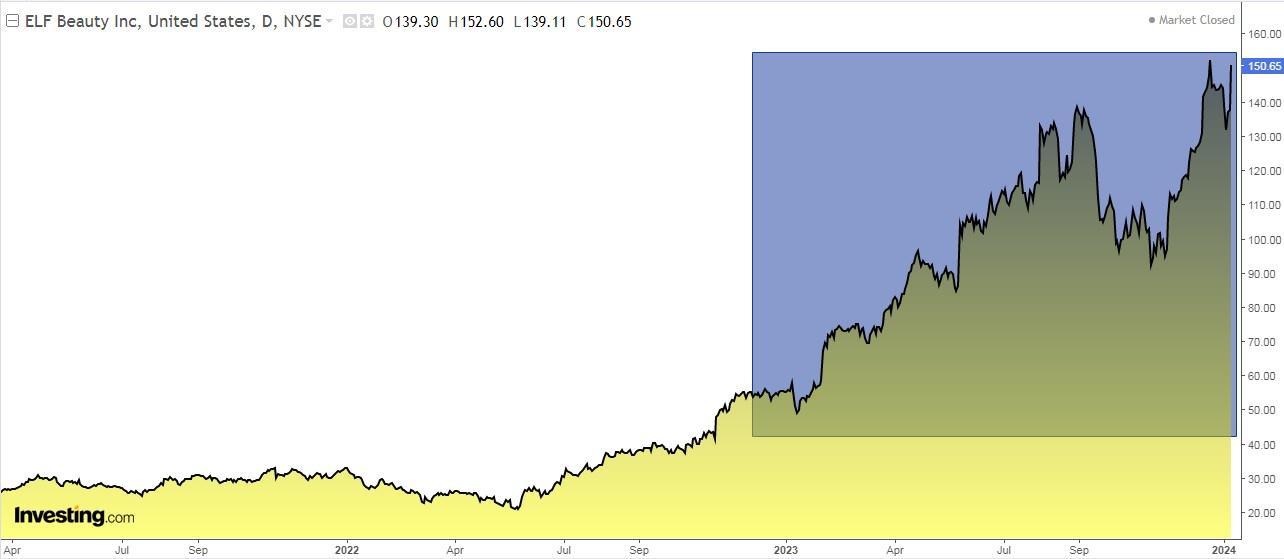

1. ELF Beauty (ELF)

ELF Beauty (NYSE:ELF) offers cosmetic and skin care products.

The company was formerly known as J.A. Cosmetics Holdings and changed its name to e.l.f. Beauty in April 2016. It was founded in 2004 and is headquartered in Oakland, California.

In the last year, its shares are up +177%.

It reports its results for the quarter on February 1. For 2024 it expects earnings per share (EPS) to increase by +60.7% and revenue by +58%.

It has 14 ratings, of which 11 are buy, 3 are hold and none are sell.

2. Abercrombie & Fitch

Abercrombie & Fitch Company (NYSE:ANF) operates as a retailer and offers a variety of apparel, personal care products, and accessories for men, women, and children. It was founded in 1892 and is headquartered in New Albany, Ohio.

Its shares rose +243.30% in the last year.

On March 6 it presents its income statement. For 2024 it expects a revenue increase of +14%.

3. Rambus

Rambus (NASDAQ:RMBS) offers semiconductor products in the United States, Taiwan, South Korea, Japan, Europe, and Canada. It was incorporated in 1990 and is headquartered in San Jose, California.

Its shares are up +77.62% in the last year.

On January 29 it presents its numbers and is expected for 2024 an increase in earnings per share (EPS) of +23.4% and revenues of +16.1%.

It has 6 ratings, all of which are buy. The market gives it potential at $77.

4. Comfort Systems USA

Comfort Systems USA (NYSE:FIX) provides installation, renovation, maintenance, and repair services for the mechanical and electrical services industry in the United States.

It was incorporated in 1996 and is headquartered in Houston, Texas.

Its shares are up +73.54% in the last year.

On February 22 it will present earnings and is expected for 2024 to increase earnings per share (EPS) by +14.2% and revenues by +11.1%.

The market gives it potential at $210.42.

5. Meritage Homes

Meritage Corporation (NYSE:MTH) designs and builds single-family townhouses in the United States. It was founded in 1985 and is based in Scottsdale, Arizona.

Its shares have risen +72.59% in the last year.

On January 31 it will present its results and is expected to increase revenues by +3.04% and earnings per share (EPS) by +21.62%.

It has 5 ratings and all of them are buy. The market sees potential at 192-195 dollars.

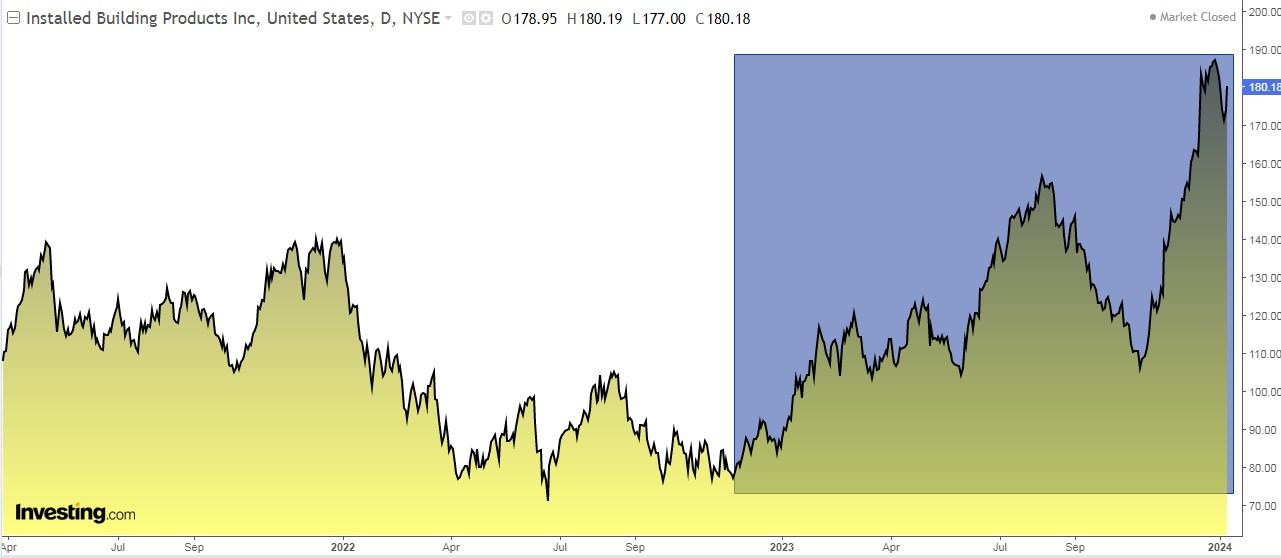

6. Installed Building Products

Installed Building Products (NYSE:IBP)is involved in the installation of insulation, waterproofing, fire protection, blinds, garage doors, etc.

The company was formerly known as CCIB Holdco. It was founded in 1977 and is headquartered in Columbus, Ohio.

Its shares are up +96.39% in the last year.

On February 29 it presents its numbers and is expected for 2024 earnings per share (EPS) up +10.47% and revenue up +5.2%.

It presents 6 ratings and all of them are buy ratings.

7. DoubleVerify

DoubleVerify (NYSE:DV) provides a software platform for digital media measurement and analytics and offers advertisers solutions that enable them to increase the effectiveness and return on their digital advertising investments.

It was founded in 2008 and is based in New York. Its shares are up +54% in the last year.

On March 5 it will present its results and is expected to increase revenues by +23.06% and earnings per share (EPS) by +15.3%.

It presents 5 ratings and all of them are buy. The market sees potential at $39.67.

***

In 2024, let hard decisions become easy with our AI-powered stock-picking tool.

Have you ever found yourself faced with the question: which stock should I buy next?

Luckily, this feeling is long gone for ProPicks users. Using state-of-the-art AI technology, ProPicks provides six market-beating stock-picking strategies, including the flagship "Tech Titans," which outperformed the market by 670% over the last decade.

________________________________________________________

Want to start using InvestingPro? Here is a small gift from us! Enjoy an extra 10% discount on the 1 or 2 year plans. Hurry up not to miss the New Year’s sale! You can save almost 60%!

Follow this link for the 1-year plan with your personal discount,

or click here for the full 2-year plan with 60% off!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple perspectives and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.