Regional REIT’s (RGL’s) H124 performance had been well flagged during its equity raising and provided no surprises. With the £110.5m equity raise completed and the (£50m) retail bond repaid, investor attention will again be focused on operational performance and the wider outlook for the regional office sector. Robust occupier demand for good-quality assets continues to generate rental growth and, with interest rates expected to fall further, the tone of the investment market has begun to improve.

Realising portfolio value

The c £105m net proceeds from the July equity raise allowed for the repayment of the £50m unsecured bonds that matured in August, a £26m reduction in secured bank debt, and provided £28m of funding for an accelerated capex programme. The latter underpins RGL’s rolling refurbishment programme, aimed at enhancing the quality, attractiveness to occupiers and return potential from core assets. Portfolio EPC ratings have shown a strong improvement over the past year, are on track to meet future legal requirements and position RGL well to meet current occupier demands. RGL will also invest in selected non-core assets (20 have initially been identified), to bring forward planning consent for alternative use assets and to capture more of the value uplift on disposal. The continuing, wider disposal programme should further reduce LTV (42% at H124 adjusted for the subsequent capital increase) and strengthen RGL’s position ahead of the first secured debt maturity in August 2026.

Income focus with capital value enhancement

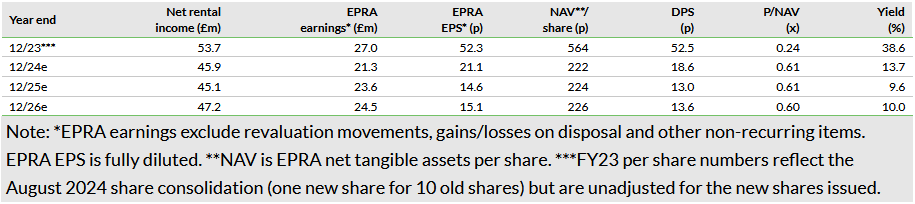

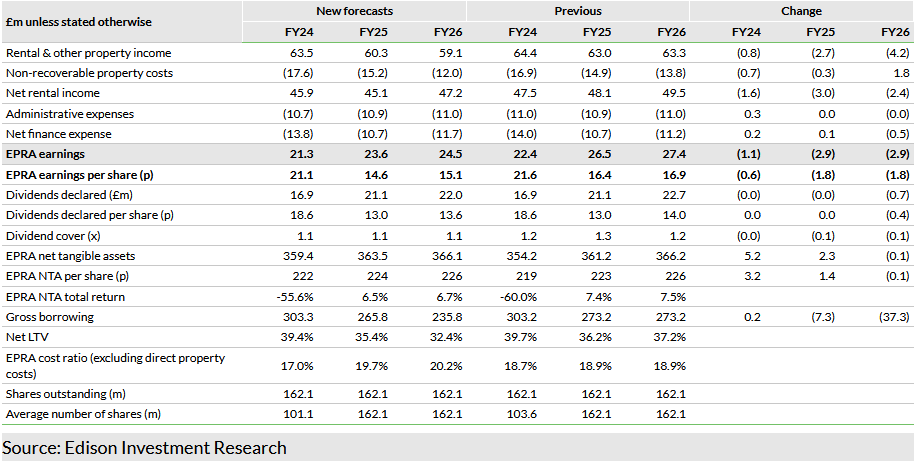

Asset management and capital recycling have been key elements of RGL’s income-focused strategy since it listed in 2015 and, in this respect, there is no material change. Regional REIT Ltd (LON:RGLR) continues to actively manage and invest in its core assets, to support long-term income growth. However, market and economic trends, which require a more flexible approach to portfolio repositioning, and an increased focus on maximising the exit value of non-core assets suggest that capital returns may in future be a larger contributor to total return. Our revised forecasts assume more significant disposals than previously and a slightly longer void period as vacant possession is obtained. FY24e EPRA earnings are reduced by c 5% (FY25e: 11%), but growing DPS is still well covered. The flipside should be faster capital growth, but this is difficult to forecast. We show no portfolio value uplifts beyond the capex.

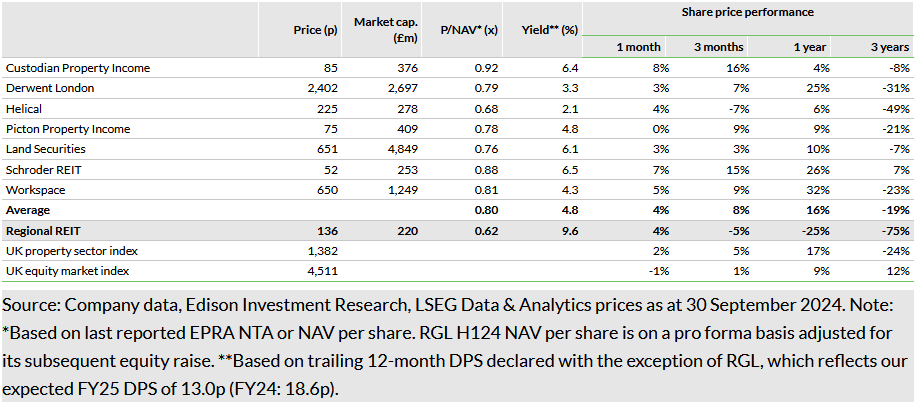

Valuation: Yet to reflect recovery potential

As a normal pattern of quarterly DPS payments is re-established in FY25, our forecast DPS, 1.2x covered, represents a yield of c 10%, broadly double that of peers. The more than 40% discount to NAV compares with c 25% for peers.

Recapitalisation returns focus to operations

The H124 results provided no material surprises given the disclosures that accompanied RGL’s equity raising. With the equity raise completed, it is more interesting to examine how this will affect RGL’s strategy and the outlook for future financial returns, about which management has provided further insights.

Since listing, RGL has been successful in meeting its income targets and its dividend yield has been consistently one of the highest in the sector. However, since the pandemic and subsequent surge in inflation and interest rates, office sector capital values have significantly weakened, and so too has RGL’s NAV progression. As the company seeks to unlock the value in its portfolio, we expect it to remain focused on generating an attractive and sustainable level of dividends, but it is also likely that capital growth will play a larger role than it has done historically, albeit difficult to anticipate in either quantum or timing and to reflect in forecasts.

From the £104.7m (net of costs) proceeds from its recent equity raise, RGL has repaid the £50m retail bond that matured in August and plans to reduce secured borrowing by at least £26m. The remaining proceeds are available to support investment in selected property assets, both as part of its rolling refurbishment programme and to capture a greater share of the upside from disposals for alternative use. The refurbishment programme enhances the quality, occupier appeal and income potential of core rental assets, as evidenced by the significant advance in portfolio EPC2 ratings and lettings well above estimated rental value (ERV). For non-core, alternative use assets, where it is profitable to do so, RGL intends to invest (in planning, architect and other professional fees) in bringing forward planning consent prior to sale, creating additional value and realised gains. An initial 20 assets have been identified alongside a larger pipeline of targeted non-core disposals.

- 1 Environmental Performance Certificate.

Evolution not revolution

Asset management and capital recycling have been key elements of RGL’s strategy since it listed in 2015. In building its portfolio, the company sought opportunities to acquire under-managed properties where it could create additional value through lease renewals and rent increases, minimising voids, enhancing the tenant mix and covenant strength, and through refurbishment, extension or change of use. When properties had met their return objectives they were assessed for sale (or to hold if their income and capital growth outlook looks strong), allowing the recycling of resources into new value-creating opportunities.

In this context, there is no material shift in strategy other than a greater focus on the overall quality of core assets and on maximising the exit value of non-core assets, the number of which has increased with market and economic trends. An occupier ‘flight to quality’ amid the lingering uncertainty about post-pandemic office use, increased capital costs, the approaching energy performance deadlines and poor investor sentiment have all accentuated the need for continuing asset and portfolio repositioning.

Reshaping the portfolio

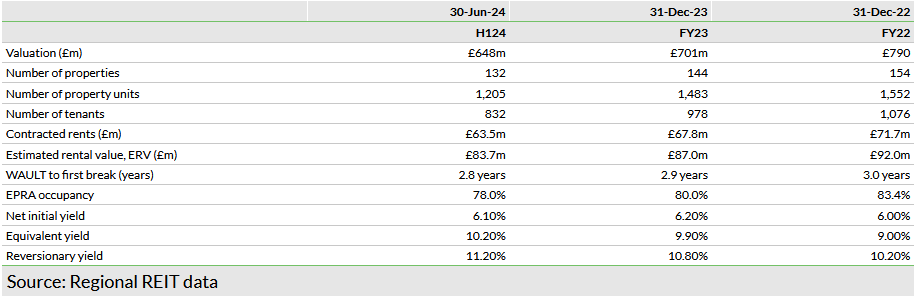

At the end of H124, RGL’s portfolio comprised 132 assets with a value of £648m. Offices in key regional centres outside the M25 motorway are RGL’s ongoing focus, representing 113 assets and 92% of the valuation.

The portfolio sustainability metrics have strengthened significantly over the past two years, in step with occupier demand for energy-efficient properties. At end H124, the proportion of the portfolio rated EPC C or better (a 2027 minimum regulatory requirement), including those that are exempt from a rating, had increased to 82%, up from 57% at the end of FY22. Properties rated B or better (a 2020 requirement), including exempt properties, reached 56%, up from 24% at end FY22. RGL is very confident of meeting energy efficiency requirements through its rolling capex programmes, aligned with leasing events, and disposals. Meanwhile, it expects a relative scarcity of good-quality, energy-efficient property to be a key driver of rental growth. Compared with its 56%, RGL says that only around a third of commercial property space in core regional centres is EPC rated B or above.

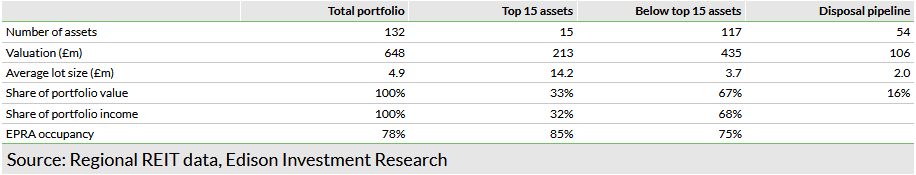

Although not broken down by the company in this way, the portfolio comprises a mix of core, good-quality, well-let income-producing properties, properties with more significant asset management potential and non-core properties earmarked for disposal. We expect the largest 15 portfolio assets to be more reflective of the core portfolio. The lot sizes are larger than the portfolio average and occupancy is higher (85% versus 78%). Outside of the top 15 assets, the properties are on average smaller and occupancy is on average lower (we estimate c 75%). Many of these will be candidates for investment and other asset management initiatives, but others are candidates for disposal. RGL has an identified disposal pipeline of 54 assets with an aggregate value of £106m. These are generally smaller assets, with weaker environmental credentials and with a higher proportion of voids.

How much capex?

RGL’s rolling refurbishment capex has typically amounted to around £8–10m pa or approximately 1% of portfolio value and includes improvements to energy efficiency that are not undertaken by tenants themselves. It was £10.2m in FY23 and £5.2m H124, but the company indicates that it would have been higher other than for pre-refinancing constraints.

For those properties where RGL intends to pursue planning consent prior to sale for alternative use, the costs per property will vary substantially depending on the circumstances, but the company expects this to be around £500k on average. That suggests a potential investment of c £10m for the initially identified 20 properties. This will not happen overnight, but equally the number of properties may increase. Vacant possession will need to be obtained, creating a near-term income drag to be later compensated by the expected capital return.

As capex picks up into FY25, we have assumed a level of around £18m pa. It is impossible to assess the uplift in capital values, realised or unrealised. Obviously, it is undertaken with the intention of enhancing value but it is difficult to predict by how much and when. In our forecast we have opted to assume that it is reflected in the value of the portfolio but no more. Our income statement therefore shows no additional valuation movements, positive or negative.

RGL’s own data show a strong return to the office, the supply of which continues to shrink and, although rising, current rent levels and increased costs do not justify new development. Data from Savills (LON:SVS) indicate the yield premium of regional offices over those in London to be at 30-year highs.

During H124, RGL’s portfolio valuation declined by 5.1% on a like-for-like basis, a better performance than the 6.4% decline in regional office values indicated by MSCI data.

A supportive benchmark investor

The equity raise was on a fully pre-emptive basis, allowing all shareholders to participate, but was fully underwritten by Bridgemere Investments. There was strong support from existing shareholders, which collectively took up 73% of their entitlement, while Bridgemere became RGL’s largest shareholder with 18.7% of the enlarged capital.

Bridgemere is a ‘family office’ investor, established by Steve Morgan CBE in 1996, with strategic, long-term investments covering a range of sectors that include housebuilding, land and property development and leisure. Morgan has significant experience and knowledge of the property sector, including much of RGL’s portfolio. He founded the housebuilder Redrow (LON:RDW) in the 1970s and Bridgemere was a cornerstone investor in two Tosca-managed funds that were reorganised as part of the creation of RGL in 2015. With his deep knowledge of regional property markets, and a strong focus on residential, he is well-placed to positively contribute to RGL and especially its repurposing plans. In most cases, the alternative uses are ‘beds and sheds’, that is either for industrial use or some kind of residential use, including student accommodation, hotels and buy-to-let.

Occupiers cautious but enquiries picking up

Occupiers remained cautious in H124, but RGL says that enquiries from potential occupiers have recently picked up. RGL expects that with the pattern of post-pandemic office use becoming clearer (most employers have adopted some form of hybrid working arrangements) and interest rates expected to decline further, occupiers will become more confident.

RGL’s own tenant survey data show that 99% of them are back in their offices and that ‘physical use’ of those offices is now slightly above pre-pandemic levels. Some of this will reflect ‘downsizing’ by some occupiers, although of those employees back in the office, they are in the office for an average 4.1 days per week.

KPMG’s recently published CEO Outlook shows that 87% of CEOs are more inclined to reward employees who work in the office on a regular basis, in terms of better projects, salary increases and promotions. 64% of respondents anticipate a full return to the office over the next three years.3

- 2 KPMG, CEO Outlook 2024.

With EPRA occupancy standing at 78%, there is a large gap between RGL’s annualised contracted rents of £63.5m and the ERV (which assumes full occupancy) of £83.7m. RGL seeks to close this gap by progressively leasing vacant space. The disposal of properties with vacant space will also close the gap. In each case, lower vacancy will reduce property void costs.

Leasing remained active in H124 but not as much as RGL would like. A total of 44 new lettings added £2.1m pa of rents but, perhaps more importantly, at an 8.4% to ERV. This is a good indication that RGL can offer the quality of property that tenants are demanding. The retention rate at lease expiry was 71.4% (the percentage of floor space that remains let).

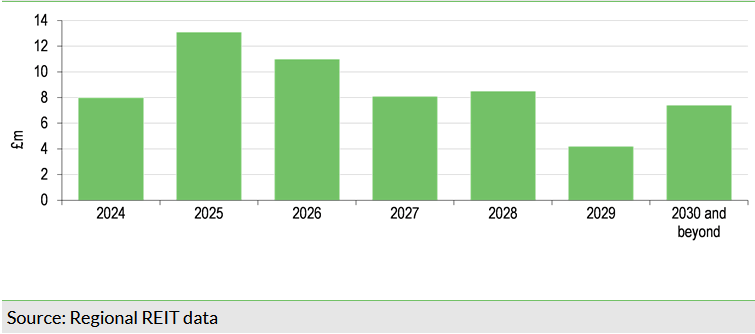

However, with c £20m of 2024 rents ‘at risk’ from lease expiries or break clauses, new letting was insufficient to maintain annualised rental income. Annualised gross contracted rents reduced by £4.3m in H124, of which disposals accounted for around half. Of the balance, a part will reflect the seeking of vacant possession ahead of refurbishment or sale.

Approximately £8.0m of rent is ‘at risk’ in H224, but this moderates to c £13.0m as a whole. Refurbishment and disposal will continue to have an effect, but RGL will also be hoping for an acceleration in leasing activity.

Investment market

With broad UK commercial property market valuations down by a quarter from the 2022 peak (regional offices by c 35%), the UK economy continuing to remain robust and further interest rate reductions expected by the markets, a more positive tone has recently been seen in the property investment markets, with transaction activity showing some recovery from very low levels and valuations stabilising.

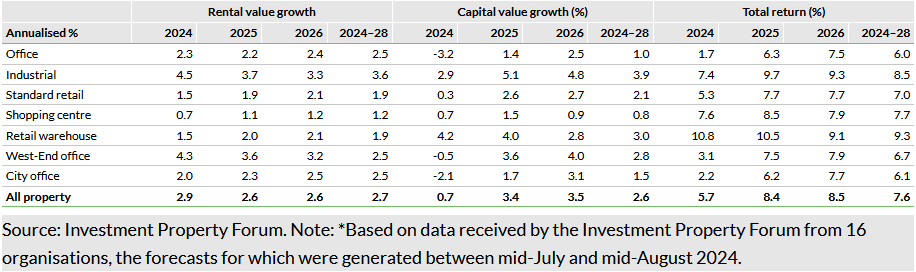

The Investment Property Forum’s third quarterly survey of the year, based on data received from 16 organisations, the forecasts for which were generated between mid-July and mid-August, shows a consensus expectation that the industrial sector will continue to show the strongest rental and capital growth and lead overall performance. Nonetheless, positive total returns are expected across all sectors during the period. RGL’s own data show a strong return to the office, the supply of which continues to shrink and, although rising, current rent levels and increased costs do not justify new development. Data from Savills indicate the yield premium of regional offices over those in London to be at 30-year highs.

Estimate revisions and valuation

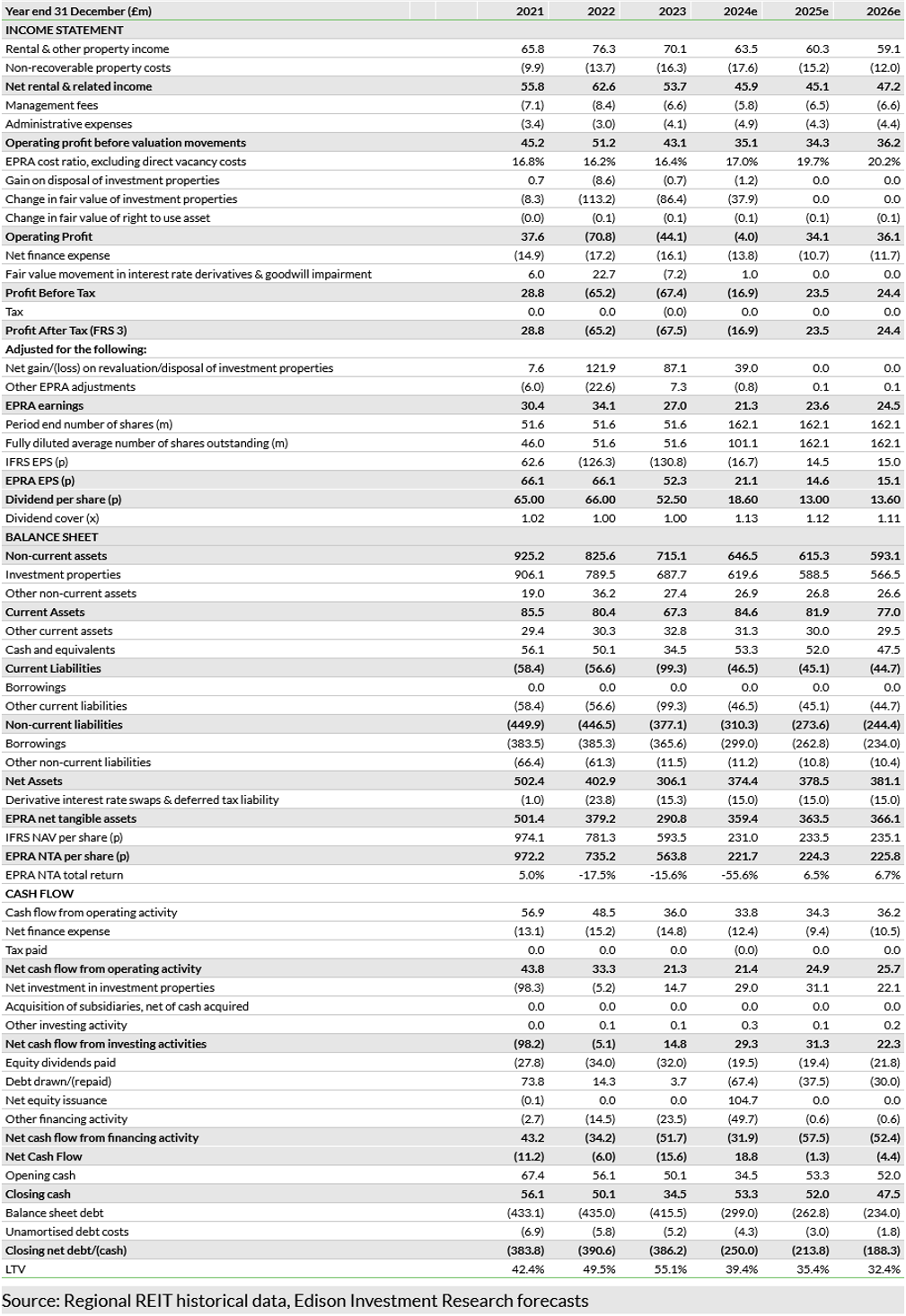

We have made some substantial estimate revisions, but RGL’s progressive dividends remain well covered by EPRA earnings. They key driver of the change is that we have assumed significantly greater disposals than previously. This reduces rental income and EPRA earnings with no offset reflected in the forecasts for potential capital enhancement from refurbishment, letting and disposals. With our forecast changes driven by net rental income, we highlight:

- Disposals of £110m through FY26 (previously £60m), more closely tracking RGL’s sales pipeline. Allowing for non-yielding assets, we assume a blended net initial yield on disposals of 5%, reducing annualised contracted rents by £5.7m (previously £3m) in aggregate by end FY26.

- Aside from the impact of disposals, we have assumed some organic decline in H224 contracted rents (occupancy changes combined with rental growth) followed by a modest gain in FY25 and FY26.

- RGL’s refined approach to the disposal of properties for alternative use will likely see extended void periods for these properties. Combined with current occupancy, we expect void costs to come down more slowly but fall more quickly in FY26.

RGL shares have continued to trade at a wide discount to the sector and are yet to respond to the balance sheet strengthening that has been brought about by the equity raise, or to the more positive tone in the regional office sector market. On a pro forma basis, adjusted for the capital raise, RGL trades at an almost 40% discount to NAV compared with the selected peer group discount of c 20%. Similarly, its dividend yield is almost twice that of the peer group4 and we expect DPS to be well covered.

- 3 The yields in Exhibit 6 are all shown on a trailing basis with the exception of RGL, which is based on our FY25 forecasts. As discussed later in this note, we expect the FY25 DPS to be below that of FY24 but above the 8.8p annualised rate of DPS implied by the three quarterly DPS of 2.2p each that RGL targets for the last three quarters of 2024.

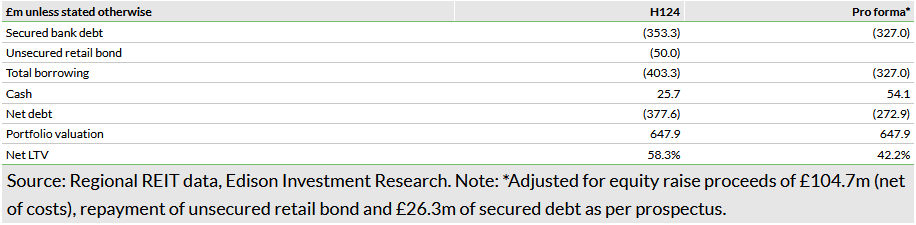

Funding and gearing

On a pro forma basis, adjusted for the August refinancing, the H124 net loan to value ratio (LTV) was 42.2% (58.3% unadjusted). We estimate a gross LTV (excluding cash) of c 51%, reflective of the weighted average LTV within the individual debt facilities. We expect continuing property sales will reduce LTV further, towards 40% on a gross basis and lower on a net basis.

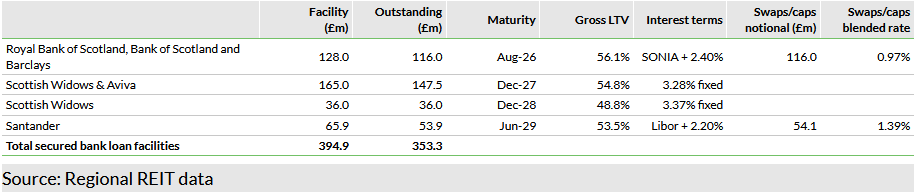

The table below shows the secured debt portfolio (ie excluding the unsecured retail bonds that were repaid in August) as reported at end H124. Drawn debt was £350m and, on a pro forma basis, adjusting for the c £26m that RGL indicated it would repay from the equity issuance proceeds, it was c £327m. All of this is hedged to maturity at a blended cost of 3.4%.

The first debt maturity is that of the Royal Bank of Scotland (LON:NWG), Bank of Scotland and Barclays (LON:BARC) syndicated facility in August 2026, the cost of which is hedged at 3.43%. Our forecasts have assumed that this debt is refinanced from the start of H126 at an unchanged margin of 2.4% over an unhedged SONIA rate (or a little over 6% in total).

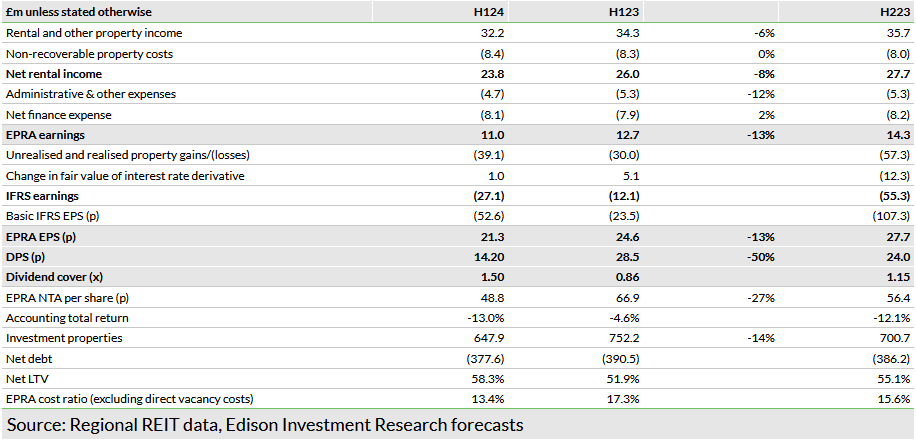

Summary of H124 financial performance

The significance of the well-flagged interim results is overshadowed by the subsequent equity raise. We have commented on key operational trends above and provide only a summary of financial performance below.

Key highlights, with comparisons to H123 except where stated otherwise, include:

- Net rental income was 8% lower, primarily the result of disposals and lower occupancy.

- Administrative expenses were 12% lower, driven by lower asset management and investment management fees (-23%), directly linked to NAV, partly offset by other administrative costs (+9%).

- The EPRA cost ratio, excluding void costs, reduced to 13.4% (H123: 17.3%; FY23: 15.6%) but increased to 40.6% including void costs (H123: 39.9%; FY23: 37.2%).

- Net finance expense was little changed, with the positive impact of lower debt offset by increased loan fee amortisation charges.

- The IFRS loss was £27.1m including unrealised (£37.9m) and realised (£1.2m) property valuation losses and a gain on the fair value of interest rate derivatives.

- EPRA NTA per share was 27% lower at 48.8p (adjusted for the subsequent share consolidation).

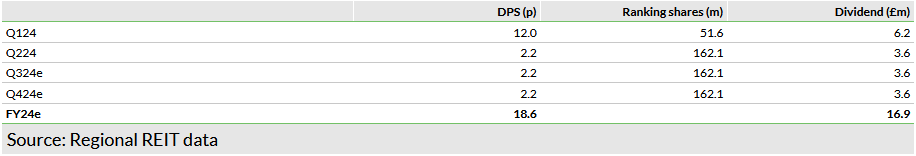

- For Q124, RGL declared a DPS of 1.2p. On post consolidation, this was equivalent to 12.0p per share, followed by 2.2p per share for Q224, with a similar level targeted for Q3 and Q4.

_____________________________________

General disclaimer and copyright

This report has been commissioned by Regional REIT and prepared and issued by Edison, in consideration of a fee payable by Regional REIT. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2024 Edison Investment Research Limited (Edison).

Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS

United Kingdom