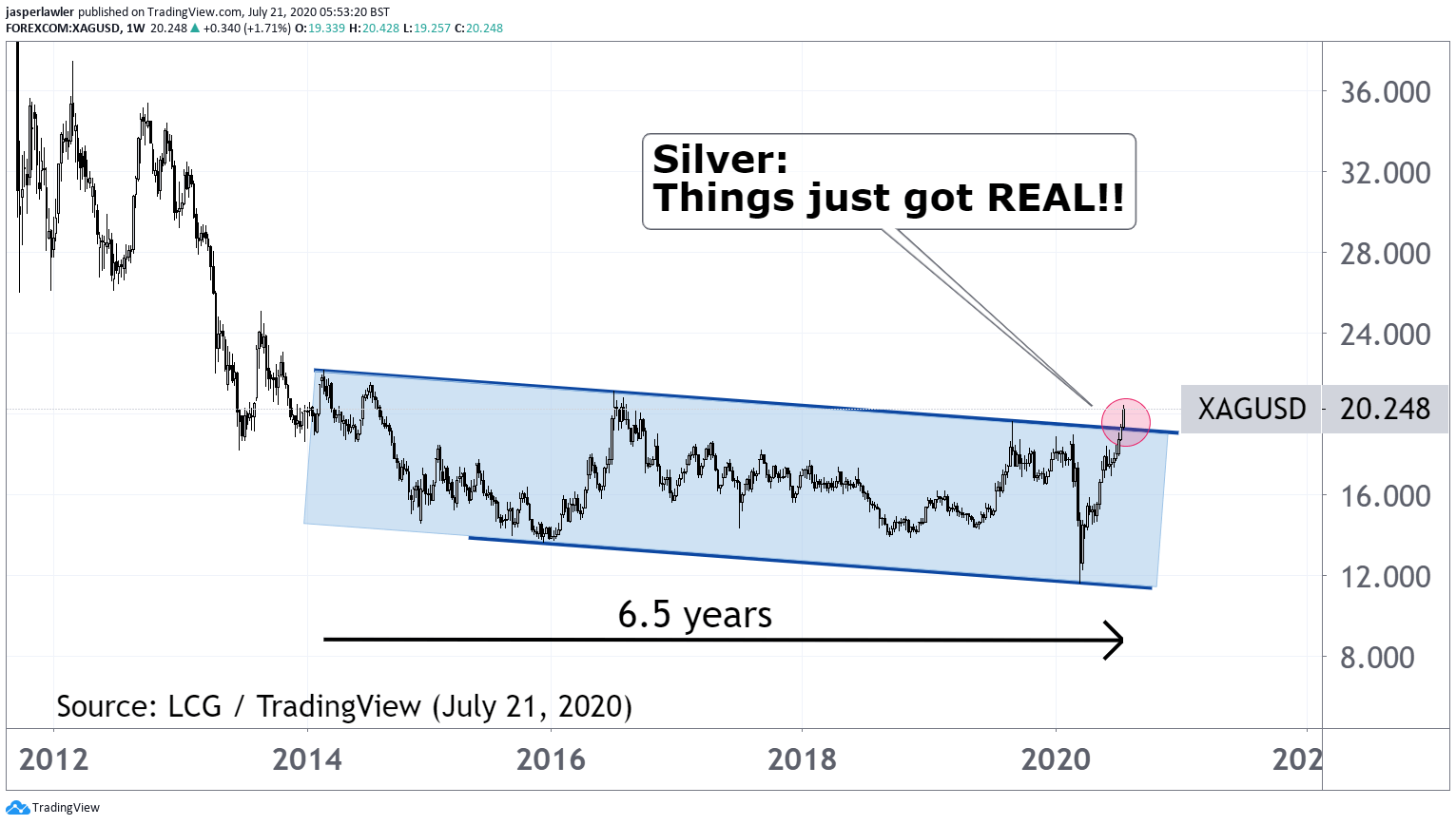

Silver tops $20 per oz for first time in 4 years Euro lower as EU leaders strike a deal on Recovery Fund and Budget Snap earnings today – Should bulls ‘snap out of it'? CHART: Silver- Things just got REAL!

Silver

The price of silver has risen above $20 per oz in a meteoric 74% price jump from the low of $11.64 in struck in March. Silver futures have touched $20.85, while spot prices hit $20.40 (see chart below). Easy money policies from central banks are generating demand for hard assets that will hold their value in debased currencies. It's not just a dollar phenomenon; silver just reached its highest versus the euro (XAG/EUR) since September 2016.

Silver is in effect holding its value while currencies lose theirs. There is a supportive backdrop for silver too. It's prominence in new battery technology and a reduction in base metal mining, which is the principal source of silver, is creating a demand/supply imbalance in itself.

Recovery Fund

EU leaders finally struck a deal late Monday/early Tuesday on an EU Recovery fund. It's a big deal for the bloc which will see countries borrow together for the first time. The €750 billion will be raised in capital markets and €390 billion of that will be dished out in grants to member states most in need because of the pandemic.

Just to be argumentative, we have been wondering aloud in the past few days why the euro hasn't acted more positively to what seemed like an almost certain deal. Notably EUR/GBP is rolling over. Now that the Recovery Fund is secured, one could make the argument there is a better chance an EU/UK trade deal can be secured now too, which is more Sterling than euro-positive.

Today: SNAP

Snap reports earnings after the close on Wall Street today. Expectations are for a loss of 9c per share on $418.6 million in revenue. The shares have tripled in value since hitting a March low of $8, now resting above $25- short of record highs at $29.44. Shares of social media companies have soared on expectations that the applications would be used even more during economic lockdown.

In the case of Snap, there may be a disconnect between the share price and app usage. Data from Bank of America has Snapchat downloads actually falling 13% over last year, while Instagram downloads rose 33%. Downloads don't affect existing user hours but don't bode well. Additionally, some of the gains come off the back of a possible (but unlikely) ban of rival app to Snapchat, TikTok by the US government. We wonder if bullish investors should ‘snap out of it'...

Chart: Silver

Silver just made its big move above $20 per oz – with a breakout above a 6.5 year-old down-sloping channel- and potentially the beginning of a new long-term uptrend.