The US government plans to ban the import and sale of cars with certain Chinese or Russian IT technology. Systems for autonomous driving and digital communication systems are particularly affected, as they are seen as a security risk. The Biden administration sees the technology used as a potential threat to national security, as malicious actors could use these systems to access sensitive data or remotely manipulate cars.

US Commerce Secretary Gina Raimondo emphasised that modern vehicles are increasingly equipped with cameras, microphones and GPS, which she said endangers the privacy of US citizens. National Security Advisor Jake Sullivan explained that the measure is intended to protect critical infrastructure and the auto industry from potential risks posed by connected vehicles from certain countries.

While no specific incidents are known to date, this is a preventive measure. Manufacturers that are particularly affected could use Chinese or Russian technology in their cars. German carmakers may also have to check whether their vehicles contain such components, since the regulation applies not only to cars but also to individual parts.

The interesting thing about this move is the reasoning behind it. The US is avoiding a wave of lawsuits from the affected manufacturers by claiming that national security is at stake. This is a nice disguise for sealing off the market and protecting its own industry.

What impact will this have on Chinese carmakers?

We cannot yet estimate the long-term effects, but for example for Nio or BYD, this push comes at the wrong time. Nio is already listed on the stock exchange in the US, plans further expansions, and BYD is in the midst of strong expansion plans. Europe in particular, but also the US, are very important markets for BYD.

Xiaomi's situation could be different for the time being. The smartphone manufacturer only presented its electric vehicle this year in March. However, it is currently only available in China. Xiaomi's smartphones also only have a small market share in the US. Xiaomi apparently only needs its domestic market to grow strongly.

Should we steer clear of Chinese stocks now, or are there enormous opportunities for us as investors there?

All three stocks mentioned are currently still in a stable uptrend, which we do not see broken by this US advance. Nevertheless, in our view, Nio and BYD are more at risk than Xiaomi.

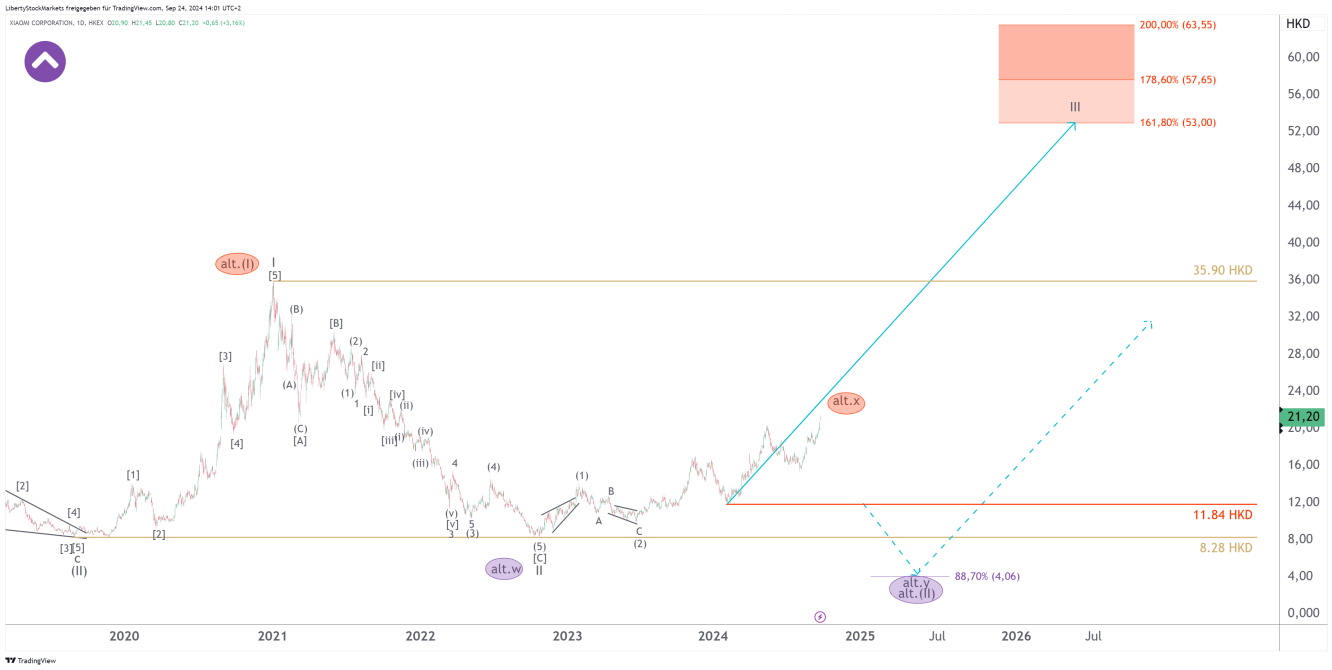

The Xiaomi stock is currently in the process of expanding a very bullish formation that clearly points upwards in the long term.

In the short term, we expect a stronger setback, which is a good opportunity to buy. We will probably use the coming bottom to buy this stock. Detailed information on the short-term price trend can be found on our website (link is below this article).

Nio could now finally break free and move sustainably higher. The structure at least points to a very strong upward trend. At BYD, as at Xiaomi, we are facing an even stronger setback.

We consider all three stocks to be very worthwhile investments in the medium to long term. However, we should not ignore the ‘China risk’. This risk is lowest for Nio, as the company is listed on the US stock exchange NYSE and can be traded there without risk.

We should not ignore the Chinese market. The Hang Seng Index is in the process of developing a bottom on which massive increases can be expected. We are planning purchases for our portfolio. However, with a lower weighting, as we take the China risk very seriously.

You can find out how things are going to develop in detail with BYD, Nio and Xiaomi on our website by clicking on the link above next to my profile picture. We offer analyses and trading signals for over 80 stocks, ETFs/indices and commodities.

Disclaimer/Risk warning:

The information provided here is for informational purposes only and does not constitute a recommendation to buy or sell. It should not be understood as an explicit or implicit assurance of a particular price development of the financial instruments mentioned or as a call to action. The purchase of securities involves risks that may lead to the total loss of the capital invested. The information provided does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either explicitly or implicitly, for the timeliness, accuracy, appropriateness or completeness of the information provided, nor for any financial losses. These are expressly not financial analyses, but journalistic texts. Readers who make investment decisions or carry out transactions based on the information provided here do so entirely at their own risk. The authors may hold securities of the companies/securities/shares discussed at the time of publication and therefore a conflict of interest may exist.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Security risk for the USA. Are BYD, Nio, Xiaomi & Co at risk?

Published 24/09/2024, 13:54

Security risk for the USA. Are BYD, Nio, Xiaomi & Co at risk?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.