Sareum's (LON:SAR) lead asset SDC-1801 is inching closer to completing its preclinical toxicology studies, although the decision to pursue a capsule alternative to the original suspension formulation, at the cost of a further delay in the clinical trial application (CTA) filing (now expected mid-2022), comes as a surprise. Management asserts that the new formulation adds value to the programme (removing the need to develop capsules at a later stage) and is supported by £4.6m of funds raised in calendar Q221/Q321. While we see merits in the strategy, continued delays may concern the market. Encouragingly, out-licensed asset, SRA737, seems to be gaining traction after Sierra Oncology’s decision to reassess it in combination with other targeted therapies. We expect that the next few months will be crucial for Sareum.

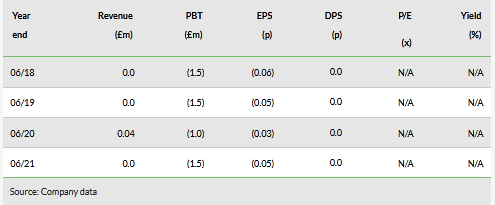

Historical financials

SDC-1801 to be developed in capsule formulation

SDC-1801, Sareum’s lead TYK2/JAK1 inhibitor, is on track to complete the final preclinical toxicology studies by the end of 2021 and the company has appointed external consultants to help develop the clinical plan and choose the optimal first indication for the clinical studies. A key development in SDC-1801’s clinical plans has been Sareum’s decision to develop its drug in a capsule form versus the original dry powder suspension. We believe these efforts towards optimising the formulation/administration could be a sensible step, although the repetitive delays in taking the asset to the clinic may concern investors.

Encouraging signals for SRA737

The recent in-licensing by Sierra of BET inhibitor AZD5153 from AstraZeneca (NASDAQ:AZN) and subsequent disclosure by Sierra that it may test the compound in combination with SRA737 in two Phase I trials (haematological malignancies and solid tumours) is a positive sign for Sareum, which owns a 27.5% economic interest in SRA737. Sierra will also be undertaking a third Phase I study assessing SRA737 along with immunotherapy/low-dose gemcitabine. First patient dosing in any one study will trigger a $2m milestone payment (thus $0.55m to Sareum).

Financing in place after equity raise

Equity raisings in calendar Q221/Q321 (totalling £4.6m) should allow Sareum to advance SDC-1801 to the clinic and complete preclinical studies on SDC-1802, as per the management. However, additional funds would be required (possibly through out-licensing deals or equity raises) to progress the programmes further.

Share price graph

Business description

Sareum is a UK-based drug development company, specialising in small molecule kinase inhibitors. Its lead programmes are its preclinical TYK2/JAK1 inhibitors, SDC-1801 for autoimmune diseases and SDC-1802 for cancer. SDC-1801 is undergoing advanced toxicology studies with a target to file a CTA in mid-2022. Other programmes include the CHK1 inhibitor SRA737, out licensed to Sierra Oncology (Sareum holds a 27.5% stake of the economics of the licence agreement) and the de-prioritised FLT3+Aurora kinase.

Bull

- SDC-1801’s novel TYK2 selectivity may be attractive to partners, pending clinical validation.

- First-in-class opportunity for SDC-1802 in multiple cancer indications.

- Possible COVID-19 opportunity with UK funding.

Bear

- Safety profile of combined TYK2/JAK1 inhibitor not certain or proved yet.

- Potential funding challenges delaying clinical progress of SDC-1801 and SDC-1802.

- Markets sought by SDC-1801 and SDC-1802 are highly competitive.

Click on the PDF below to read the full report: