This article was written exclusively for Investing.com

The latest FOMC minutes seem to be very clear. The Fed is very anxious to get financial conditions to neutral, which means real yields need to move much higher.

Real yields have already started to climb, making a very sharp move over the past couple of weeks. Tracking the real yield may be as simple as watching the TIP ETF (NYSE:TIP), which holds Treasury Inflation-Protected Securities. So, when the TIP ETF drops, real rates rise.

The fantastic thing about the TIP ETF is that the NASDAQ 100 ETF (NYSE:QQQ) and many NASDAQ stocks have tracked the TIP ETF very closely since 2018. If the Fed accomplishes what it sets out to do, then the TIP ETF will need to continue to move lower as real rates rise and head towards and above 0%. If this is the case, then the TIP ETF should only continue to drop, and if the current correlation with stocks continues, stocks should follow it lower as financial conditions tighten.

Huge Move In Real Rates

The 10-year TIP rate has jumped in recent weeks, from roughly -1.1% on Mar. 8 to -0.19% on Apr. 7. This has sent the TIP ETF plunging to approximately $129 to $121 over the same time. This is a massive move for real rates in a brief period.

The Fed has made it clear that it plans to raise rates aggressively for the balance of this year to bring inflation down.

This should have negative implications for the TIP ETF, and it may tell us precisely the direction stocks are heading. The QQQ has tracked the TIP ETF very closely since the winter of 2018. Over that time, in nearly every twist and turn the TIP ETF has taken, the QQQ has followed.

The relationship is due to how the market has valued stocks using real yields over the past few years. Rising real yields make a company’s future earnings and cash flow worth less when discounted back to today.

Meanwhile, falling real yields make those earnings and cash flows worth more. So when the TIP ETF rises, real yields fall, and thus the QQQ increases. When real yields rise, the TIP ETF falls, pushing the QQQ ETF down.

Strong Correlations with Stocks

This relationship can be seen across several individual stocks, like Amazon (NASDAQ:AMZN), NVIDIA (NASDAQ:NVDA), Shopify (NYSE:SHOP), and Adobe (NASDAQ:ADBE); the list can go on and on. These stocks have just been following along with the TIP ETF. At this point, there has been a divergence in the path since the middle of March. But it seems unlikely that the course will deviate for much longer; after all, this has been the relationship for nearly five years.

Financial Conditions

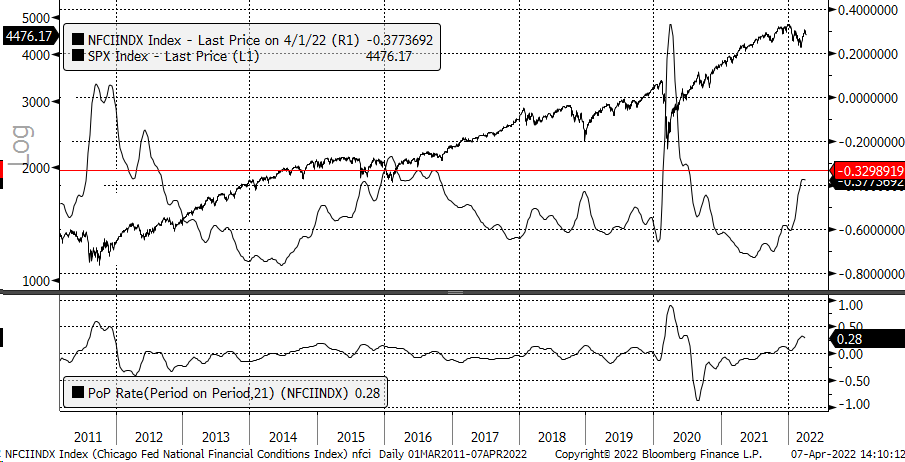

If rising yields don’t kill the stock market, then it seems that the tighter financial conditions caused by increasing rates will. The Chicago Fed National Financial Conditions suggest there is still a very long way to go until the Fed reaches neutral conditions. Every time financial conditions tighten; it leads to lower equity prices.

It would almost seem as if the Fed’s primary objective is to lower asset prices overall because many of the steps taken to combat inflation will do a lot of damage to stocks over the next several months.

You must ask yourself if you are up to the challenge of fighting the Fed.