It was a brutal week for equities with the Dow Jones Industrial Average falling more than 3% and the S&P 500 slipping 4%. This is the fourth out of five weeks that the S&P 500 has fallen.

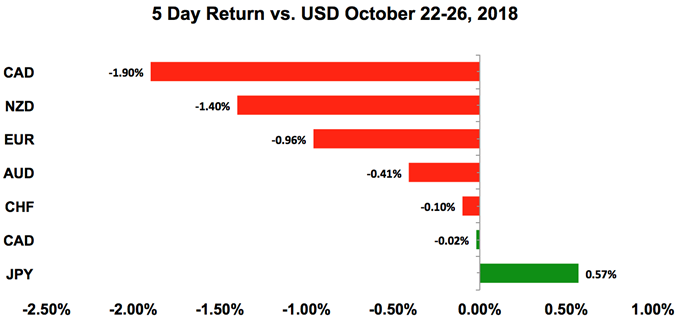

Typically when we see such sharp declines in equities and increase in day-to-day volatility, currencies are punished broadly. However some but not all of the major currencies experienced losses over the past week – sterling and the New Zealand dollar fell sharply but the Canadian dollar and Swiss franc were unchanged while the Japanese yen appreciated against all of the major currencies. The US dollar is still one of the strongest currencies but the outperformance of the yen tells us that risk aversion was the main driver of currency flows. Unfortunately, that’s not going to change in the coming week as nervousness turns into fear. Stock markets around the world are moving into bear territory and the possibility of further losses encourages investors to shift to cash. We have a busy week ahead with the US Nonfarm payrolls report, Bank of England and Bank of Japan monetary policy decisions on the calendar but at the end of the day, traders should brace for more losses as risk appetite in a bear market doesn’t usually turn quickly.

US Dollar

Data Review

- House Price Index 0.3% vs 0.3% Expected

- Manufacturing PMI 55.9 vs 55.3 Expected

- Services PMI 54.7 vs 54.0 Expected

- Composite PMI 54.8 vs 53.9 Prior

- New Home Sales -5.5% vs -0.6% Expected

- Advance Goods Trade Balance -$76.0b vs -$75.1b Expected

- Wholesale Inventories 0.3% vs 0.5% Expected

- Retail Inventories 0.1% vs 0.6% Prior

- Durable Goods Orders 0.8% vs -1.5% Expected

- Durables Ex Transportation 0.1% vs 0.4% Expected

- Pending Home Sales 0.5% vs 0.0% Expected

- GDP Annualized 3.5% vs 3.3% Expected

- Personal Consumption 4.0% vs 3.5% Expected

- Core PCE 1.6% vs 1.8% Expected

- U. of Mich. Sentiment 98.6 vs 99 Expected

- U. of Mich. Current Conditions 113.1 vs 114.4 Prior

- U. of Mich. Expectations 89.3 vs 89.1 Prior

Data Preview

- Personal Income, Personal Spending and PCE Deflator - Potential for downside surprise given weaker retail sales

- Consumer Confidence - Potential for downside surprise given weakness in retail sales, stocks. Umich survey also point to softer confidence

- ADP Employment Change - ADP is difficult to predict but can be very market moving

- Chicago PMI - Potential for upside surprise given stronger Empire and only slightly weaker Philly Fed manufacturing index

- ISM Manufacturing - Will have to see how Chicago PMI fares but empire strong and Philly weak

- Trade Balance and Labor Report - Job growth is expected to rebound after weak numbers in October but wage growth could slow

- BoJ Rate Decision - No changes expected from BoJ but rate decisions are always worth watching

Key Levels

- Support 111.00

- Resistance 113.00

For the time being, there is very little reason to expect the US dollar’s trend to change. Over the past few months, 3 distinct factors drove the dollar higher – US rate hikes, trade wars and economic outperformance and there have been no meaningful changes to these drivers over the past week. The Fed is still committed to raising interest rates, President Trump is focused on protectionist policies and the latest economic reports showed GDP growth slowing less than expected in the third quarter. There have been signs of weakness in the housing market and trade activity but according to the PMIs, manufacturing- and service-sector activity continued to improve. Now there are pockets of weakness that have become more concerning such as earnings and the Beige Book but even with the recent decline in stocks, we think the Fed will proceed with raising interest rates in December. More importantly, risk aversion has become the fourth contributor to the dollar’s rally and with sentiment turning sour and earnings disappointing, the sell-off in stocks could deepen, driving investors into the safety of US dollars. While we see the dollar extending its rise against euro, sterling, aussie and kiwi, risk aversion should keep USD/JPY under pressure.

What Could Halt The Dollar’s Rise?

The question now is: what could stem the slide in stocks and put a halt to the dollar’s rally? We see two factors that could reverse market sentiment easily. The first would be a change in the Federal Reserve’s guidance. While we anticipate a rate hike in December, the Fed may not want to be as aggressive next year, especially if stocks continue to fall. They’ve looked as stocks as overvalued for some time so chances are they view the current decline as a correction but if the slide deepens so could their concerns. This Friday’s Nonfarm payrolls report is the first test of US economic strength. Over the past month investors have overlooked mixed data but if we don’t see a significant recovery in job growth in October (only 134K jobs were created in September) along with steady wage growth, the dollar could give back its gains. The second factor that could turn the markets around is the upcoming US midterm elections. If the Democrats secure control of the House or Senate, the hope that President Trump will tone down his protectionist sentiment should lead to a relief rally in equities, high-beta and emerging-market currencies.

Euro

Data Review

- ECB keeps rates steady, Draghi downplays data deterioration

- GE PPI 0.5% vs 0.3% Expected

- EZ Consumer Confidence -2.7 vs -3.2 Expected

- GE Manufacturing 52.3 vs 53.4 Expected

- GE Services PMI 53.6 vs 55.5 Expected

- GE Composite PMI 52.7 vs 54.8 Expected

- EZ Manufacturing PMI 52.1 vs 53 Expected

- EZ Services PMI 53.3 vs 54.5 Expected

- EZ Composite PMI 52.7 vs 53.9 Expected

- GE IFO Business Climate 102.8 vs 1013.1 Expected

- GE IFO Expectations 99.8 vs 100.4 Expected

- GE IFO Current Assessment 105.9 vs 106 Expected

- GE GfK Consumer Confidence 10.6 vs 10.5 Expected

Data Preview

- GE Unemployment Change and Unemployment Claims - Potential for downside surprise given strong but slightly weaker labour market activity

- EZ GDP - Most important release is Q3 GDP and based on EZ retail sales & trade, data should be weaker

- GE CPI - Potential for upside surprise given a sharp rise in PPI. Lower euro should also boost inflation

- EZ Unemployment Rate and CPI Core - Will have to see how German data fares

- GE and EZ PMI Manufacturing - Revisions can be market moving but difficult to predict

Key Levels

- Support 1.1300

- Resistance 1.1600

Euro Shrugs Off ECB Optimism

The European Central Bank may not be fazed by the recent deterioration in Eurozone data but that did not stop the euro from falling to a 2-month low versus the US dollar. After leaving interest rates unchanged this past week and reinforcing their plans to end asset purchases this year, ECB President Draghi downplayed the latest declines in PMI, IFO and ZEW by describing the loss of economic momentum as a return to normal conditions after an exceptional 2017. He said, “we’re talking about weaker momentum, not a downturn.” “Is this enough of a change to make us change the baseline scenario? The answer is ‘No’.” He was also positive on inflation, saying they found the trend in wage growth comforting. While these comments were certainly less dovish than the market anticipated, investors may find it difficult to buy into his positive outlook until data or market sentiment improves. And if it doesn’t, the deterioration in the economy or acceleration in the decline in asset values could force the ECB to revise down its forecasts and Draghi to reconsider his optimism. In the meantime Eurozone inflation numbers are scheduled for release next week – the weaker currency may have driven price pressures higher but the impact of this data could be limited by the market’s focus on risk appetite and the US Nonfarm payrolls report. There could also be some fallout from S&P’s decision to leave Italy’s credit rating unchanged but cut their outlook to negative. Technically, EUR/USD appears to have found support near 1.14 but the downtrend remains intact as long as its trading below 1.16.

British Pound

Data Review

- CBI Total Trends -6 vs 2 Expected

- CBI Selling Prices 10 vs 15 Expected

- CBI Business Optimism -16 vs -4 Expected

Data Preview

- PMI Manufacturing - Potential for downside surprise given a sharp drop in CBI index

- BoE Rate Decision - No changes expected to be made to BoE but possible dovish tilt to Quarterly Report

Key Levels

- Support 1.2700

- Resistance 1.3000

Beware Of Potential Cautiousness From Bank Of England

Sterling was hit hard over the past week and unfortunately, it could see further losses in the coming week. With the clock ticking, concerns about a no deal Brexit is growing. Prime Minister May has now set a November date for the government to start preparing for a no deal Brexit. While these are just precautionary preparations, the fact that these activities need to be triggered highlights the risk of the UK crashing out of the EU with no agreement. Although we remain hopeful that a deal will be reached before March until that happens, GBP will have a difficult time rallying particularly this week with a Bank of England monetary policy announcement and Quarterly Inflation Report on the calendar. Everyone knows that the BoE is in no position to change interest rates but in an environment where investors are looking for any excuse to sell the currency, dovish comments about inflation or growth could send GBP/USD below 1.28. When the BoE last met in September, they expressed optimism on wages and the labor market but said inflation could ease next year because of an energy price cap. Their tone this month could be even more cautious because of the meltdown in global equities and the growing possibility of a no-deal Brexit. If the UK fails to secure an agreement with the European Union, the BoE will want to keep policy accommodative because the longer period of uncertainty will take a bigger toll on the economy. We have already seen a weakness with the following table showing deterioration in retail sales, inflation, manufacturing- and service-sector activity. The market is not pricing in a rate hike for 2018 or 2019 and we expect the Bank of England to confirm this view. If the Quarterly Inflation Report shows lower growth or lower inflation estimates, sterling could fall quickly and aggressively. If they leave their forecasts unchanged but their outlook is more cautious, we should still see a decline in GBP, albeit a more modest one. In the unlikely scenario that they emphasize the need for gradual tightening, GBP will rally.

AUD, NZD, CAD

Data Review

Australia

- No Data

New Zealand

- Trade Balance -1560m vs -1365m Expected

Canada

- BoC Raises Rates by 25bp to 1.75% with hawkish bias

- Wholesale Trade Sales -0.1% vs -0.2% Expected

Data Preview

Australia

- AU CPI - Potential for upside surprise given stronger consumer inflation expectations & Melbourne inflation gauge

- CH Non-Manufacturing, Manufacturing and Composite PMI - Chinese data Is hard to predict but can be market moving

- AU PMI Manufacturing and Trade Balance - Potential for downside surprise given slower Chinese growth

- PPI and Retail Sales - Will have to see how CPI fares but retail sales should be weaker given softer spending in July & Aug

New Zealand

- No Data

Canada

- GDP - Stronger trade balance offset by weaker retail sales

- International Merchandise Trade and Employment Report - Potential for downside surprise given a sharp drop in the employment component of Sept IVEY

Key Levels

- Support AUD .7000 NZD .6400 CAD .1.3000

- Resistance AUD .7200 NZD .6550 CAD 1.3200

AUD Hit By USD And CNY Weakness

While the sell-off in stocks and rise in the US dollar prevented the commodity currencies from rallying, the Australian, New Zealand and Canadian dollars behaved in very different ways. With no local economic reports, the Australian dollar traded exclusively on the back of US dollar strength and Yuan weakness. AUD/USD fell to fresh 32 month lows before stabilizing toward the end of the week. The biggest story for AUD was the yuan, which fell to a 10-year low. The decline in the yuan has been persistent ever since the Trump Administration escalated the trade-war rhetoric between the two nations and the recent weakening will only exacerbate the situation as the Trump Administration will view the price action as an attempt to offset the costs caused by tariffs. Given the fact that US Goods Trade deficits widened for the fourth month in a row, the Trump Administration's policy on trade is clearly not working and last week’s move in the USD/CNY exchange rate will only make markets more nervous that further retaliation will follow. AUD/USD may have rallied but the downtrend remains firmly intact. Expect some big moves in A$ this coming week with CPI, PPI, retail sales, PMI manufacturing and trade balance reports scheduled for release.

The New Zealand dollar was hit hard at the start of the week and the selling gained momentum as equities jockeyed around and New Zealand’s trade deficit dropped to a record low. It's hard to explain exactly why NZD has been performing so poorly outside of the fact that it is a high beta currency that can be particularly sensitive to market volatility. There are no major New Zealand economic reports on the calendar this week so the currency is likely to take its cue from risk appetite and the market’s demand for US dollars. Like AUD/USD, it remains firmly in a downtrend until there’s a close above 67 cents.

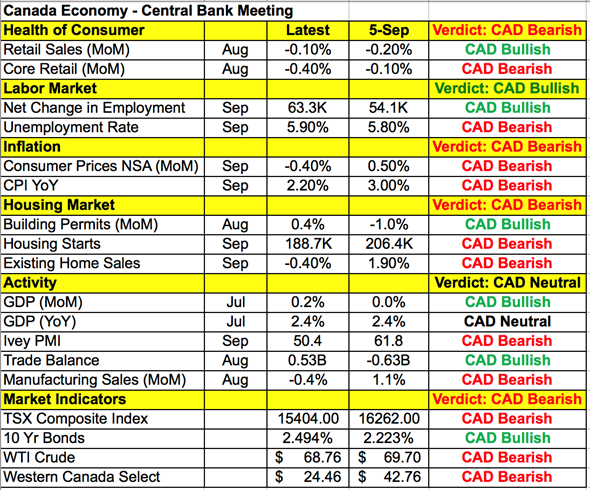

Bank Of Canada Hikes, Talks Of More To Come

The only currency (besides the yen) that should be legitimately resilient against the dollar is the Canadian dollar. The Bank of Canada raised interest rates by 25bp this past week and while the increase was in line with the expectations, their hawkishness was not. Recent data hasn’t been great and Western Canada Select oil prices are trading sharply lower than crude but instead of recognizing this weakness and toning down their optimism, the Bank of Canada dropped the word “gradual” from their comment on future hikes and upgraded its assessment of exports and investments. They want to bring rates back to neutral which means they are planning for another 75 to 100bp of tightening. However, when trends are strong and policymaker views are counter to data trends, the skepticism of investors prevents the currency from rallying. We saw that with the euro and also the loonie this past week. USD/CAD ended the week unchanged and while we think the loonie will outperform other currencies, equity weakness could limit its gains versus the dollar. The Canadian dollar will also be in focus next week with GDP, trade and labor market numbers scheduled for release. Positive data would reinforce the BoC optimism and give the CAD a better chance of a rally whereas softer data would reinforce the market’s skepticism and exacerbate the decline. As long as USDCAD holds above 1.30, its uptrend is intact.

Thanks to stronger service-sector activity and consumer-price growth, the New Zealand dollar was last week’s best-performing currency. CPI grew at its fastest pace since the first quarter of 2017 and year-over-year price growth accelerated to 1.9% from 1.5%. So while dairy prices continue to fall, the Reserve Bank’s concerns and in turn their dovishness will be eased by the increase in CPI. The service sector is doing better than the manufacturing sector but economists are looking for the trade balance to improve after hitting a record low in August. Technically, as long as NZD/USD is trading below 66 cents it remains in a downtrend but if it exceeds that level, a stronger recovery could be in the cards. Considering that there are not many New Zealand economic reports on the calendar this week, the outlook for NZD could hinge on the market’s appetite for risk and US dollars.

AUD/USD Still In A Downtrend Below 72 Cents

Both the Australian and New Zealand dollars benefitted from the US government’s decision to pass on branding China as a currency manipulator. Like NZD, the downtrend in the Australian dollar remains intact until AUD/USD rises above 72 cents. Data from Australia was mixed. Only 5600 jobs were created in September (against expectations for 15K jobs) and the participation rate declined but full-time job growth was strong. Full-time jobs rose by 21K while the unemployment rate dipped to 5.0%. Over the past year, trend employment increased by over 290,000 persons or 2.4 percent, which was above the average year-on-year growth over the past 20 years (2.0 percent). The labor data suggests that growth Down Under remains surprisingly resilient despite risk off and trade-war woes. However Australian businesses are getting worried because business confidence fell to its lowest level in two years. These concerns are justified with the Chinese economy growing at its slowest pace since 2009 according to the latest GDP report. There are no major Australian economic reports scheduled for release this week but the RBA’s Deputy and Assistant Governors will be speaking. They are likely to echo the RBA minutes, which said there’s no strong case for near-term policy adjustment. While the weaker Australian dollar is helping the currency, they are worried about consumption uncertainty.