This article was written exclusively for Investing.com

- HSY shares have rallied in 2022 while the S&P 500 is lower

- Cocoa prices decline in 2022

- Consumer staples outperform the stock market

- Impressive earnings plus dividend brush off the bear

Spain was the first European country to incorporate chocolate into its cuisine, after explorers from the country brought the cocoa bean back from the new world in the 1400s and 1500s where the Maya, Toltec, and Aztec people used it to prepare a chocolate beverage which they considered to be food of the gods. Today, chocolate remains an epicurean treat in a variety of forms that range from bitter to sweet.

The Hershey Company (NYSE:HSY) has been in business since 1894 and is synonymous with chocolate in the United States; The company's headquarters remain in the eponymously named Hershey, Pennsylvania.

Unlike much of the rest of the stock market during the ongoing currency correction, HSY shares have not declined. Indeed, demand for its chocolate confectionery products continues to be robust.

Hershey shares rallied in 2022 while the S&P is lower

Hershey shares closed 2021 at the $193.47 level.

Source: Barchart

The chart illustrates the move to a new record high of $231.59 in April 2022. Closing at the $209.25 level on May 23, HSY has corrected from the high but remains 8.16% higher so far in 2022.

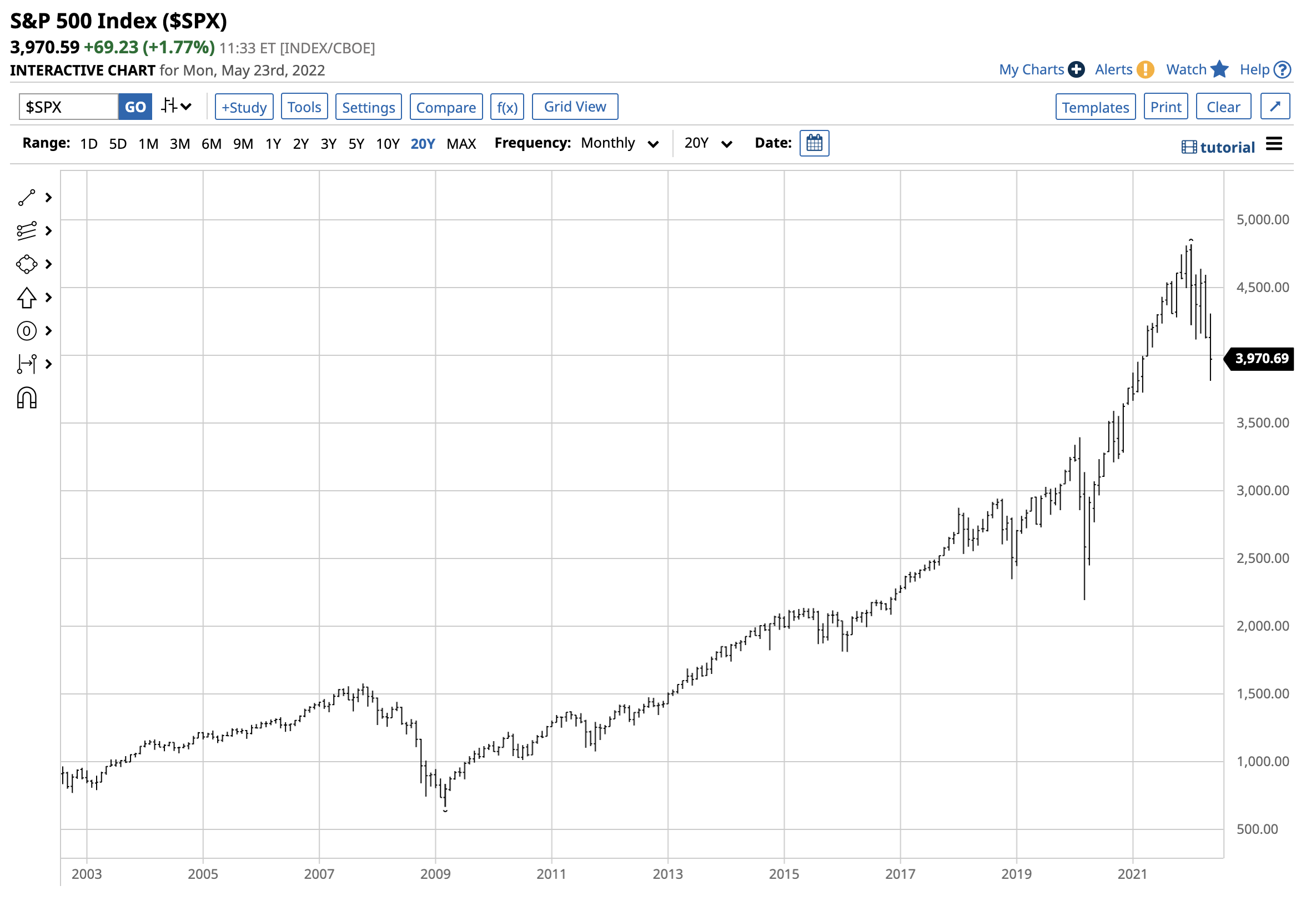

Conversely, the S&P 500, which is the US's most diversified equity index and reflects the overall stock market, has declined over the same period.

Source: Barchart

The chart above shows the broad benchmark closed 2021 at the 4,766.18 level. Finishing at 3,973.75 on May 23, the S&P 500 was 16.62% lower in 2022.

HSY has outperformed the stock market thus far in 2022, making it a safe and potentially defensive stock for portfolios given the current volatile environment.

Cocoa prices decline in 2022

Cocoa beans are the primary ingredient in chocolate confectionery products. As a leader in chocolate manufacturing, for Hershey's, cocoa is a primary ingredient in many of the company's products, and the price impacts its cost of goods sold. While many commodity prices have soared in 2022, cocoa has moved lower since the end of last year.

Source: Barchart

The chart of nearby ICE cocoa futures highlights the decline from $2,563 on Dec. 31, 2021, to close at $2,448.50 per ton on May 23, a 4.8% drop.

Lower cocoa prices have not put upside pressure on HSY’s costs, while inflationary pressures have increased other production expenses over the past year.

Consumer staples outperform the stock market

While the S&P 500 has declined by nearly 17% in 2022, consumer staples have done better.

Source: Barchart

The chart above, of the S&P 500 Consumer Staples Select Sector SPDR® Fund (NYSE:XLP), highlights the sector decline from $77.11 on Dec. 31, 2021, to $72.16 on May 23. The 6.42% drop outperformed the S&P 500 but underperformed HSY over the period.

XLP held a 1.63% exposure to Hershey shares as of May 23.

Impressive earnings plus dividend brush off the bear

HSY has exceeded consensus EPS forecasts over the past four consecutive quarters.

Source: Yahoo Finance

The chart shows that in Q1 2022, HSY reported earnings of $2.53 per share, higher than the $2.10 estimates. The market expects the company to earn $1.68 in Q2.

Source: Yahoo Finance

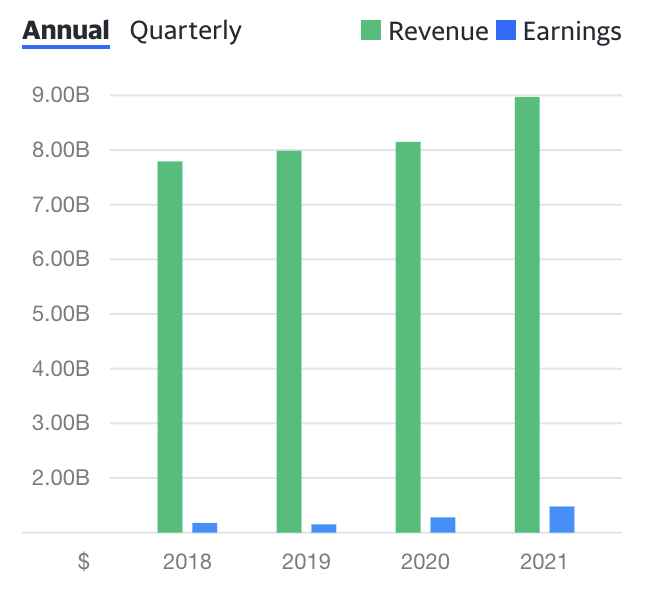

The trend in revenue and earnings supports Hershey shares.

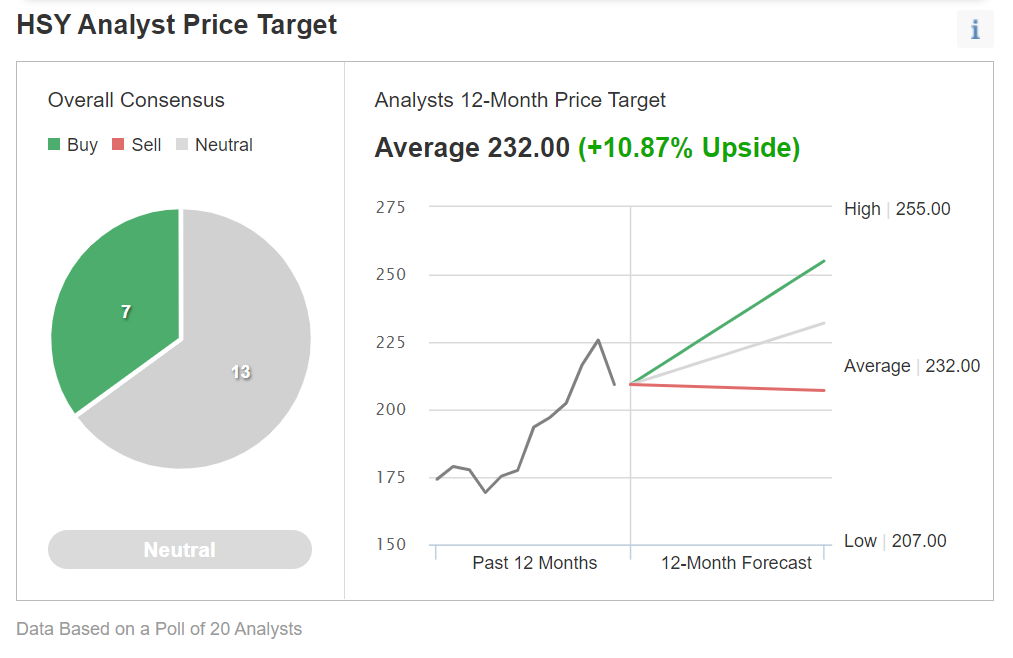

Among 20 analysts surveyed by Investing.com, the average 12-month price target on the stock is $232, with estimates ranging from $207 to $255.

Source: Investing.com

At the $209.25 level, HSY is just above the bottom end of the range, in the buy zone.

Hershey's also pays shareholders a $3.60 annual dividend, translating to a 1.74% yield.

Clearly, chocolate is a recession-proof indulgence, and HSY is a leading producer of the treat. At this level, I'm a buyer of Hershey shares. Plus, I'll leave room to add to my holdings on any further price weakness.