CRYPTO: Retail investors are sticking with the big tech sector and crypto investments that have served them so well in 2023 and this year. This is according to our latest global survey of 10,000 DIY investors in 13 countries. Crypto is now the second most popular asset class after stocks for DIY investors. With a third (34%) of retail investors owning crypto and making it a uniquely retail-dominated asset class. It is easily the best-performing asset of 2024 so far, driven by a fundamental supply-demand squeeze. With the strong demand from the new spot Bitcoin ETFs. And 25 days until the four-yearly Bitcoin halving event that will further act to slow supply growth.

TECH: Tech sector stocks are the most popular with retail investors, and they are sticking with them. It is the second most broadly held (by 44%) sector, and the most favoured one for new investments (by 16%) in our global survey. The top-10 most held on the eToro platform are also all tech. Much of this interest is on the ‘Magnificent 7’ largest stocks. They benefit from a rare combination of 1) a recent overall 60% earnings surge, alongside 2) fortress balance sheets and high profit margins. DIY investors are drawn more by this strong growth (33% say it’s the main attraction) and AI exposure (33%). Fewer by the defensive qualities (13%).

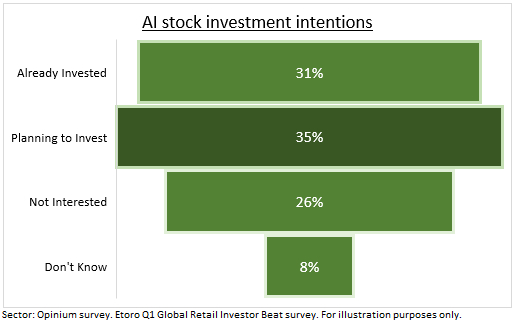

AI GAINS: Artificial Intelligence (AI) themes are already very popular with retail investors. And set to get more so, according to our survey. This could potentially drive even further AI price outperformance. With AI stocks such as Nvidia (NASDAQ:NVDA), ARM (ARM) and Super Micro (SMCI) already among the best performers so far this year. The proportion of global retail investors holding AI-related stocks rose from 27% to 31% in the past three months. Led by younger investors, Poland, Germany, and US. Whilst a much larger 35% plan to invest in AI stocks in the future. Led by Romania, Spain, Italy and peak-earning investors aged 45-54.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Retail sticking with crypto, tech, and AI

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.