- Micron offered bleak view of semiconductor industry in late June

- But two major global players provided upbeat results in early July

- More chipmakers report quarterly profit numbers this week

Amid a season of negative guidance numbers and concerning tech outlooks, two standouts thus far are Samsung Electronics (KS:005930) and Taiwan Semiconductor (NYSE:TSM).

Earlier this month, Samsung’s share price rose more than 3% on ‘better than feared’ earnings and guidance. The chip rally did not stop there. On July 14, the world’s biggest chipmaker—TSM—reported record profits in its second quarter report. Still, the firm said its capital expenditures would be delayed into 2023, according to CNBC. While there are impressive signs of life for the cyclically-oriented tech industry, caution remains.

Were those two global semiconductor companies a bellwether for upcoming tech earnings? Or will more stocks succumb to major selling pressure as we saw in Snap (NYSE:SNAP) last Thursday evening? We will get more clues on the state of the industry when major firms report this week: Texas Instruments (NASDAQ:TXN) results are Tuesday after the close, followed by Qualcomm (NASDAQ:QCOM) on Wednesday after the close, then Intel (NASDAQ:INTC) on Thursday after the close, according to Wall Street Horizon. August features numbers from Advanced Micro Devices (NASDAQ:AMD), NVIDIA (NASDAQ:NVDA), and Broadcom (NASDAQ:AVGO).

Earnings and Events Calendar

Source: Wall Street Horizon

The global chip saga continues. A severe shortage rocked many areas from automakers to computers to home appliances. Now, as the bullwhip effect suggests, some industries report having too many chips. Late last month, industry heavyweight Micron Technology (NASDAQ:MU) said it would cut production as demand may turn south soon.

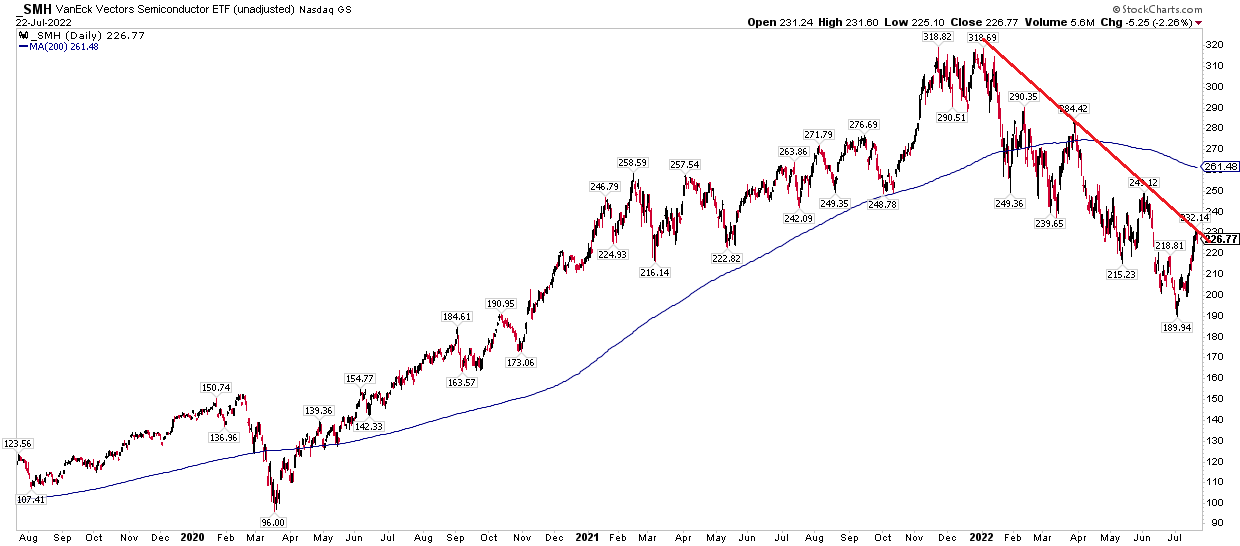

The popular way to play the space is through the VanEck Semiconductor ETF (NASDAQ:SMH). The fund holds 25 of the world’s largest semiconductor stocks, with Taiwan Semi and NVIDIA making up nearly 20% of the portfolio. SMH is a mega-cap ETF with a weighted average market cap of $152 billion, according to VanEck. It’s also relatively volatile with a 3-year beta of 1.09 vs. the S&P 500.

There are a handful of ETFs I review when trying to get a sense of where the broad market is headed. Transports (IYT), regional banks (KRE), homebuilders (XHB), and semis are the four horsemen in my technical eye.

All these charts have significant repair work to do in order to establish new uptrends. With SMH, there’s been an impressive bounce off the June low, but it is simply back at trendline resistance. Its 200-day moving average is also negatively sloped, indicating an established downtrend.

SMH ETF 3-Year Chart: Downtrend in Place with Falling 200 DMA

Source: Stockcharts.com

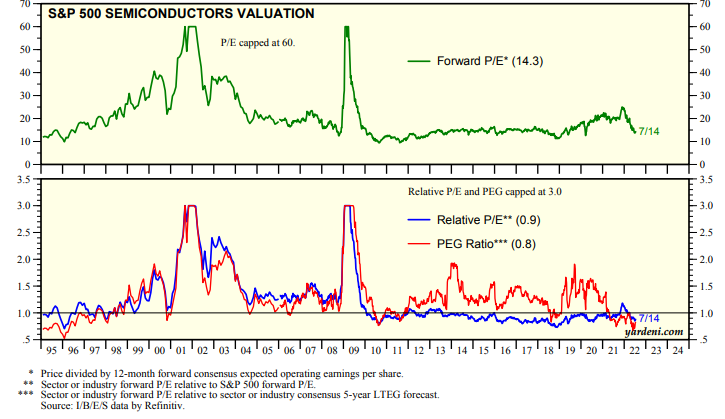

The valuation picture is actually quite compelling here, though. According to Yardeni Research, the S&P 500 Semiconductor index trades at just a 14.3 earnings multiple as of July 14 (the group is up about 10% since then). Moreover, when compared to expected EPS growth, its PEG ratio is near 25-year lows.

S&P 500 Semiconductor Index Valuation

Source: Yardeni Research

The Bottom Line

Semiconductor stocks will be critical to watch this earnings season after mixed results from Micron (bearish) and Taiwan Semi and Samsung (bullish). While the group trades at a reasonable valuation, the earnings are still unknown given the uncertain economic landscape. The technical chart, for now, suggests the current snapback is a bear market bounce.

Disclaimer: Mike Zaccardi does not own positions in any of the securities mentioned in this article.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI