Severfield (LON:SFR) has maintained a steady and robust course in FY22 trading to date and management confidence in the outlook is backed by further order book growth, to record levels. This trading performance has not been reflected in the company’s recent share price movement, which is surprising as the order book has traditionally been a reliable indicator for near-term profitability.

H1 edges ahead year-on-year

Severfield’s H121 revenues were up 5% with reported EBIT ahead by c 7%. We believe these increases were primarily attributable to DAM Structures (acquired in February 2021) as contract costs are substantially fixed and – bar transport surcharges – the influence of cost inflation is unlikely to have been material for this period. In line with previously disclosed order book splits, the active project mix has been spread across commercial, distribution, energy and transport among other sectors. Furthermore, the UK/Ireland order book has continued to rise, standing at a record £393m (at 1 November). The Indian JV returned to profitability in H1, driven by a recovery in activity from FY21 levels and managed to sustain its £140m order book. With an improved contribution from JV/associates also, PBT rose by 23% y-o-y. H1 DPS was increased by 9%. Activity levels in Q2 and moving into a particularly busy H2 resulted in a project working capital outflow, which explained the move to a c £7m core net debt position (pre IFRS 16) at the period end.

On course for full year

Management’s expectations for a strong H2 and full year trading remain unchanged. A record and balanced UK/Ireland order book – including significant new stadia and transport subsector wins – provides excellent visibility going into FY23. For FY22, we have made minor changes to our estimates by trimming EBIT, which is balanced out by an increased Indian JV profit contribution giving no net change and no other material adjustments in any of our forecast years.

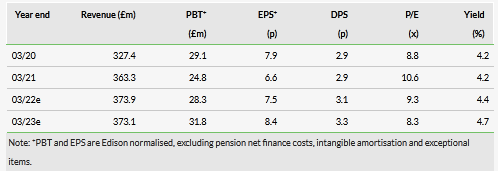

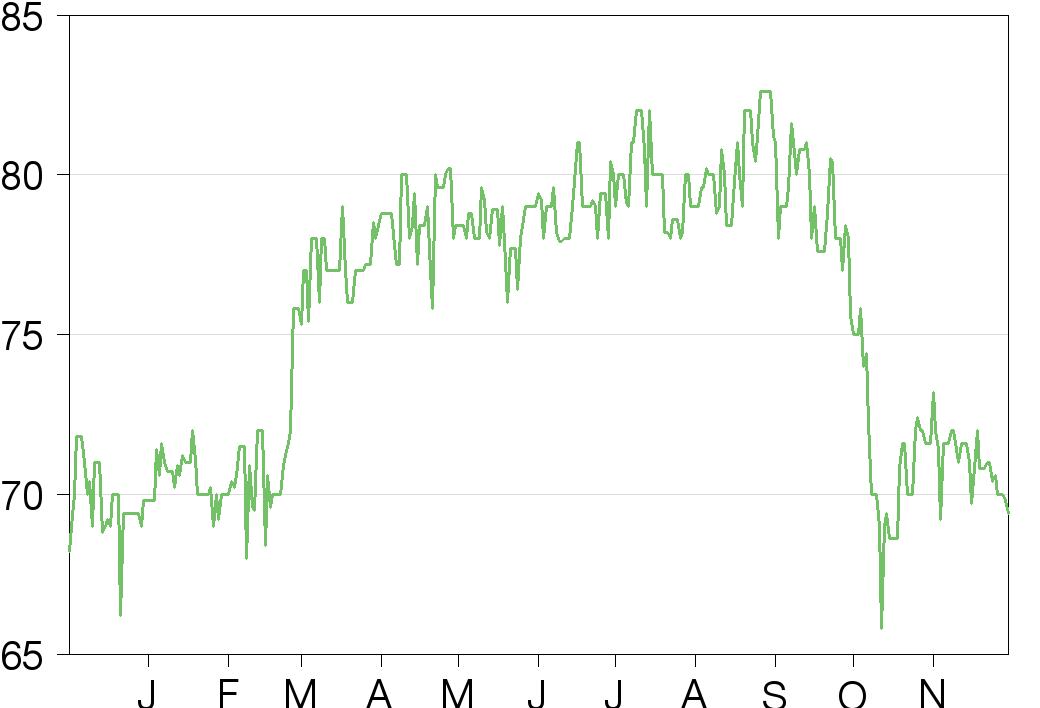

Valuation: Order book outperforms share price

Severfield’s share price has underperformed the FTSE All-Share since the end of August and retraced to the level at the start of 2021. In contrast, the UK/Ireland order book is 30% higher than when FY21 results were reported in June and sits at record levels. We find the share price move counterintuitive as there is excellent visibility and a more even spread of subsector exposures. On our estimates, Severfield’s FY22e P/E and EV/EBITDA multiples are 9.3x and 6.3x respectively – plus a prospective 4.4% dividend yield – and 8.3x and 5.8x for FY23e.

Share price performance

Business description

Severfield is a leading UK structural steelwork fabricator operating across a broad range of market sectors. An Indian facility undertakes structural steelwork projects for the local market and was expanded in FY20

Click on the PDF below to read the full report: