Market Overview

Another drip feed of positive newsflow from the push towards a Phase One trade agreement between the US and China has boosted market sentiment again. The discussion is turning to the potential for tariff removal, which would be a real boost for sentiment if agreed. The impact is coming through higher Treasury yields but also the continued steepening of the US yield curve (US 3 month/10 year spread is now at over +25bps and at eight month highs). This has helped the shift out of risk averse assets such as the Japanese yen, Swiss franc and gold. Subsequently we see flow into higher beta currencies, such as the Aussie, Canadian dollar, but also the US dollar. Another key indicator of this risk improvement is the Chinese yuan which is strengthening back towards 7.00 against USD, a level not seen since mid-August.

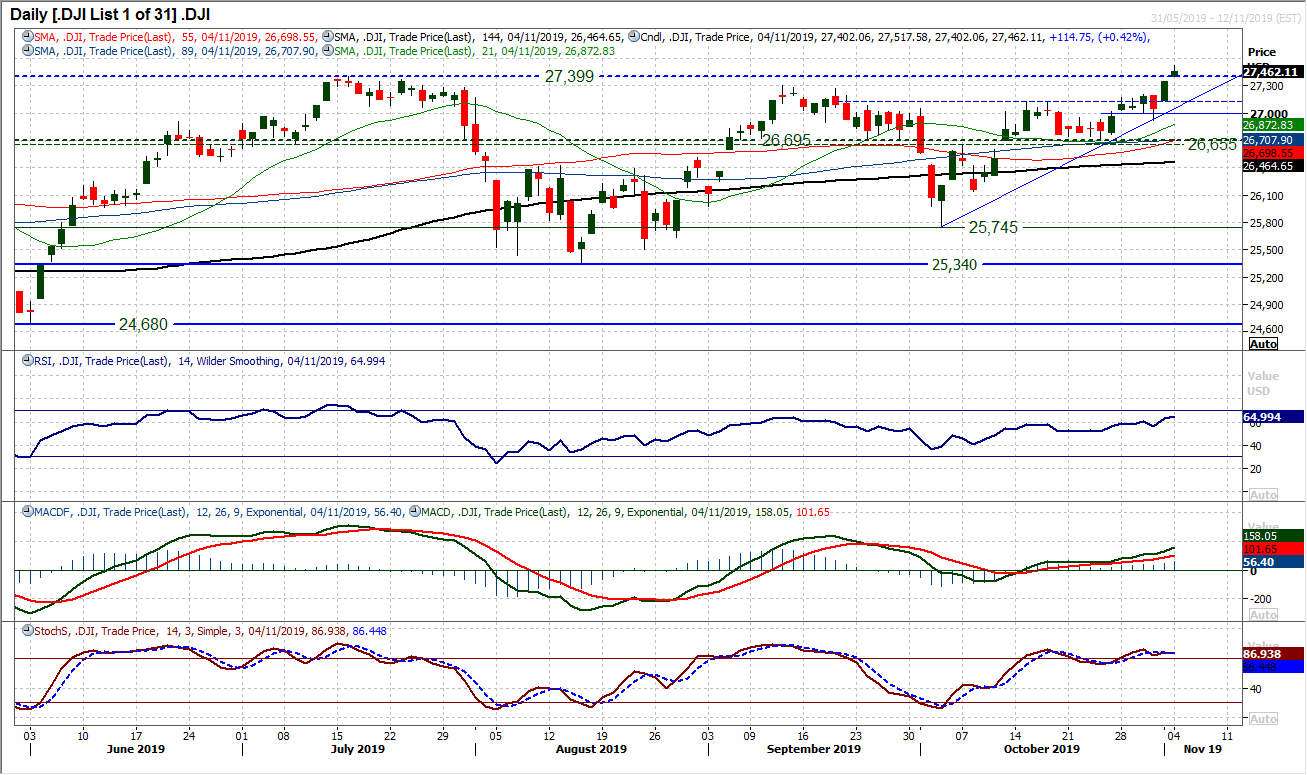

The positive risk environment has also continued to see flow into equities, where we now have seen the Dow Jones Industrial Average moving into all-time highs. Will this positivity last though? The ISM Non-Manufacturing reading will give a crucial insight as to whether the continued manufacturing sector contraction is pulling into the all-important consumer sector. The Reserve Bank of Australia held monetary policy unchanged today with rates at +0.75% (no change expected at +0.75%). The RBA will continue to monitor the outlook for consumer spending and inflation. There is an ongoing expectation of a rate cut in the coming months, but as yet the RBA is holding firm.

Wall Street closed another positive session with markets at all-time highs. The S&P 500 closed another +0.4% higher at 3078, whilst US futures are another +0.2% higher in early moves today. This has helped Asian markets higher with the Nikkei +1.8% higher (although playing catch up after a public holiday yesterday) along with the Shanghai Composite +0.5%. In Europe, there is a following of US futures, with FTSE futures +0.2% and the DAX futures +0.2% higher. In forex, the positive risk environment is showing through with underperformance of the safe havens JPY and CHF, whilst the commodity currencies are all stronger with AUD and NZD leading the way. In commodities, gold is marginally weaker whilst silver is supported. Oil is trading mixed after its recent gains.

The services PMIs will be key for today’s economic calendar. The UK Services PMI is at 09:30 GMT and is expected to improve marginally to 49.7 (from 49.5 in September).

The US Trade Balance is at 13:30 GMT with an expectation that the deficit would improve marginally in September to -$52.5bn (from August’s -$54.9bn). The US ISM Non-Manufacturing is at 1500GMT and is expected to improve to 53.5 in October (from 52.6 in September).

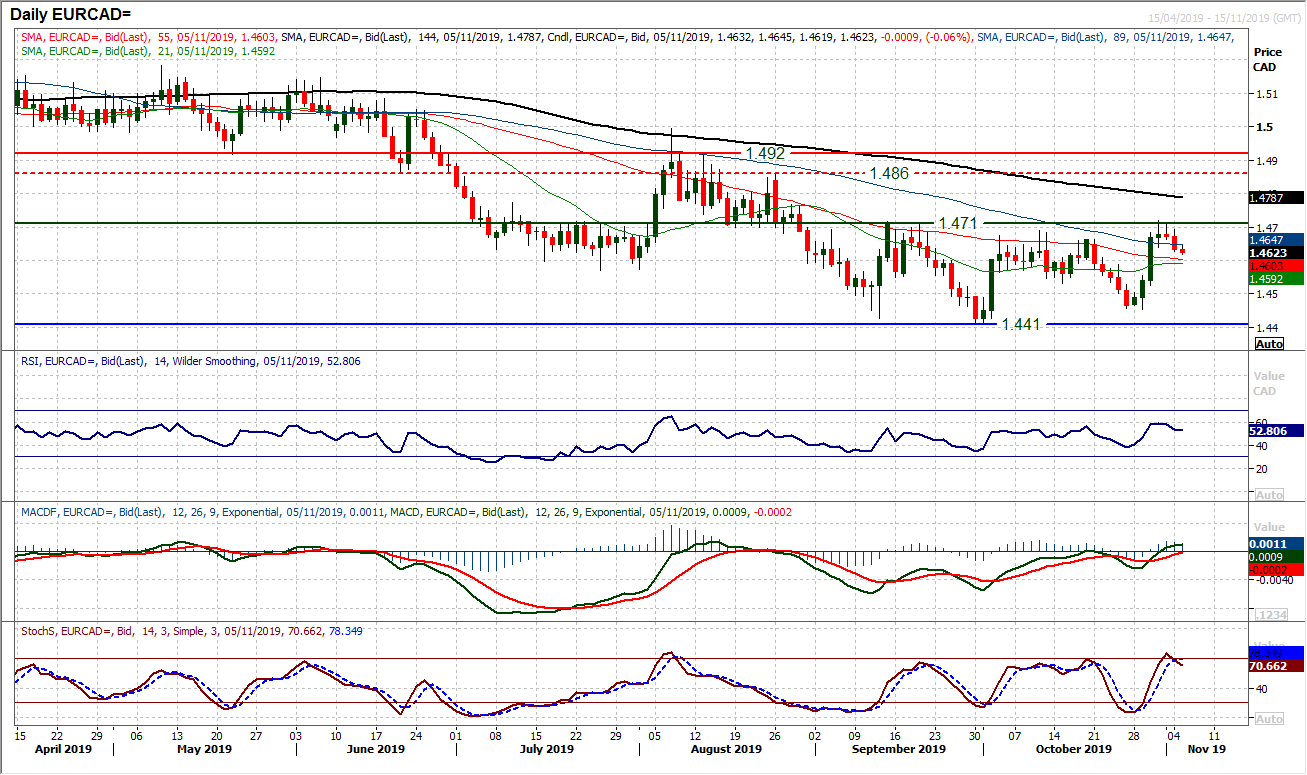

Chart of the Day – EUR/CAD

The euro outlook may have been improving recently, however throughout 2019, the Canadian dollar has been driving continued outperformance. This means that EUR/CAD has been posting consistent lower highs and lower lows. A sharp rebound last week certainly posed a few questions of this outlook, but for now at least, the key multi-month pivot band around 1.4700/1.4720 remain intact as resistance. It was interesting to see the rally losing momentum at the resistance to now turn lower. The RSI falling over again around 60, as it has done throughout 2019 gives a sense of another chance to sell. MACD lines are struggling for traction around neutral whilst Stochastics also bear crossing around 80. A decisive negative candle yesterday seems to have pulled the sellers back in, with a close under 1.4640 (initial support). The hourly chart shows negative pressure beginning to take hold whilst below 1.4640 completes a small top and would imply -80 pips initially. This would then re-open the key lows around 1.4410/1.4450. Initial support at 1.4550/1.4580. The importance of resistance at 1.4710 is just growing.

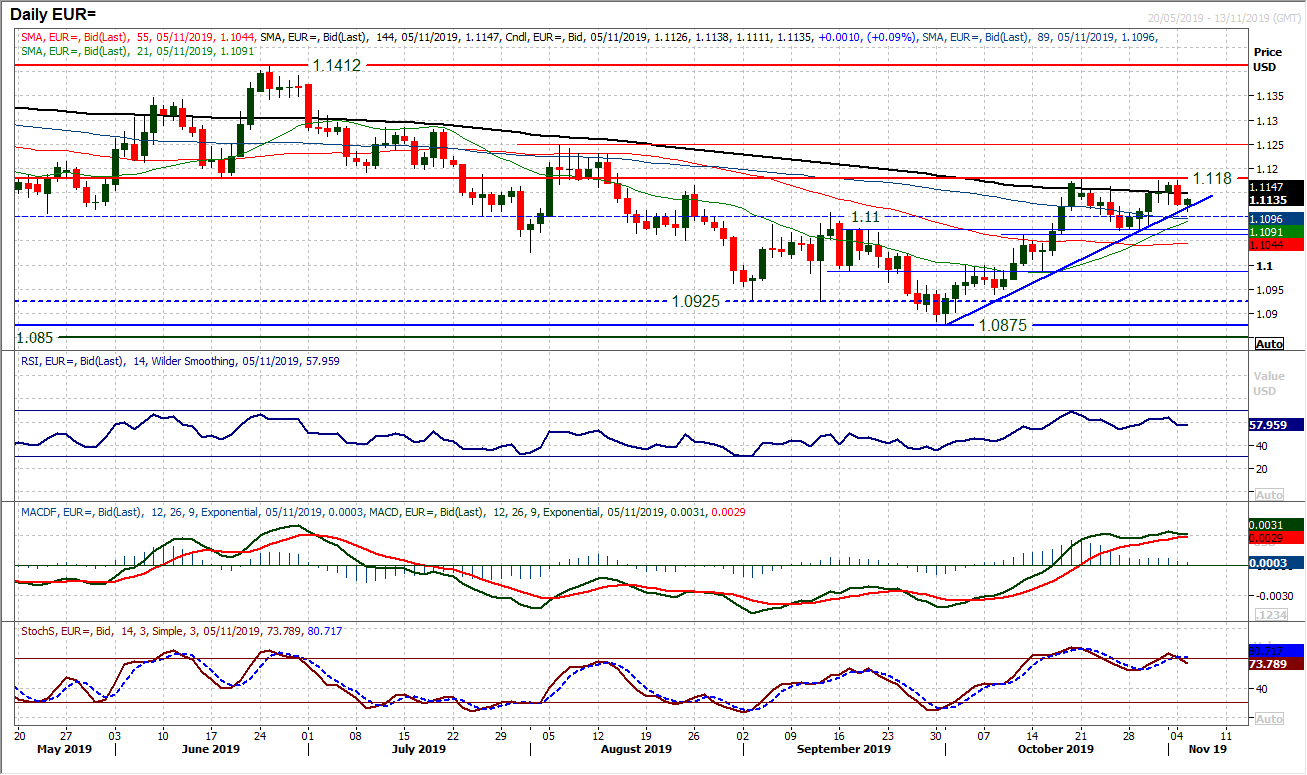

The euro is suddenly under pressure once more. After edging back higher over recent sessions, a decisive negative candle threatens the recovery uptrend again. Another failure to breakout above the October resistance at $1.1180 is a concern as the emphasis turns back on the five week uptrend again. We have already had to slightly redraw the trend higher following intraday breaches a week ago, so already the integrity of the trend has been questioned. Another drop back under $1.1100 would now break the euro recovery trend. Momentum indicators are also now beginning to question too. The Stochastics and RSI are looking tentative, whilst the MACD lines have converged and could easily now bear cross. The rising 21 day moving average (a good trend gauge) needs watching at $1.1090 but the key support is the $1.1070 low. Hourly indicators look on the brink of turning corrective now. A failure on hourly RSI under 50/60 would be a worry. Initial support at $1.1110.

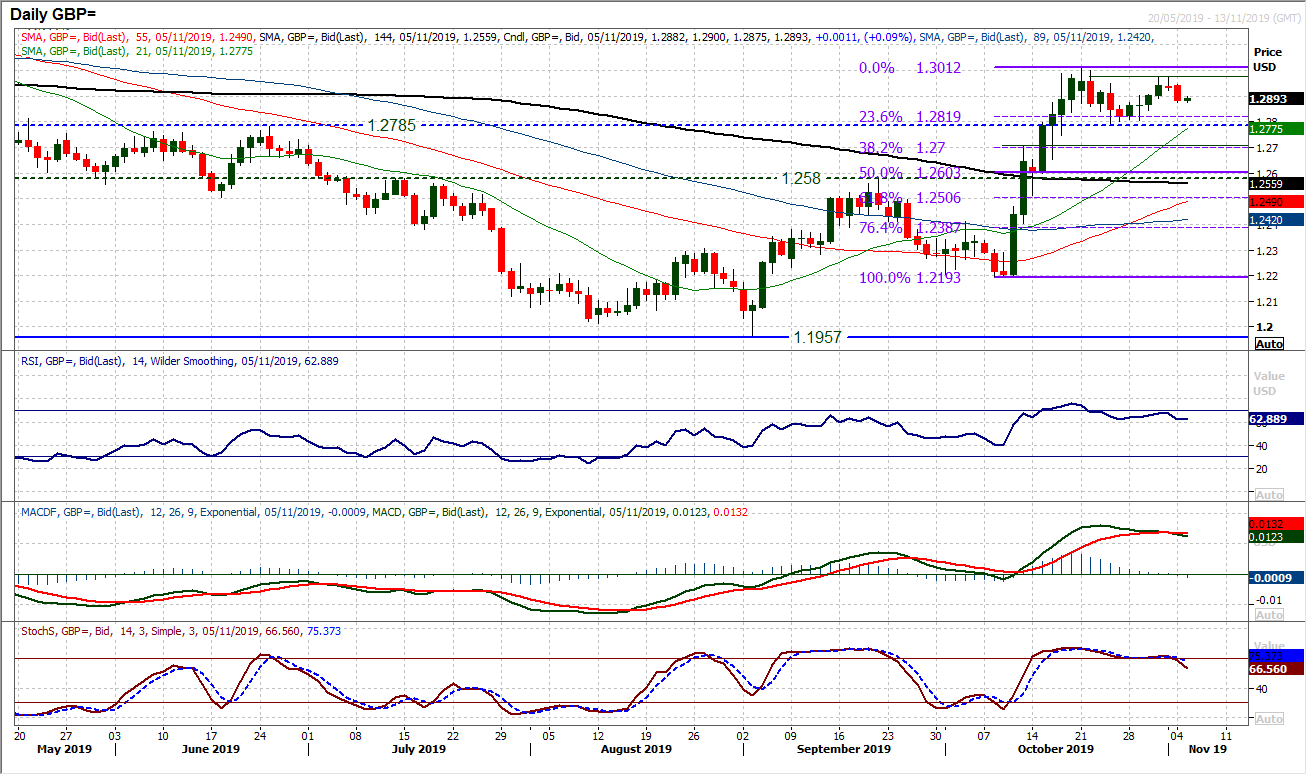

A solid negative candle has re-iterated what we now see as a likely trading range formation on Cable. The mild rally of last week has topped out at $1.2975 to bolster what is increasing resistance around the key $1.3000 area. This move back lower is now weighing on the near term outlook again. Momentum indicators are turning over, with the Stochastics threatening lower and MACD lines also having started to drift away. There is nothing overly bearish about these moves (yet) and we foresee this to be playing out as part of a drifting range consolidation between the $1.2785 support and $1.3010 high. The hourly chart reflects a slippage but more of a ranging momentum. Initial support at $1.2840 today, with resistance $1.2905/$1.2925.

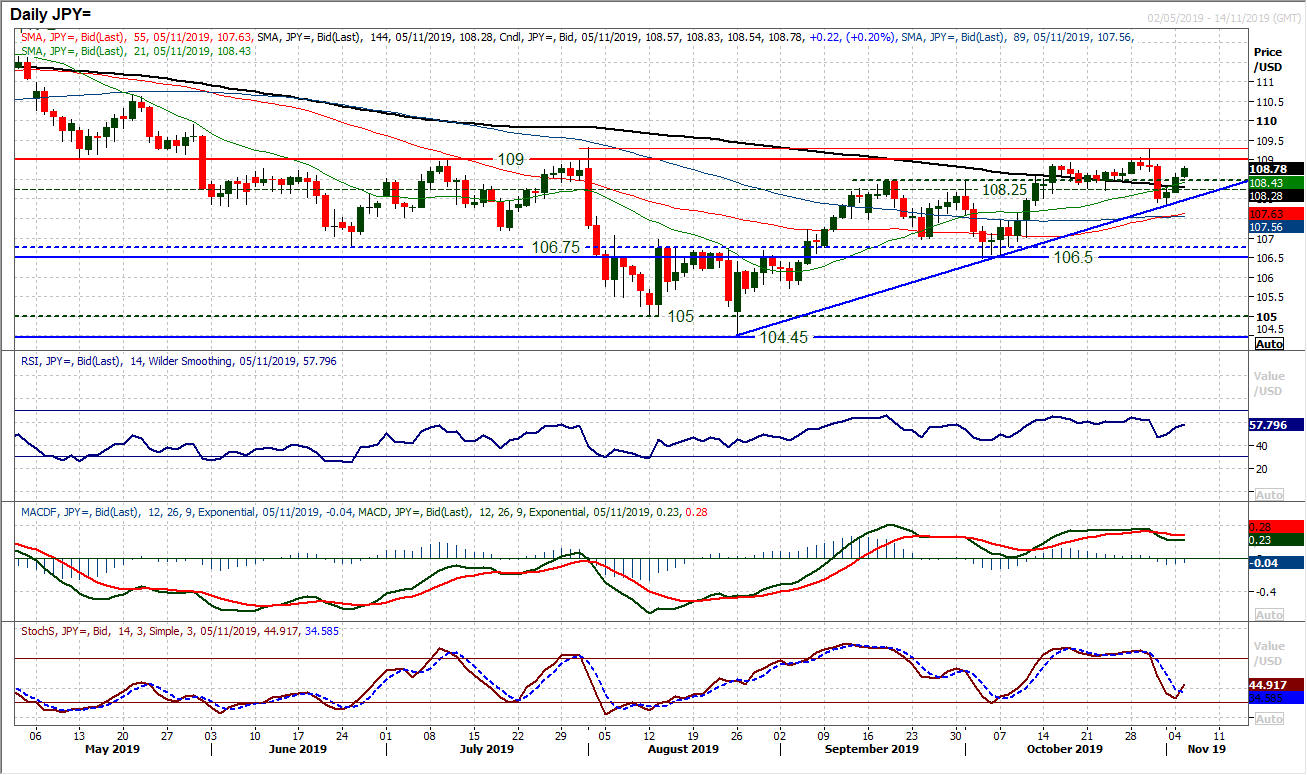

The dollar bulls look rattled after the FOMC decision last week, but have managed to pick themselves up and string together two positive sessions. The prospects of a third positive session today are also good. A reaction straight back up through near term resistance 108.25/108.50 on the hourly chart has taken the market back up into a more positive near term configuration. The bulls will be keen to retain this momentum for a test of the 109.00 key medium term resistance area. Given the recent failures at this resistance, it would be a significant achievement to breakout. However, daily momentum studies retain their ranging configuration and we feel it unlikely at this stage. The band 108.25/108.50 turns back supportive today.

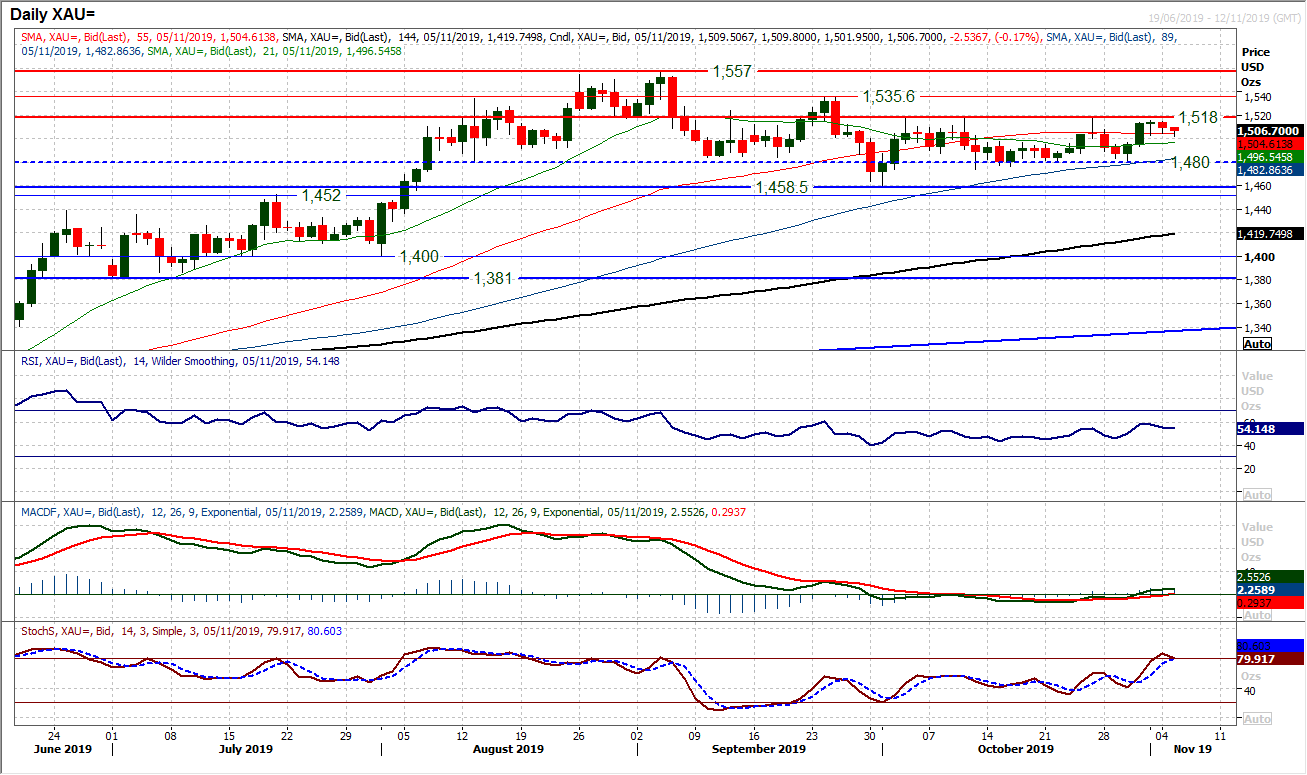

Gold

Another stalling candle under the $1518 resistance suggests the multi- week range between $1480/$1518 will continue. After Friday’s consolidation, a slight drift off yesterday has done little for either bulls or bears. This negative drift has continued into today’s session too. Essentially the market is still trading above the $1500 mid-range pivot, but also has once more failed to sustain the recent positive traction. The slight positive bias on momentum indicators is also now starting to wane. The RSI again failing under 60 reflects this, whilst Stochastics are faltering and MACD lines are a damp squib. It is difficult to see much of any conviction in trading gold right now and until we see a decisive breakout above $1518 (or below $1480) it will be difficult to trust signals. Below $1500 turns attention back on $1480.

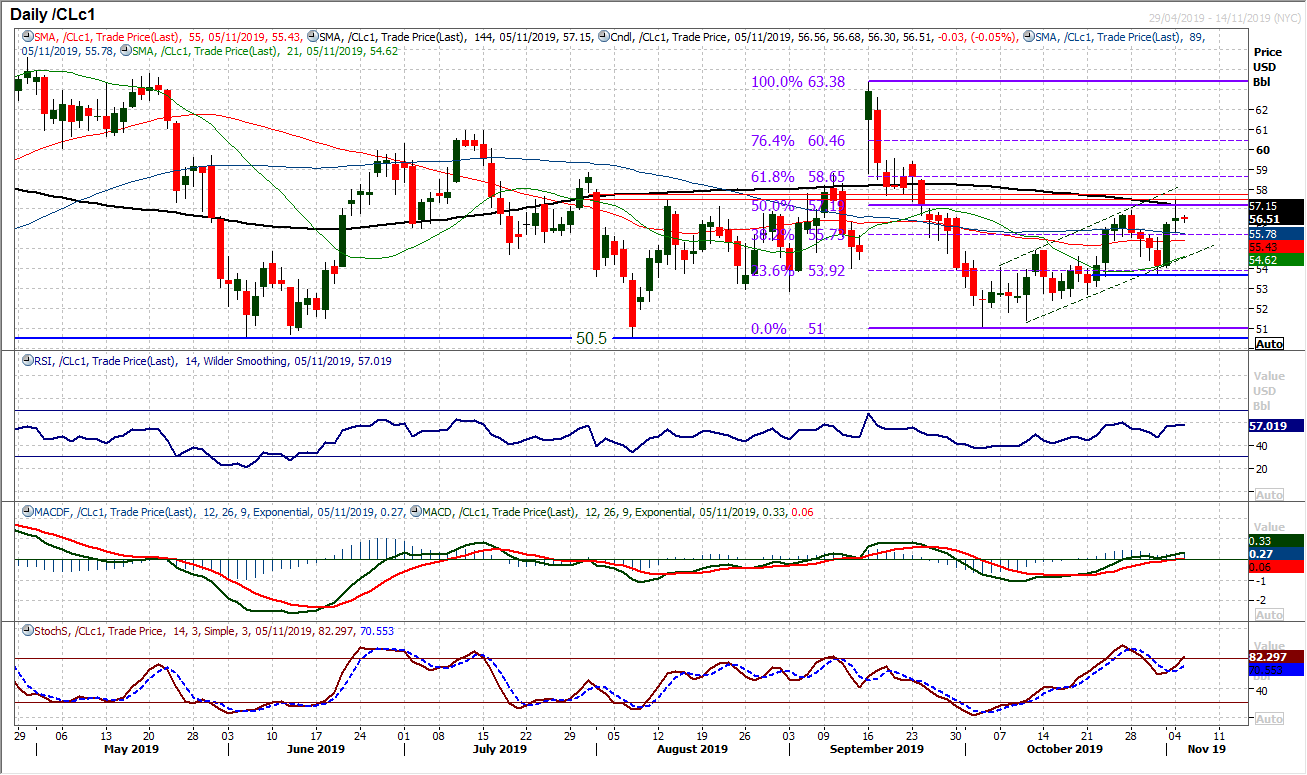

WTI Oil

A couple of positive sessions looked to be flipping the outlook of gold positive again, but traction is questionable. Given the run of higher lows, an uptrend channel is still a viable argument, but the recovery continues to splutter. There is a bullish bias with the momentum indicators, with the MACD lines above neutral and Stochastics turning higher again above 50. However, a breakout above $56.90 faltered into the close to form a rather questionable positive candle yesterday. The 50% Fibonacci retracement (of $63.40/$51.00) at $57.20 is also an overhead barrier. The bull trend channel of the past few weeks is certainly still in play and this means that buying into weakness is still a viable strategy. The only concern is that decisive traction in the recovery is repeatedly lost. Initial support now $55.60/$55.90.

Finally the Dow has joined the S&P 500 in all-time high territory. The impressively strong candle from Friday has been followed by a gap and close into all-time high above the old July peak of 27,399. Momentum is strong and is confirming the move, with RSI rising in the mid-60s to four month highs, but also having further upside potential. The immediate thought needs to be the gap which remains open at 27,347 meaning there is support 27,347/27,399 now. However, the configuration is strong to the extent that weakness will be seen as an opportunity for the bulls. Futures are suggesting additional gains at the open today. Yesterday’s high of 27,517 is initial resistance, but the shackles are now off and the bulls can set their sights higher now.

"""DISCLAIMER: This report does not constitute personal investment advice, nor does it take into account the individual financial circumstances or objectives of the clients who receive it. All information and research produced by Hantec Markets is intended to be general in nature; it does not constitute a recommendation or offer for the purchase or sale of any financial instrument, nor should it be construed as such.

All of the views or suggestions within this report are those solely and exclusively of the author, and accurately reflect his personal views about any and all of the subject instruments and are presented to the best of the author’s knowledge. Any person relying on this report to undertake trading does so entirely at his/her own risk and Hantec Markets does not accept any liability. """