A base from which to build

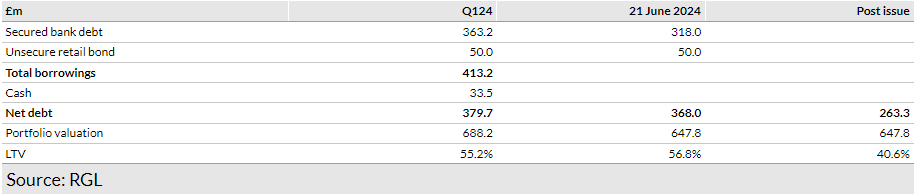

The equity raise proceeds allow for the repayment of the £50m unsecured bonds that mature this month and a £26m reduction in secured bank debt, and provide £28m of funding for an accelerated capex programme. The latter is aimed at enhancing the quality, attractiveness to occupiers and return potential from core assets, and will also allow RGL to pursue planning consent for change of use assets ahead of disposal, to benefit from valuation uplifts. Loan to value (LTV) has been reduced from c 57% immediately ahead of the issue to c 41%. Disposals will continue and will reduce LTV further, strengthening the company’s position well ahead of the first secured debt maturity in August 2026 (around a quarter of current debt). In H124, disposals amounted to £22m and RGL has identified 56 additional properties, with a value of £113m, for potential sale.

Substantial change to financial forecasts

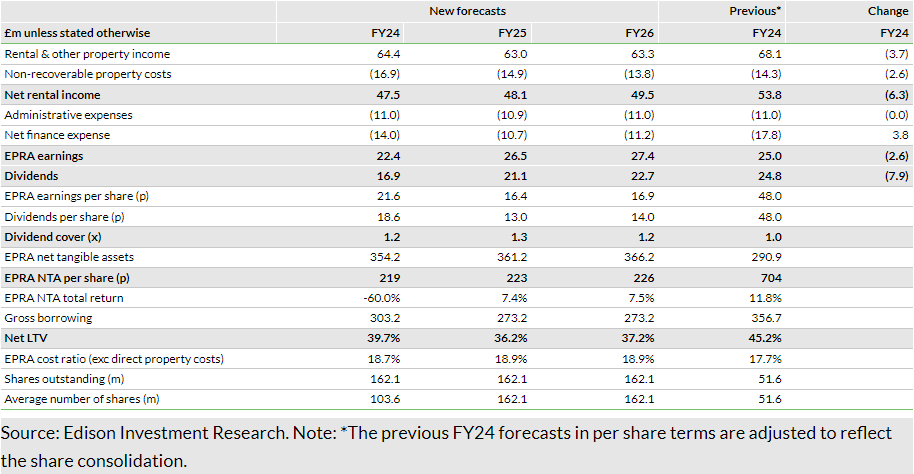

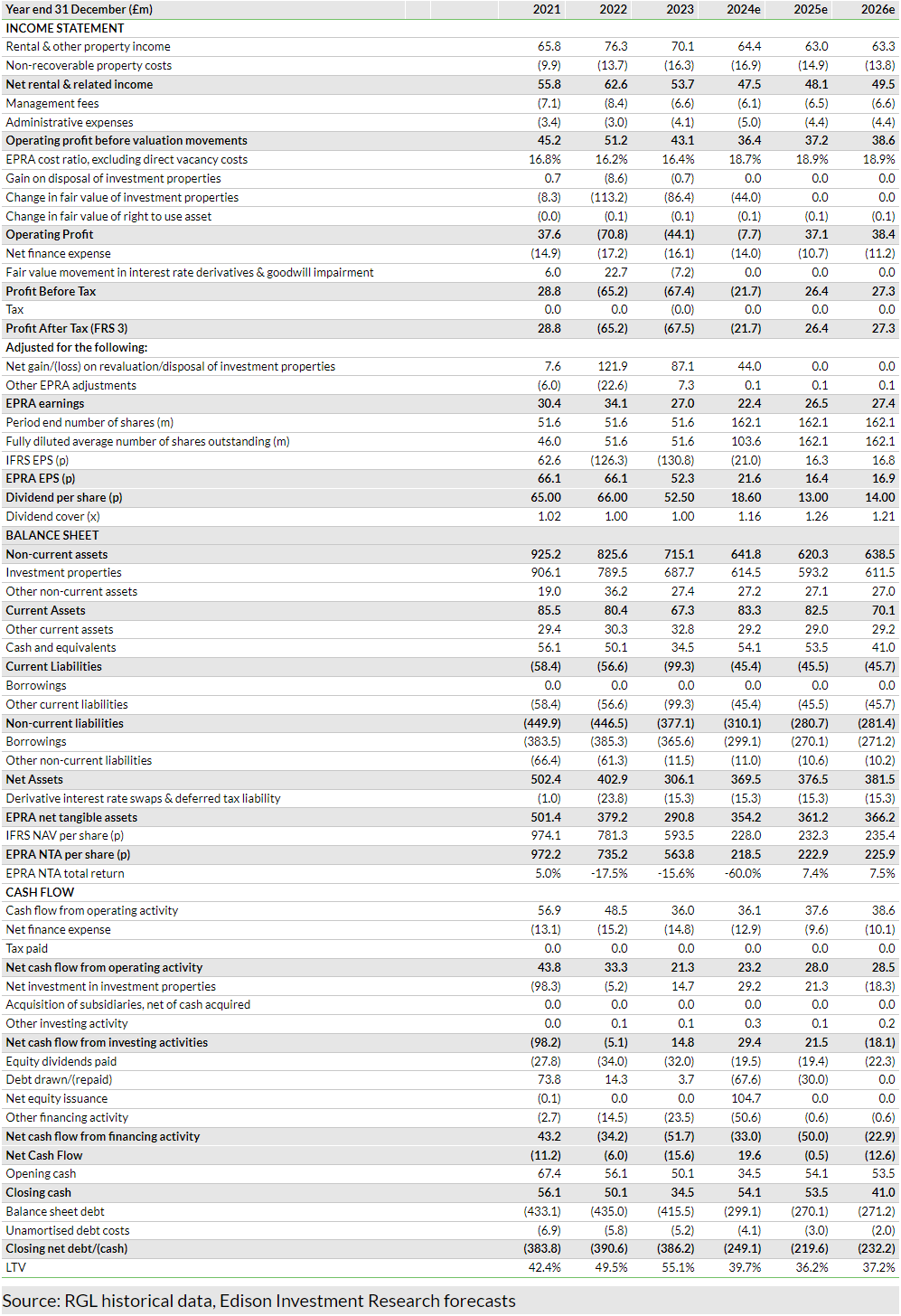

The repayment of borrowing has a positive impact on the company’s earnings, but lower gearing reduces return on equity. The significant 50% discount at which the new shares were issued has a very material impact on earnings, dividends and NAV per share but, importantly, shareholders were offered full pre-emption. Those participating were able to maintain their ‘stake’ in the company and avoid dilution. The equity raise was followed by a one-for-10 share consolidation that has no impact on returns to investors. Our updated forecasts, covered in detail in this report, are based on FY24e EPRA earnings of £22m (£25m prior to the issue) with interest savings offset by lower rental income. FY24e dividends of £19m compare with £25m previously forecast but are 1.2x covered compared with 1.0x. Underlying net assets, excluding the equity raised, are negatively affected by H124 revaluation losses.

Valuation: Yet to reflect recovery potential

As a normal pattern of quarterly DPS payments is re-established in FY25, our forecast DPS, 1.2x covered, represents a yield of 10.5%, broadly double that of peers. The more than 40% discount to NAV compares with c 25% for peers.

Recapitalisation returns focus to operations

The details of the equity raise can be found further on in this report. Importantly, it was fully underwritten and provided full pre-emption rights for existing shareholders. No equity was made available to new investors other than the underwriter, in respect of those shares not subscribed for by existing shareholders.

Elsewhere in this report we cover in detail the impact of the equity raise on our forecasts for earnings, dividends and NAV. Our previous forecasts were suspended upon the announcement of the equity raise. Compared with the last published forecasts, on an underlying basis, we expect EPRA earnings to be lower, primarily due to a more cautious approach to net leasing progress, in part reflected in the development of contracted rent roll and occupancy in Q124. This is substantially offset by reduced borrowing costs.

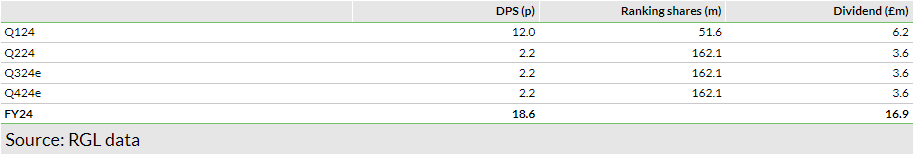

FY24 dividends include the higher Q124 payout (12p per share rebased for the share consolidation) and three quarters at 2.2p as targeted by RGL (a total of 18.6p). As well as the total distribution of c £17m being below our previous expectation, the aggregate DPS will be lower in FY25 (we forecast 13p or 3.25p per quarter) as the new quarterly basis for distributions takes effect for a full year. While maintaining its real estate investment trust (REIT) status, RGL targets a lower payout ratio than previously to conserve capital to fund capex. We expect DPS cover of c 1.2x over FY24–25, or a payout of EPRA earnings of c 80%. REIT distributable earnings are based on taxable rental income, which is affected by a range of factors including capital expenditure tax allowances.

The increase in LTV over the past two years has been driven by a sharp reduction in office asset valuations, even though RGL has continued to reduce net debt. Data from the equity raise prospectus (up to 21 June) show a further like-for-like decline in RGL’s portfolio valuation and reflected in the pre-issue EPRA net tangible assets of £251m (end-FY23: £291m) and LTV of 56.8% (end-FY23: 55.1%). With broad UK commercial property market valuations down by a quarter from the 2022 peak (regional offices by c 35%), the UK economy continuing to remain robust and a trend decline in interest rates anticipated by markets, a more positive tone has recently been seen in the property investment markets, with transactions activity showing some recovery from very low levels and valuations stabilising. With a 0.3% gain in the most recent quarter, the MSCI UK Monthly Property Index now shows three consecutive quarters of positive capital growth for the first time since 2022. With industrial, warehouse and logistics assets continuing to show the greatest resilience and office valuations continuing to fall, there are grounds for increased optimism.

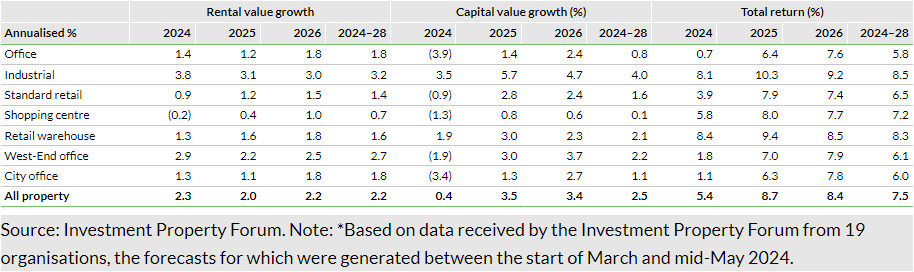

The Investment Property Forum’s second quarterly survey of the year, based on data received from 19 organisations, the forecasts for which were generated between the start of March and mid-May 2024, shows a consensus expectation that the industrial and retail warehouse sectors will continue to show the strongest rental and capital growth and lead overall performance. Nonetheless, positive total returns are expected across all sectors during the period. RGL’s own data show a strong return to the office, the supply of which continues to shrink, and although rising, current rent levels and increased costs do not justify new development. Data from Savills (LON:SVS) indicate the yield premium of regional offices over those in London to be at 30-year highs.

A base from which to build

Substantially revised forecasts

Our substantially revised forecasts reflect the positive impact of the post-issue debt reduction on financing costs, more than offset by the stubbornness of vacancy during H124, negatively affecting gross rental income and void property costs. Our FY24 EPRA earnings forecast is reduced by £2.6m, to £22.4m, compared with the forecast published before the equity raise and withdrawn following issue of the prospectus.

Compared with the £2.6m reduction in FY24e EPRA earnings, RGL’s guidance for dividends indicates a £7.9m reduction in the aggregate FY24 distribution and a strong increase in DPS cover (from c 1.0x to c 1.2x), providing increased cash retention to fund capex.

Adjusting for the c £105m net proceeds from the equity raise, our forecast for FY24 net tangible assets is reduced by c £41m, all accounted for the further H124 reduction in investment property valuations.

Reflecting the new shares issued, in per share terms the new FY24 forecasts look materially different from the old forecasts, which is shown on a post-consolidation basis in the table below.

Earnings and dividends to grow in FY25 and FY26

Our FY25 and FY26 forecasts, published for the first time, show a recovery in earnings and dividends paid from the newly established base. We expect £27.4m of EPRA earnings in FY26 and dividends paid of £22.7m compared with £16.9m in FY24. It is worth focusing on the transition from pre-issue DPS to post-issue, which we show in the table below. Ahead of the issue, RGL declared and paid a Q124 DPS of 12.0p (1.29p pre-consolidation). It has declared a Q224 DPS of 2.2p (0.22p pre-consolidation), payable on the shares in issue post-equity raise, and targets similar quarterly DPS for the balance of the year.

The increased DPS that we forecast for FY25, amounting to £21.1m, is lower in per share terms versus FY24 (13.0p versus 18.6p) but is payable on the enlarged share base for a full year.

We expect DPS cover to be c 1.2–1.3x throughout FY24–26, a payout ratio of c 80%. We expect RGL to remain compliant with the UK REIT requirement that at least 90% of earnings are derived from property rental activities. Among other factors, capital expenditure allowances have an impact on the earnings from which distributions must be made and these have no impact on EPRA earnings.

Continuing disposals and accelerated capex

Notwithstanding the post-equity raise reduction in LTV, RGL’s disposal programme is continuing. As well as further de-gearing, it is improving the overall quality of the portfolio, with a focus on properties with smaller lot sizes, high levels of vacancy and where the returns on required capex are unattractive. In most cases, the acquirers are seeking alternative uses for the assets, most often as student accommodation, residential or hotels. In H124, RGL completed the sale of 13 properties with an aggregate value of £21.9m (before costs) and has identified 56 additional properties, with a value of £113m, for potential sale. As at 21 June, two sales (£1.4m) were contracted, seven (£15.9m) were under offer or in legal due diligence, four (£6.5m) were in negotiation, 14 (£18.9m) were being marketed and 29 potential disposals (£69.8m) were being prepared for market.

We have included £60m of additional disposals in our forecasts through H224 and FY25, conservatively less than RGL’s sales pipeline. Allowing for non-yielding assets, we assume a blended net initial yield on disposals of 5%, reducing contracted rents by £3m in aggregate.

We forecast an increase in capex to around £20m pa compared with around £10m pa more recently, but much lower in H124, reflecting capital constraints. We expect most of this will be directed at the enhancement of core portfolio assets, supporting the leasing of vacant space, rent potential and valuations. The capex will enable the leasing of currently vacant buildings. In addition, RGL has signalled an intention to seek planning consent for change of use assets in order to benefit from valuation uplifts ahead of disposal. RGL expects the upfront investment to be more than recouped by the increased marketability of the assets and enhanced sales value.

Leasing momentum has remained positive

The pattern of office use, post-pandemic, continues to evolve, particularly with respect to the long-term adoption of remote and hybrid working arrangements. Combined with economic uncertainties, this has created some general occupier hesitancy, but with interest focused increasingly on well-located, good-quality and sustainable space. Similarly, in the investment market, secondary space, in need of capital expenditure to meet occupier demands and regulatory requirements for energy efficiency, rents and capital values face a significant headwind.

Against this background, although positive leasing momentum has been maintained, occupancy has been slower to build than RGL may have hoped over the past year. We believe this partly reflects constraints on capex ahead of the refinancing, slowing the refurbishment of vacated space for re-letting. In terms of physical occupancy across the portfolio, the company has seen a significant increase in office attendance and use. RGL’s tenant survey in mid-2023 showed effectively all tenants back in occupation, with employees who confirmed they were back in the office attending for an average 4.2 days per week. The survey also showed an increase in active office occupation2 to 71.4% across the portfolio, above the pre-pandemic level.

1 The percentage of desks actually in use at any time, with the balance unused due to holidays, sickness or out of office business.

Strong improvements in the portfolio sustainability metrics are also in step with occupier demands. By end-Q124, the proportion of the portfolio rated EPC C or better (a 2027 minimum regulatory requirement) had increased to 82%, up from 57% a year earlier. RGL is confident of meeting EPC targets through a combination of its rolling capex programmes, aligned with leasing events, and the disposal of remaining EPC D and E-rated properties.

Coming into FY24, the weighted average unexpired lease length was 4.7 years (2.8 years to first break) with 12-month lease maturities amounting to rent of c £10m pa (c £20m including lease break options), out of total contracted rent of £67.8m.

In Q124, notable new lettings amounted to £1.2m pa of rental income when fully occupied, at a blended average rental uplift of 9.1% to December’s estimated rental value (ERV), with £1.2m of notable lease renewals at a 4.4% uplift to ERV. EPRA occupancy was 79.9% (end-FY23: 80.0%) but, allowing for expiries and including asset sales (we estimate £1.4m pa of rental income), rent roll was £2.3m lower at £65.5m. Further new lettings in Q224 added £0.7m pa of rental income when fully occupied, at an average uplift of 11.0% to end-FY23 ERV, and completed renewals secured £0.6m pa of rents.

On an underlying basis (ie excluding the impact of disposals) we expect annualised contracted rents to decline further during FY24 but increase modestly in FY25 and FY26, a combination of rental growth and occupancy improvement.

Funding and gearing

The post-equity issue LTV of 40.6% is in line with RGL’s long-held medium-term target of 40%, but continuing property sales are likely to further reduce this and strengthen the company’s position in future debt refinancing.

Including repayment of the retail bond and part-repayment of outstanding secured debt, post-equity raise net borrowing, on a pro-forma basis, was £263m.

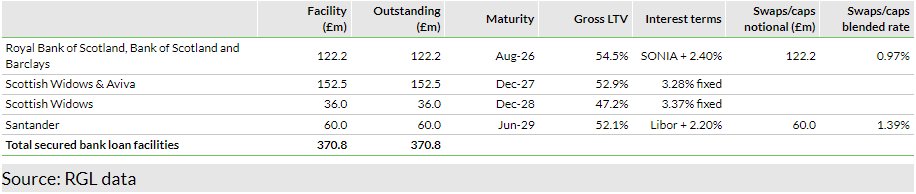

The table below shows the secured debt portfolio (ie excluding the unsecured retail bonds) at end-FY23, all of which was hedged to maturity at a blended cost of 3.4%. We estimate that the £370m of gross drawn debt has now reduced to c £325m.

The first debt maturity is that of the Royal Bank of Scotland (LON:NWG), Bank of Scotland and Barclays (LON:BARC) syndicated facility in August 2026, the cost of which is hedged at 3.43%. Our forecasts have assumed that this debt is refinanced from the start of H126 at an unchanged margin of 2.4% over an unhedged SONIA rate (or a little over 6% in total).

Further details of the capital raise

RGL’s much anticipated capital raise was announced on 27 June and, following shareholder approval at an EGM held on 18 July, began trading the following day. The one-for-10 share consolidation took effect on 29 July. The equity issue was structured as a Placing, Overseas Placing and Open Offer. The offer was fully underwritten, providing certainty to the company as to the equity capital that would be raised, but on a fully pre-emptive basis, providing existing shareholders with the opportunity to participate and avoid dilution of their interest in the company.

RGL raised £110.5m before costs (£104.7m net of costs), issuing c 1.1bn new shares at 10p, on the basis of 15 new shares for every seven existing shares. The issue price represented a discount of c 50% to the closing price immediately before the announcement and a discount of c 82.3% to the end-FY23 (31 December 2023) EPRA NTA per share of 56.4p, a level that the company considered appropriate to secure the underwriting and ensure the success of the transaction.

The net proceeds of £104.7m will be utilised as follows:

- £50m will be used to repay the retail bond maturing in August 2024.

- £26.3m will be used to reduce bank facilities. The syndicate banking facility that has the highest LTV (54.5% at December 2023) and the shortest maturity (August 2026) will see the largest repayment.

- £28.4m will provide additional flexibility to fund a selective capex programme.

Existing shareholders took up 73% of their entitlement and the underwriter, Bridgemere Investments, the balance, becoming RGL’s largest shareholder with 18.8% of the enlarged capital. Following the equity issue and share consolidation there are now c 162.1m shares in issue.

Bridgemere Investments is part of the Bridgemere group of companies (Bridgemere), established by Steve Morgan CBE in 1996, and consisting of a portfolio of individual businesses and strategic, long-term investments covering a range of sectors, which include housebuilding, land and property development and leisure. Morgan has significant experience and knowledge of the property sector, including much of the RGL portfolio. He founded the housebuilder Redrow (LON:RDW) in the 1970s, and Bridgemore was a cornerstone investor in two Tosca managed funds that were reorganised as part of the creation of RGL in 2015.

Following the equity raise, as RGL’s largest shareholder, Bridgemere has the right to appoint a non-executive director (NED). Meanwhile, Kevin McGrath (chairman) and Dan Taylor (NED) intend to step down from the board.

_________________________________

General disclaimer and copyright

This report has been commissioned by Regional REIT and prepared and issued by Edison, in consideration of a fee payable by Regional REIT. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2024 Edison Investment Research Limited (Edison).

Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS

United Kingdom