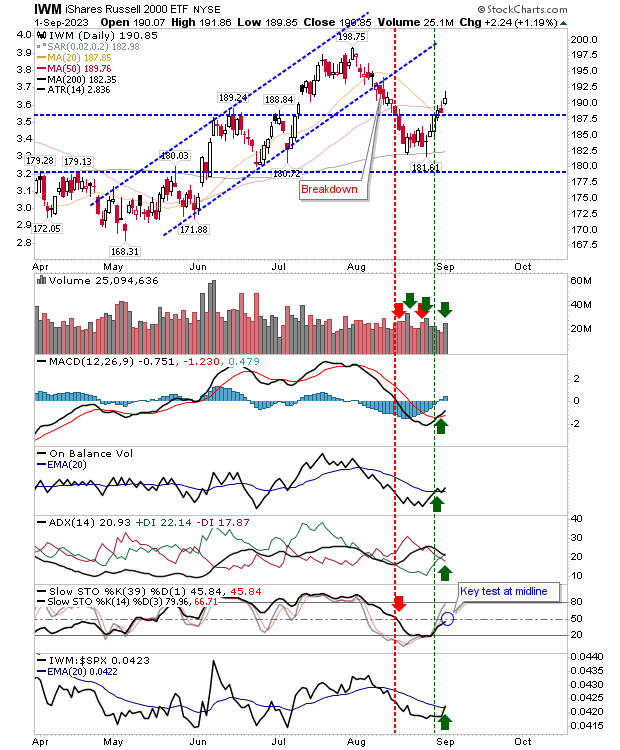

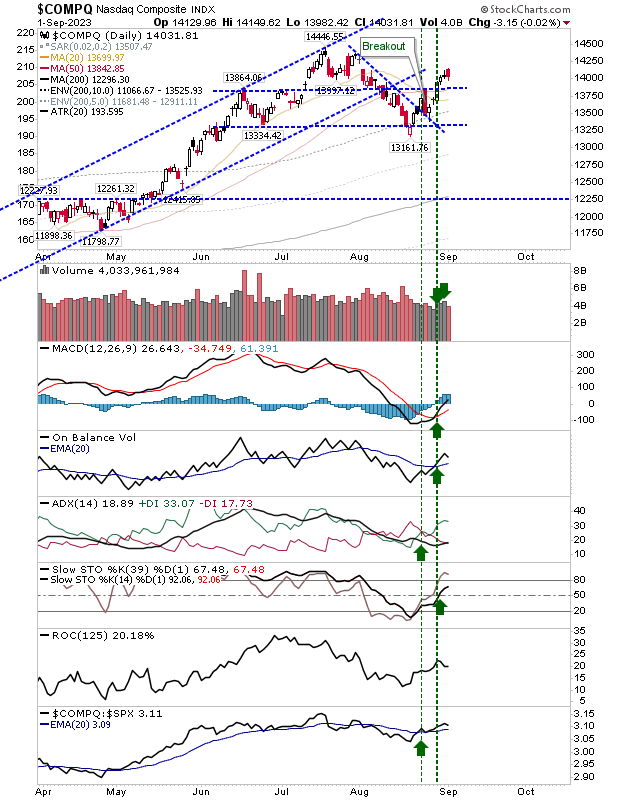

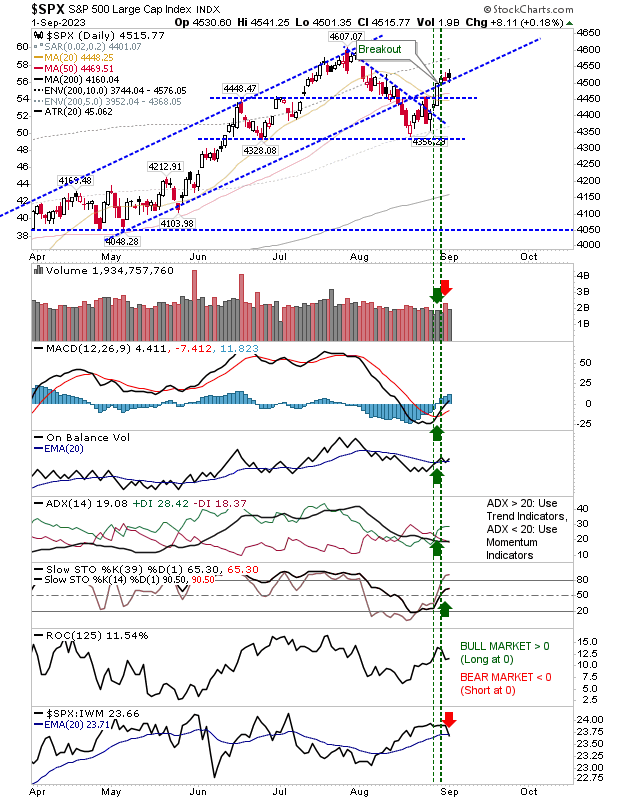

The Labor Day weekend will keep things on hold for another day, but the coming week is important for lead indexes. We have the Russell 2000 (IWM) at the cusp of a return to a net bullish state in its technical picture, matching the state for the Nasdaq and S&P 500 on the daily timeframe.

The only holdout is the stochatic [39,1], which hasn't yet crossed the midline. Friday's closing candlestick for the Russell 2000 was a little iffy and, in combination with stochastic mid-line resistance, could spell a period of weakness for the week. However, from a price perspective, it's trading above $189 breakout support and key moving averages, so there is reason to be optimistic here. Another tick in the bullish column is the net accumulation in volume.

There are some minor concerns for the Nasdaq. It enjoys solid, bullish technical strength, with the index outperforming the S&P 500 and the Russell 2000 (IWM). The only concern was Friday's bearish candlestick (that some may view as a bearish engulfing pattern on Thursday's bearish 'gravestone' doji), which may also lead to some downside in the early part of the week. Certainly, for Tuesday, I would be looking for a lower close, but not a close below key support of 13,850 (intraday violations accepted though).

The S&P 500 may have had the best of Friday's action, although it too didn't have a great candlestick finish; a 'black' candlestick (higher open, lower close > previous day close) is never one to get excited about as a bull. If there is a weak start to the week for the Russell 2000 ($IWM) and Nasdaq, I would find it hard for this index to buck the trend.

There was a risk in the early part of last week for a head-and-shoulder reversal across the lead indexes, which seems to have passed with the push beyond what would have been the left-hand-shoulder high (the price peak from early June). So, instead, what we are looking for is an ease back to the June swing high, preferably with a successful support test and bounce.

If this is not the case, we are looking at a test of the June/August swing lows to set up a possible longer trading range, perhaps lasting into Christmas. The Nasdaq and S&P 500 are trending above their 200-day MAs without being too extended, so I don't have many concerns with these indexes. The Russell 2000 (IWM) is playing with a fire a little, but this is more of a "holding" pattern rather than anything outright bearish.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI